Mali, Burkina Faso, and Niger Forge Ahead with $895 Million Regional Investment Bank for Sahel’s Economic Resilience

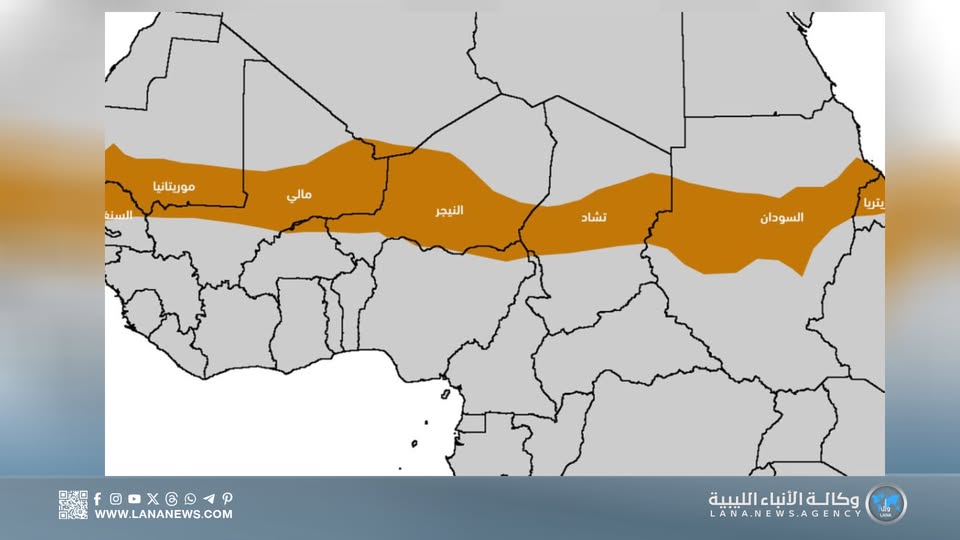

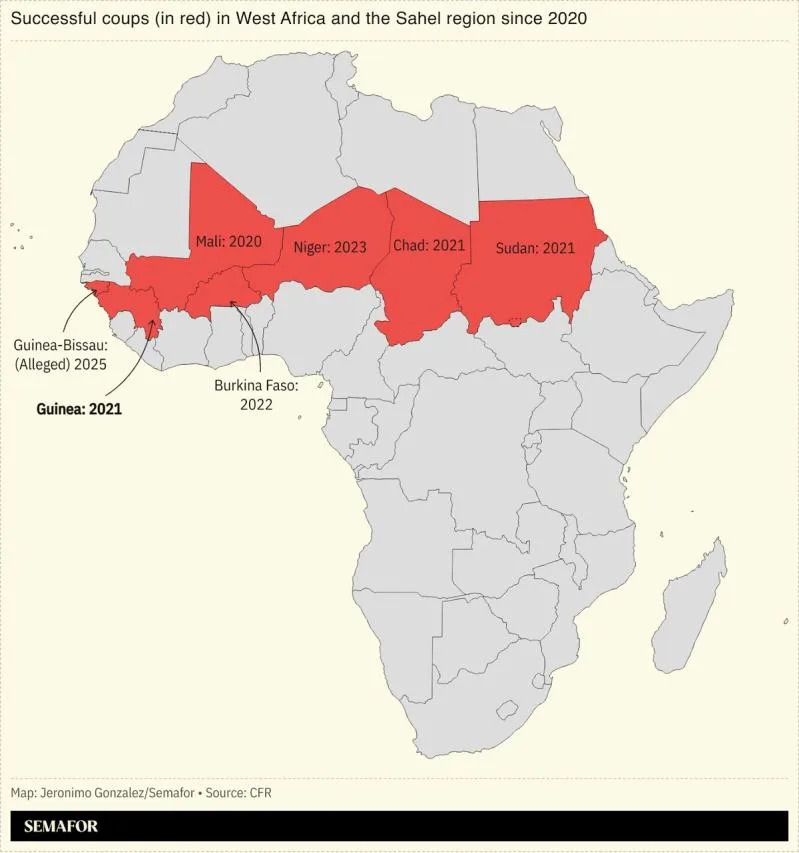

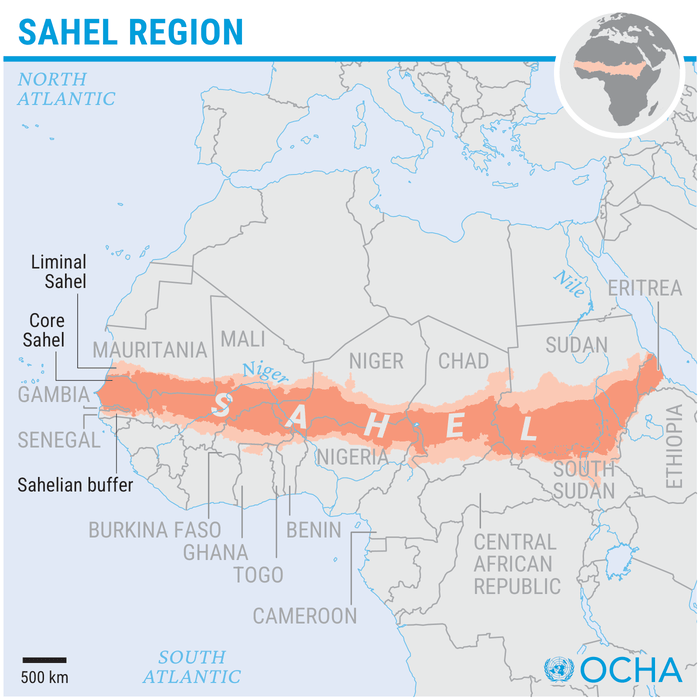

In a powerful move to champion their economic independence and kickstart development, Mali, Burkina Faso, and Niger have officially launched a new regional investment bank, boasting an impressive $895 million in capital. This isn’t just about money, it’s about strategic focus: infrastructure, energy, and agriculture are at the top of the list. What does this mean for the Sahel? It means a concerted effort to weave a stronger economic fabric and foster genuine, sustainable growth across these West African nations, especially as they navigate persistent security concerns and political instability. By pooling resources, they’re not just building a bank, they’re building a future, aiming to lift these countries out of economic vulnerabilities and accelerate crucial regional integration.

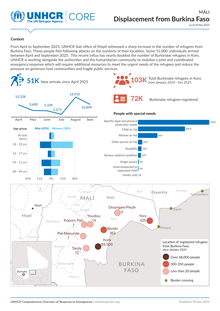

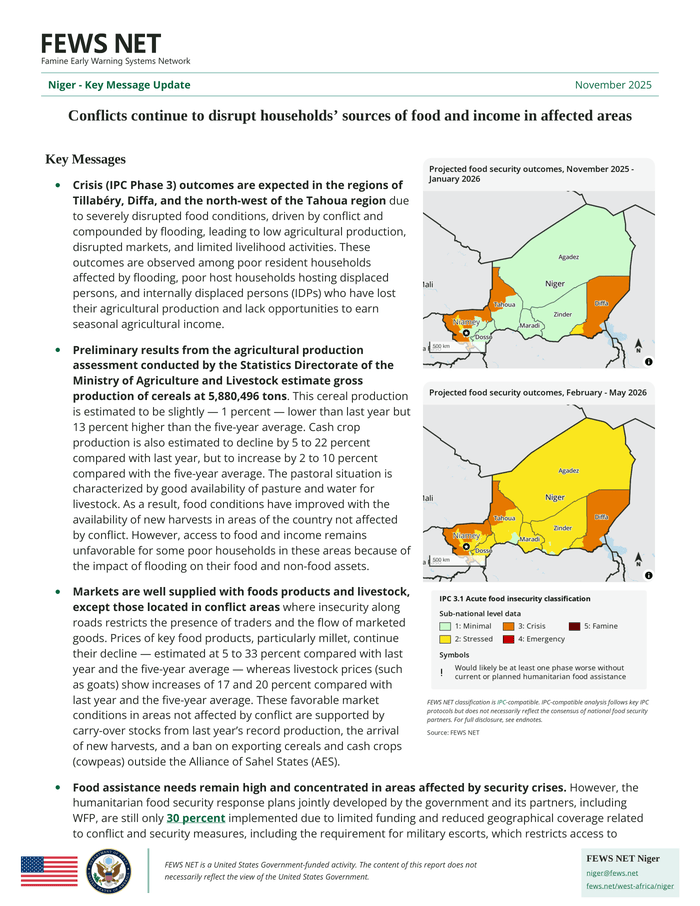

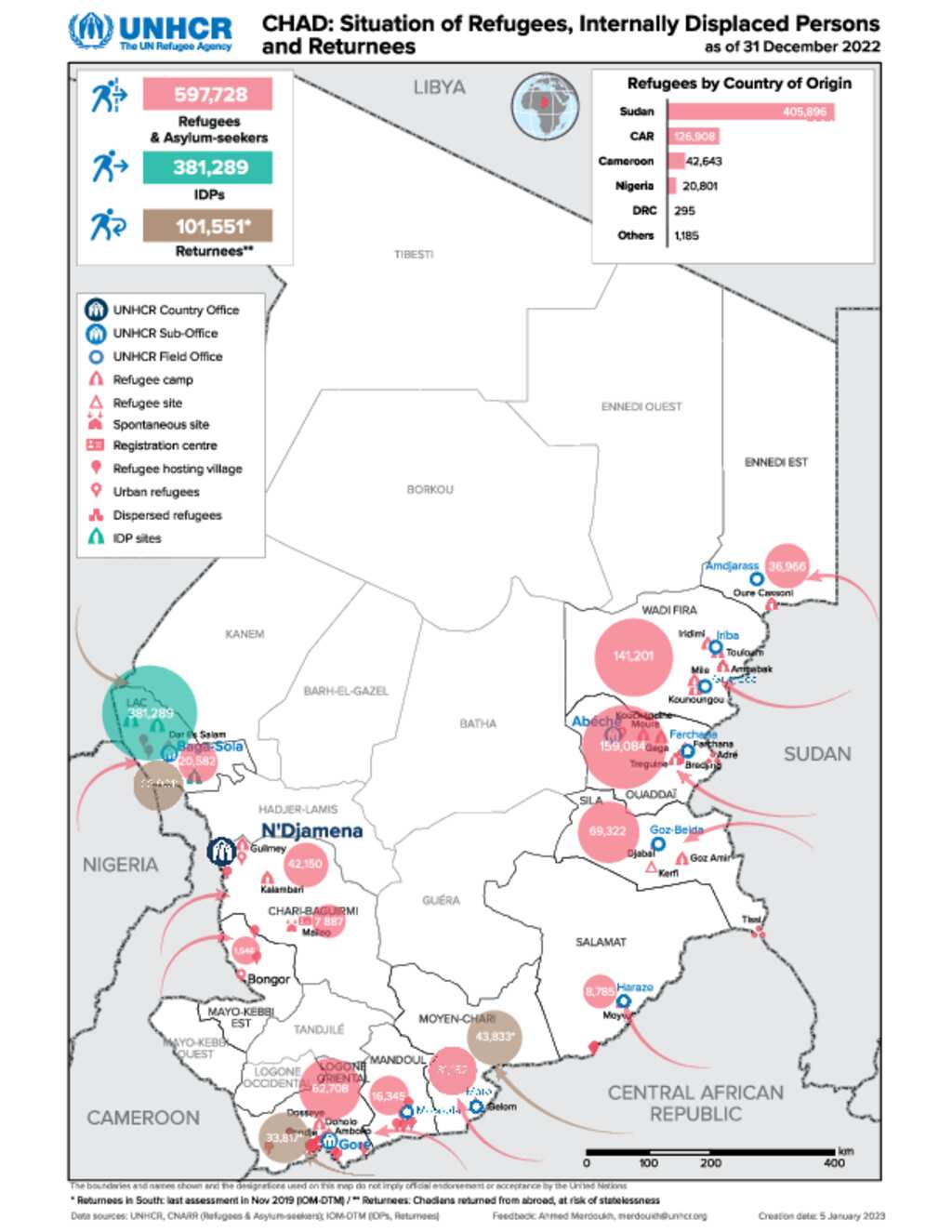

Think about the everyday impact. Infrastructure development stands as a core mission for this new institution. Anyone traveling through Mali, Burkina Faso, or Niger knows the pressing need for better roads, more reliable power, and smarter water management. This bank’s financing will zero in on these areas, directly tackling long-standing deficits that have hampered trade, movement, and industrial activity for far too long. Improved connectivity won’t just help local economies thrive; it’ll also position these Sahel nations for greater economic resilience, making them more competitive players in the broader African market, as reported by Welcome Africa. Energy, too, is essential for unlocking the region’s potential. Right now, energy shortages and unreliable supply chains hold back both agriculture and industry. The bank plans to channel funds into diverse energy projects, including renewable sources like solar power. Given the Sahel’s abundant sunshine, adopting innovative energy solutions could significantly cut import reliance, lower production costs, and drive environmentally sustainable growth. And let’s not forget agriculture, the lifeblood of these economies. It supports a huge portion of the population and contributes immensely to GDP, yet it battles climate change, limited tech, and insufficient funding. This new bank envisages financing modern farming techniques, irrigation, and agro-processing, aiming to boost productivity and add value. Strengthening Burkina Faso’s agricultural reforms will also enhance food security, a critical concern with erratic weather and conflict-driven displacement.

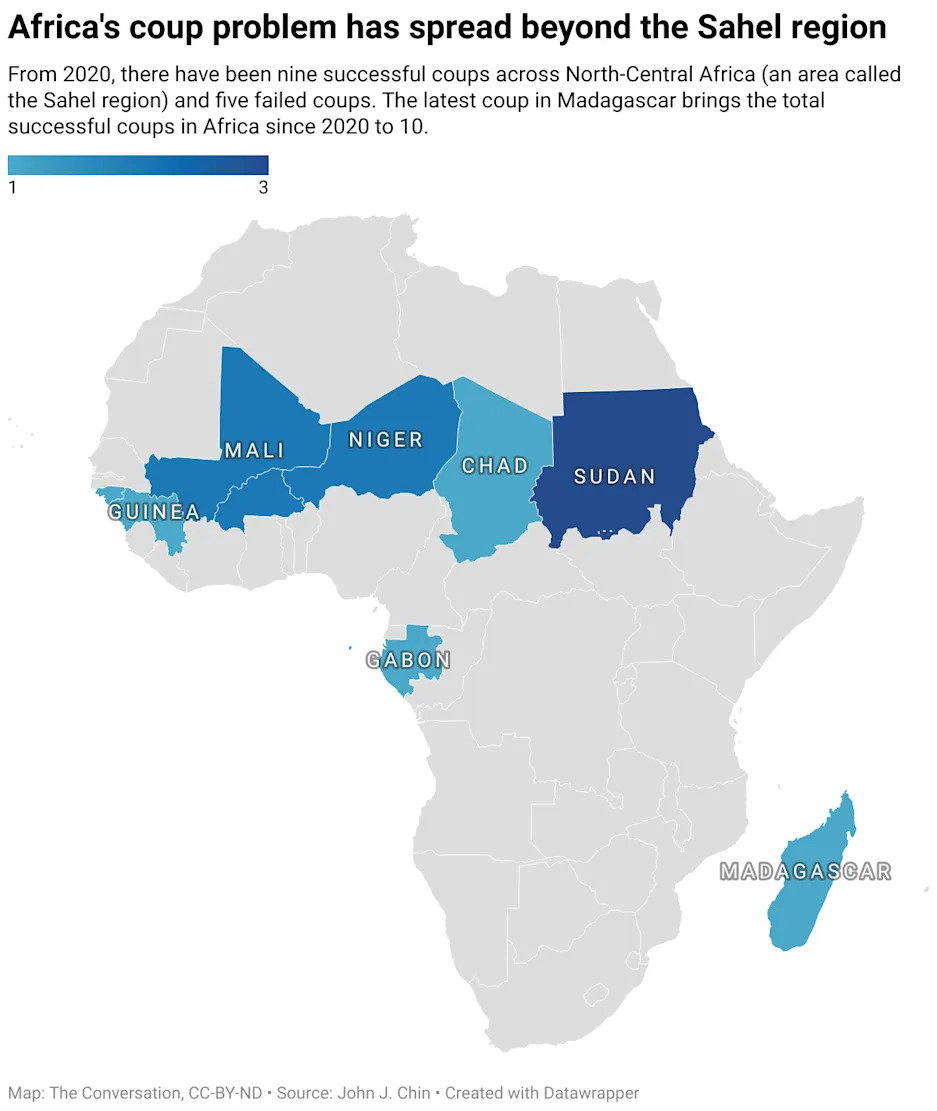

Of course, we can’t ignore the complex security situation. Parts of Mali faces a growing jihadist threat and Burkina Faso remain under the influence of groups like the al-Qaeda-linked Jama’at Nusrat al-Islam wal-Muslimin (JNIM). The ongoing presence of these armed factions has severely disrupted daily life, especially for communities, like the Fulani women, living under their control, a reality highlighted by Life under jihadist rule in the Sahel. Security instability directly stifles development, deterring investment and complicating projects. It’s clear: economic progress and security must advance hand-in-hand for any lasting change. On a more optimistic note, diplomatic engagements are expanding. Egypt, for example, has shown interest in collaborating on Mali’s development projects. As Egypt’s Minister of Foreign Affairs, Emigration, and Egyptian Expatriates, Badr Abdelatty, stated, Egyptian companies bring vast expertise in infrastructure and are eager to participate. Such partnerships could inject vital technical know-how and capital into Sahel initiatives, creating a favorable environment for accelerated progress. Could this regional bank, paired with improved security and expanded international ties, truly redefine the Sahel’s economic landscape? It’s a bold vision, one that promises sustained prosperity, transformed livelihoods, and renewed hope for a region often defined by conflict and underdevelopment.