Africa’s Startup Surge Hits a Critical Scaling Moment

Across Africa right now, there’s a fascinating convergence happening. Fresh capital, rapidly growing tech talent, and some serious policy debates are all colliding to ask one tough question: can the continent turn its undeniable opportunities into businesses that actually last? We’re seeing this play out in real time. Take Kenya’s Delta40, which just closed a new $20 million fund backed by billionaire George Soros. Bloomberg reported this as clear proof that international investors haven’t lost interest in African founders. But here’s the thing, money’s flowing more selectively these days. At the same time, events like SWEAT Africa outside Stellenbosch are becoming crucial matchmakers. Over 100 startups met with 50-plus international investors there recently, turning what used to be networking parties into concentrated marketplaces where real deals get done. This isn’t just growth, it’s maturation, and you can see more evidence in our coverage of the continent’s record startup ecosystem boom.

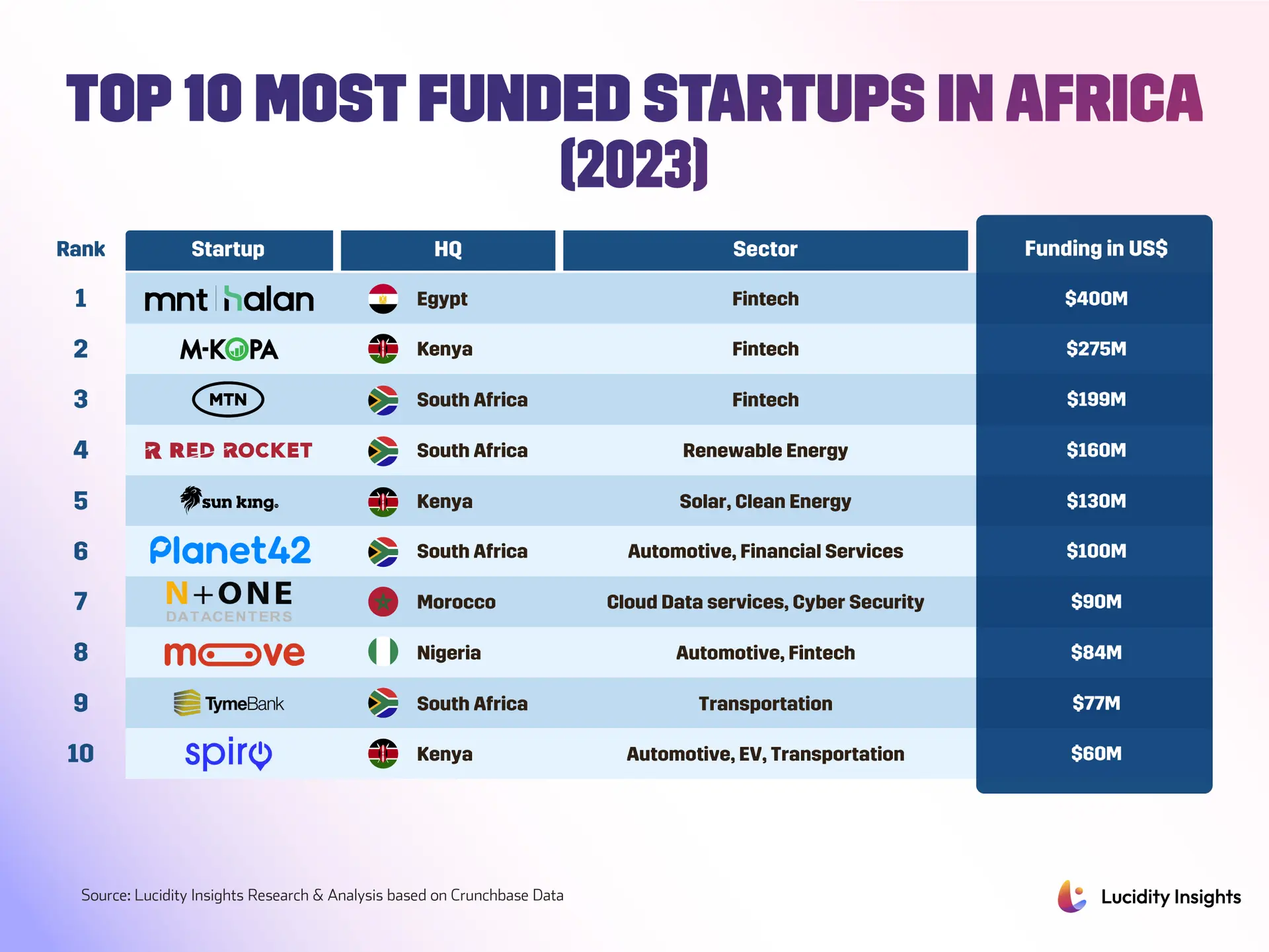

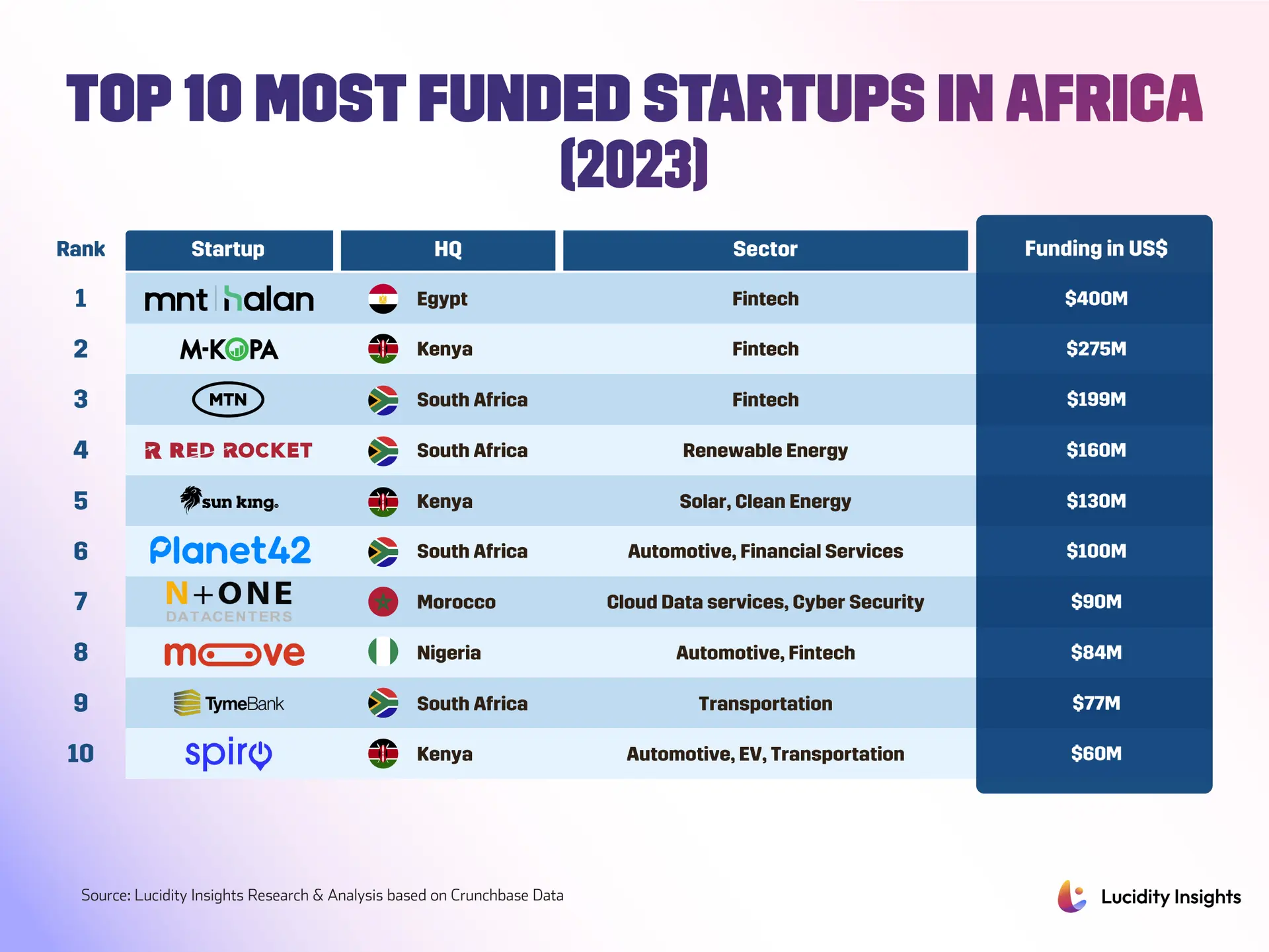

The startup pipeline itself is diversifying in exciting ways. Pan-African e-commerce giant Jumia reported a 34 percent revenue jump to $61.4 million in late 2025, showing that consumer markets here can definitely scale. Meanwhile, Nigerian AI startup Decide earned global recognition for building some of the world’s most accurate AI agents for spreadsheet tasks, proving local teams can create enterprise-grade tools. Google’s calling for applications to its Google for Startups Accelerator Africa, a 12-week program focused on AI and scaling for Series A companies. Fintech and education tech continue to lead the charge, with firms upgrading everything from payments to classroom tools. But here’s where it gets interesting, investors aren’t just writing checks anymore. They’re asking tougher questions, demanding reproducible unit economics and clear paths to profitability. This shift from what some call “frothy check writing” to serious due diligence is healthy for the ecosystem, but it puts pressure on founders to demonstrate both product-market fit and solid governance. It’s all part of Africa’s broader tech renaissance that’s driving innovation and investment across sectors.

Policy and global markets add another layer of complexity. The European Union’s implementing a carbon border adjustment mechanism, essentially a fee on imports based on their carbon intensity. This could change the game for African exporters, meaning sectors like agriculture, where analysts see trillion-dollar opportunities, must adopt greener practices to keep European market access. Energy reforms and debates about redirecting fossil fuel income into renewable investments, like those happening in Uganda, show how governance decisions shape economic futures. Bridging capital, policy, and talent requires intermediaries who truly understand local markets, accelerators and regional funds that can translate global capital into solutions that work within African regulatory and infrastructure realities. What’s emerging isn’t a simple story of triumph or crisis, but a mosaic of experiments being scaled under pressure. Some markets, like consumer e-commerce and fintech, are showing real revenue evidence of scale. Deep tech and climate solutions still need patient capital and policy support to move from pilots to widespread deployment. The good news is that Africa’s talent and ideas have never been more visible to global capital. The challenge is turning that visibility into durable success. As we’ve seen with the continent’s $1.4 billion investment surge, the momentum is real, but the next chapter will be written by those who can transform meetings and headlines into businesses that survive both market cycles and regulatory shifts.