Africa’s Tech Moment 2026, From Fintech to Solar, Founders Build for Profit and Impact

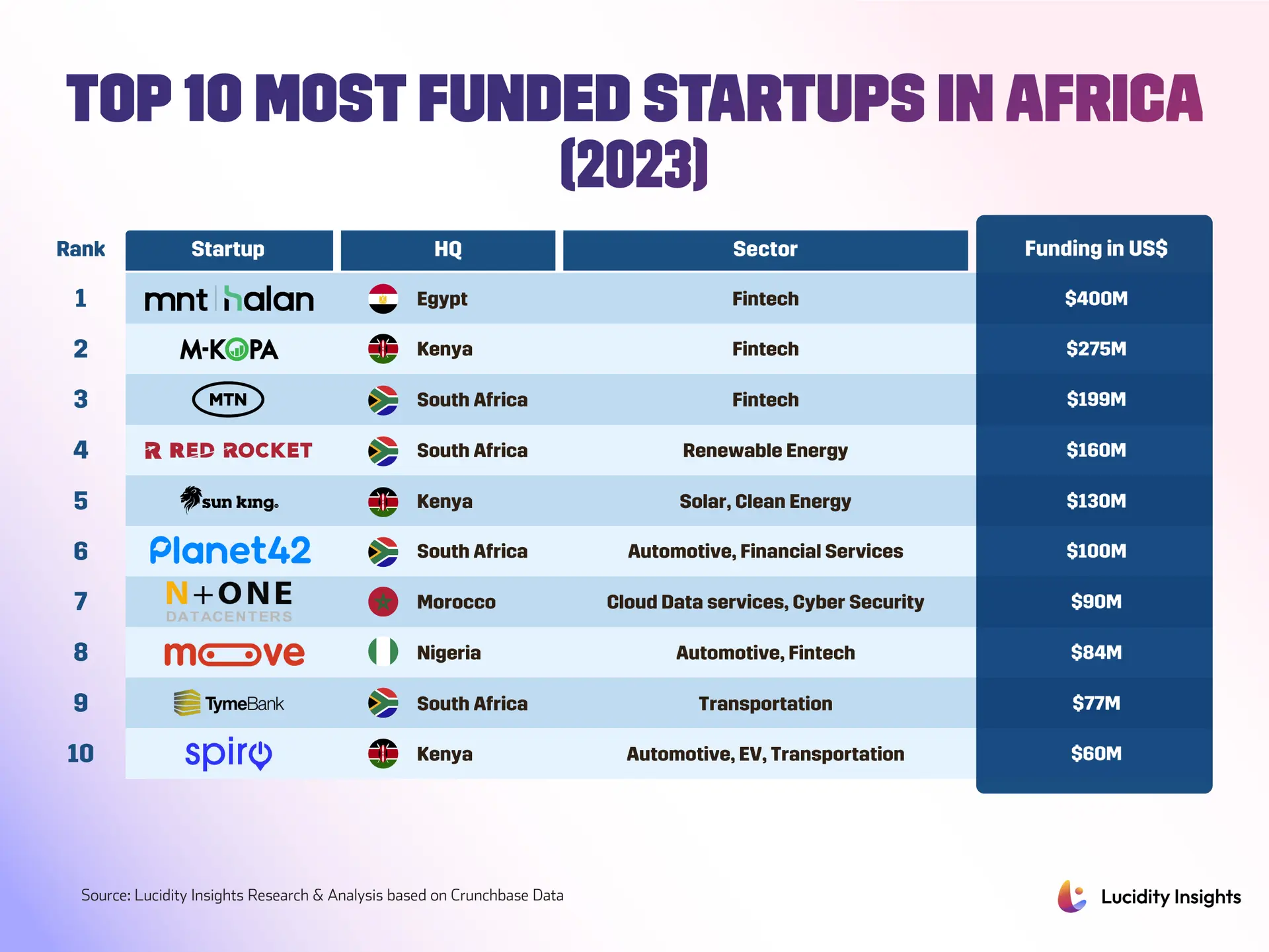

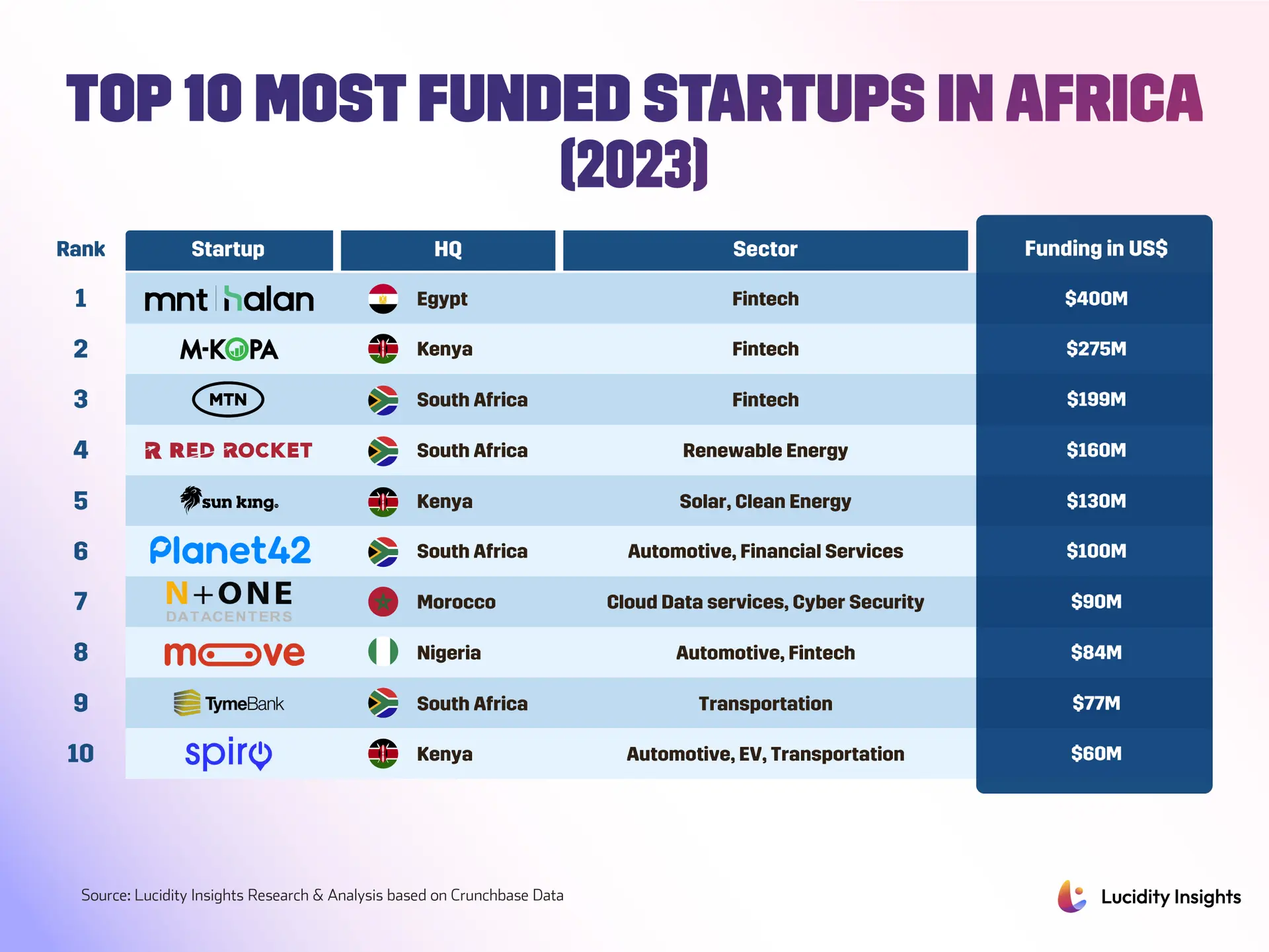

Something’s shifting across Africa’s tech hubs, from Lagos to Nairobi and Accra to Dakar. A new generation of founders isn’t just chasing headlines anymore, they’re building businesses that actually make sense. After startups pulled in about $4.1 billion in 2025, investors have started asking tougher questions. They want to see clear unit economics, cross-border scale, and real social impact, not just growth for growth’s sake. The result? A tech ecosystem that’s growing up fast while it speeds ahead, one that could help shape a projected $180 billion African digital economy. Money that used to chase unicorn dreams now chases fundamentals. Venture deals still concentrate in traditional hubs, with cities across Kenya, Nigeria and South Africa driving roughly 72 percent of rounds. But capital isn’t just equity chasing fairy tales anymore. Lenders and structured financiers increasingly use debt, securitization and hybrid instruments, favoring companies that can show cash flow and asset-backed models. Clean energy and distributed power projects led the largest transactions in 2025, signaling investor comfort with tangible assets that address Africa’s persistent electricity problems. This shift reflects a broader tech renaissance that’s transforming the continent’s economic landscape.

Fintech remains Africa’s engine, and for good reason. Payment rails, cross-border transfers and SME lending attracted big checks because they solve everyday constraints for traders and small businesses. New financial infrastructure is taking shape under the African Continental Free Trade Area (AfCFTA), which lowers the cost and friction of moving goods and payments across borders. For ordinary traders who used to lose days and pay high fees to move money, the change feels immediate. Startups like a South Africa-based fintech, recently financed to scale SME lending, show how capital targets closing the financial inclusion gap for businesses that were previously cash-only. At the intersection of blockchain and payments, a handful of companies reduce the time and cost of cross-border flows using stablecoins. One example processing significant volumes has onboarded hundreds of thousands of users and hundreds of businesses, moving tens of millions per month, drawing seed funding to expand. These newer financial rails aren’t gimmicks, they’re answers to decades of fragmented systems that hampered regional trade. Meanwhile, clean energy initiatives are gaining momentum alongside financial innovation, creating a powerful combination for sustainable development.

Agritech is another front where measurable gains draw investor attention. In Nigeria and Kenya, apps and IoT sensors connect farmers directly to buyers, bypassing middlemen and delivering market prices to the palm of a phone. The result? Lower post-harvest losses, often cited at 20 to 25 percent reductions where digital logistics and cold chain monitoring deploy. Medium and large farms track toward widespread IoT adoption by the end of 2026, which analysts say could lift yields and cut costs across staple supply chains. Startups building foundational infrastructure, not just flashy consumer apps, quietly reshape sectors. Aviation analytics firms consolidate opaque airline data to help regulators and lessors make evidence-driven decisions. Market trust solutions tackle longstanding problems, like the murky used car market, by providing inspection and verification services that reduce fraud and increase resale value. These companies show why investors prioritize measurable unit economics and regional scalability. Energy remains the single biggest constraint and the biggest commercial opportunity. Many African cities register low power reliability scores, and entrepreneurs meet that reality head-on. Green tech companies pair solar assets with AI-driven controls to stabilize supply for homes and businesses. Because these projects are both mission-critical and asset-backed, they attract large structured deals, giving founders a model to demonstrate revenue visibility to more conservative financiers. Local venture capital steps into gaps left by retreating global players. African VCs now provide roughly 40 percent of early-stage capital in some markets, improving odds for founders who develop locally relevant products. According to recent research on African tech startups, this local investment surge marks a significant shift in the continent’s funding landscape. The continent’s startup ecosystem matures in how it builds products too. Successful teams tend to price early, validate concepts with dozens of users, and scale methodically across cities rather than hinging on a single big launch. That discipline has translated into roughly 1.2 million jobs for young professionals under 35, according to market observers tracking the 2025 funding wave. As detailed in analyses of top African startups, this pragmatic approach distinguishes the current generation of entrepreneurs from their predecessors.

Barriers remain, of course. Unreliable infrastructure, complex regulation and uneven access to early-stage capital continue to slow the most promising ideas. Power availability scores of roughly 35 out of 100 in many markets, and an early-stage funding drought in some countries, mean entrepreneurs still need workarounds. Solar backups, local partnerships and revenue-first strategies are common fixes, but they add complexity and cost in the short term. Policy and market structure will matter more than ever. AfCFTA stands to amplify cross-border fintech and trade tech by reducing tariffs and harmonizing rules, but that promise depends on smoother customs operations and interoperable payment systems. Similarly, the impact of new global rules, such as carbon border taxes, could reconfigure which industries attract investment and how startups position themselves for export markets. If 2025 was a proving year for capital allocation, 2026 looks like the era of scale and durability. Founders who solve real bottlenecks in energy, payments, agriculture and logistics secure financing on the basis of predictable revenue, not only potential market size. For cities from Lagos to Nairobi, and for rising tech communities like Dakar and Accra, that shift means stronger supply chains, cleaner power, and more formal pathways for SMEs to enter the digital economy. Looking ahead, the most consequential bets will be on platforms that combine local market knowledge with technologies that reduce friction at scale. Investors will reward teams that can prove both profitability and impact. For entrepreneurs on the ground, the advice is familiar and still true: test early, price sensibly, and expand city by city. For the continent, that pragmatic approach may finally turn promise into sustained prosperity. Tracking this evolution requires close attention to funding rounds and trends across African markets, while the broader startup ecosystem continues its remarkable expansion.