Africa’s Startup Renaissance, but on New Terms: Investment, IPOs, and the Rise of Debt-Backed Growth

After weathering several turbulent years, Africa’s technology startup scene has roared back to life, but the money flowing into the continent now looks fundamentally different. Investors returned in greater numbers throughout 2025, drawn to businesses with clear unit economics, regional scale, and the ability to deploy capital efficiently across markets. At the same time, financiers are expressing caution, preferring asset-backed, debt, or hybrid structures that prioritize cash flow and downside protection. This comeback is measured in both money and instruments. Across 2025, African tech startups raised about $4.1 billion, a roughly 25 percent increase on the prior year, according to sector reporting. Equity funding rose modestly to roughly $2.4 billion, while venture debt surged to an estimated $1.6 billion, an increase of about 63 percent. Deal activity ticked up as well, with roughly 570 transactions recorded, signaling renewed appetite among investors, yet a markedly more disciplined approach to where and how capital is deployed. The shift toward debt and securitization reflects investor comfort with predictable cashflows and tangible assets, especially in clean energy and distributed infrastructure. Clean energy companies accounted for some of the largest transactions in 2025, a sign that climate-aligned ventures remain a priority for both public and private capital seeking scalable, revenue-generating models. The rebound isn’t only about private rounds. A clutch of IPOs and high-profile financings underscored maturation across the ecosystem. Notable listings in late 2024 and 2025 included LeapFrog Investments on NASDAQ and several South African exchanges hosting listings from legacy telecom and tech firms. Those public exits matter because they create visible returns and a pathway for patient capital to recycle into new ventures. At the same time, a new generation of venture funds and studios are emerging to bridge early-stage gaps, as detailed in our analysis of the broader startup ecosystem boom. Kenya-based Delta40, an integrated venture studio and fund focused on energy, agriculture, water and mobility, closed a $20 million raise to accelerate climate tech innovations across Africa. In fintech, South Africa’s Lula raised about $21 million to scale SME lending and widen financial inclusion, reflecting persistent investor interest in financial services businesses that can win customers at scale. This renewed momentum is part of a larger tech renaissance transforming the continent’s economic landscape.

Where the Deals Are Happening

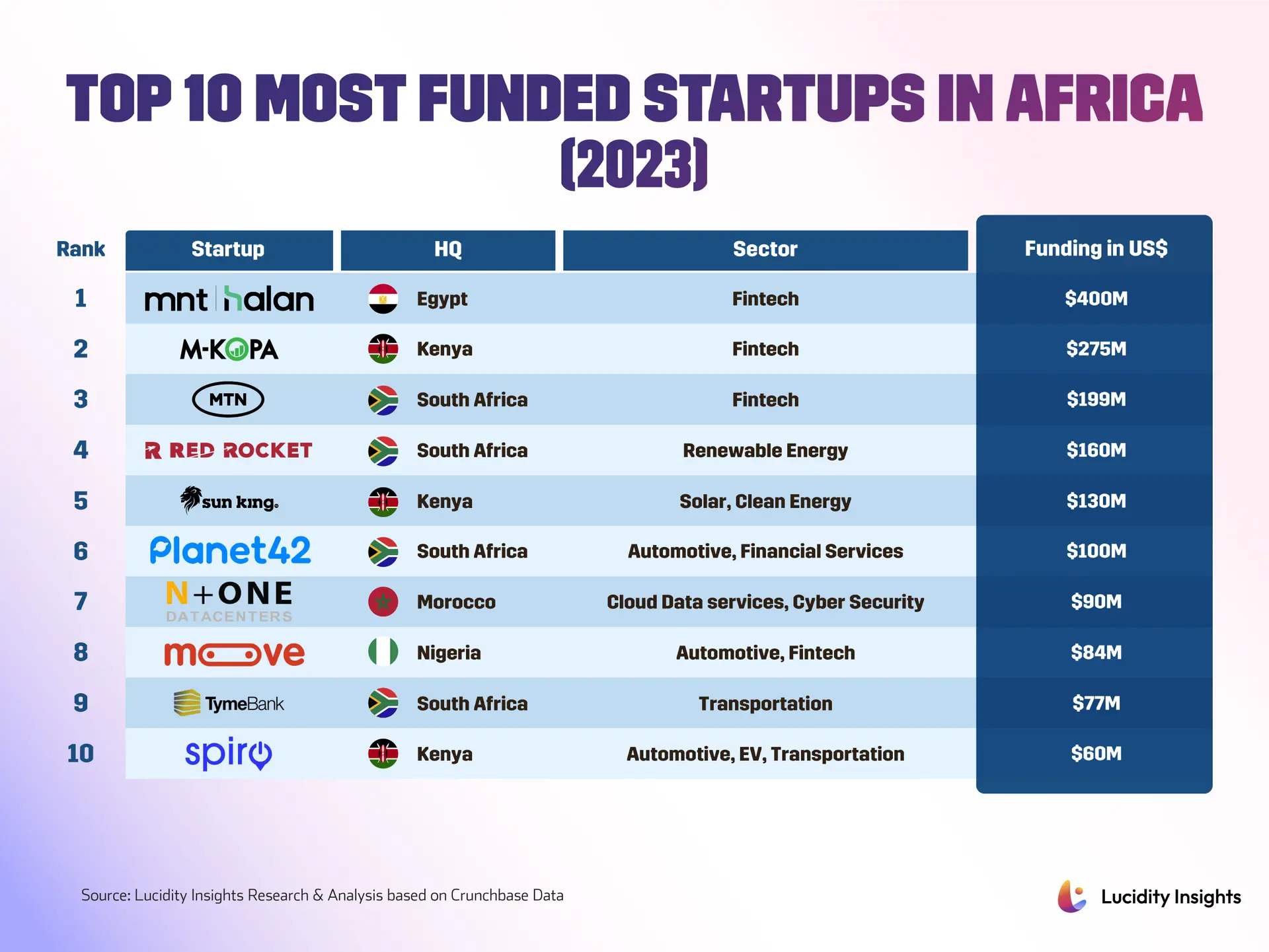

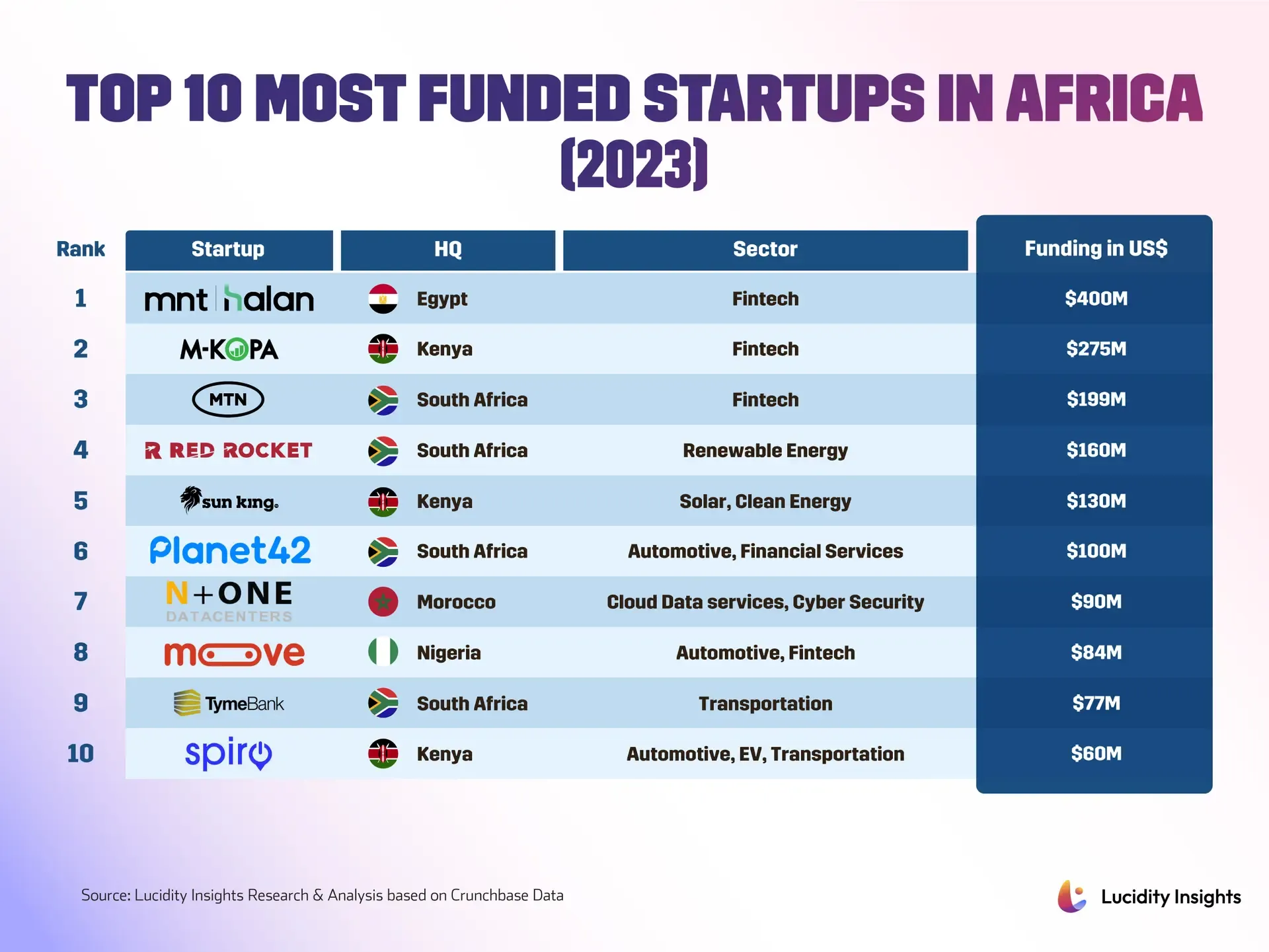

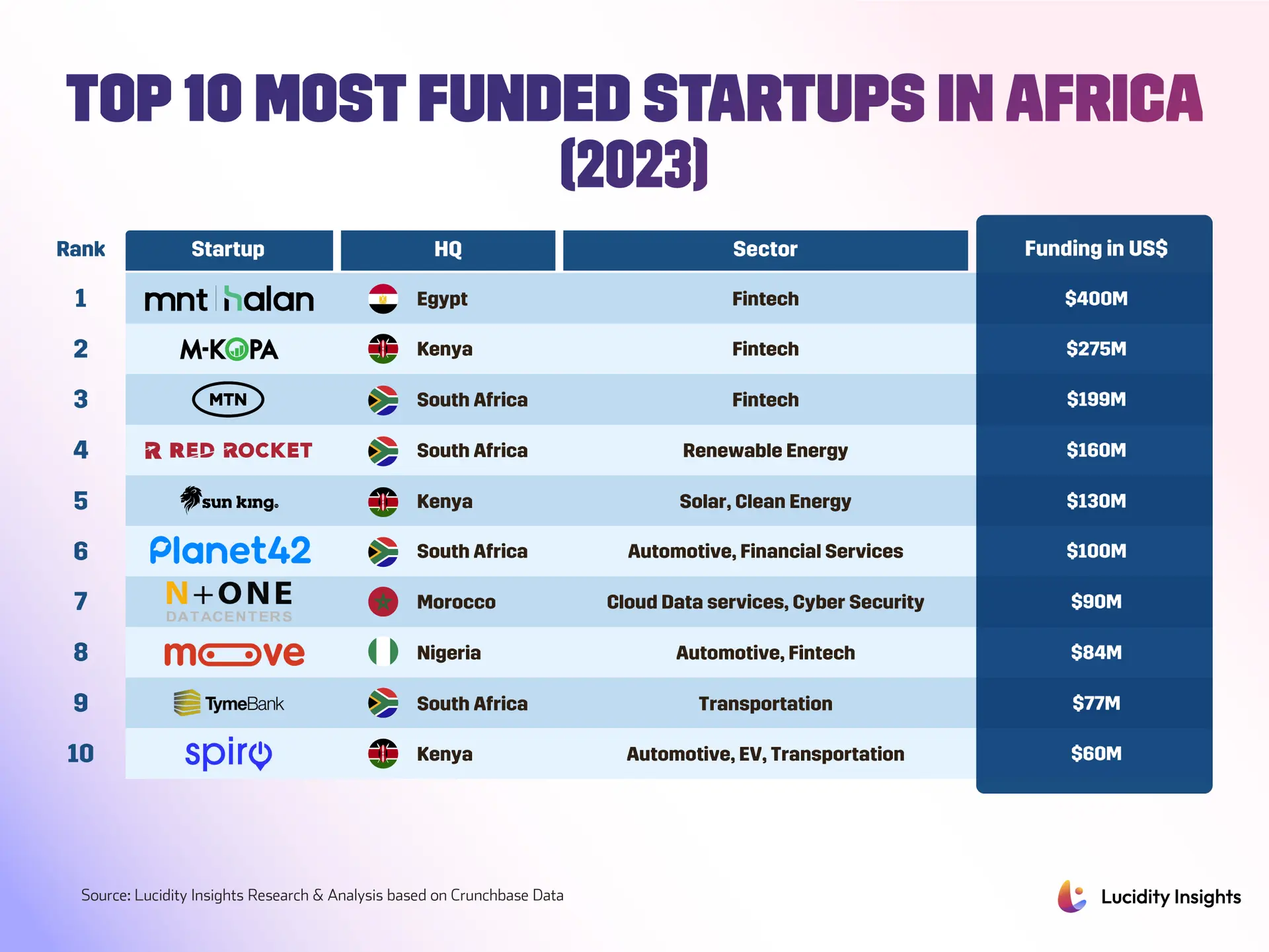

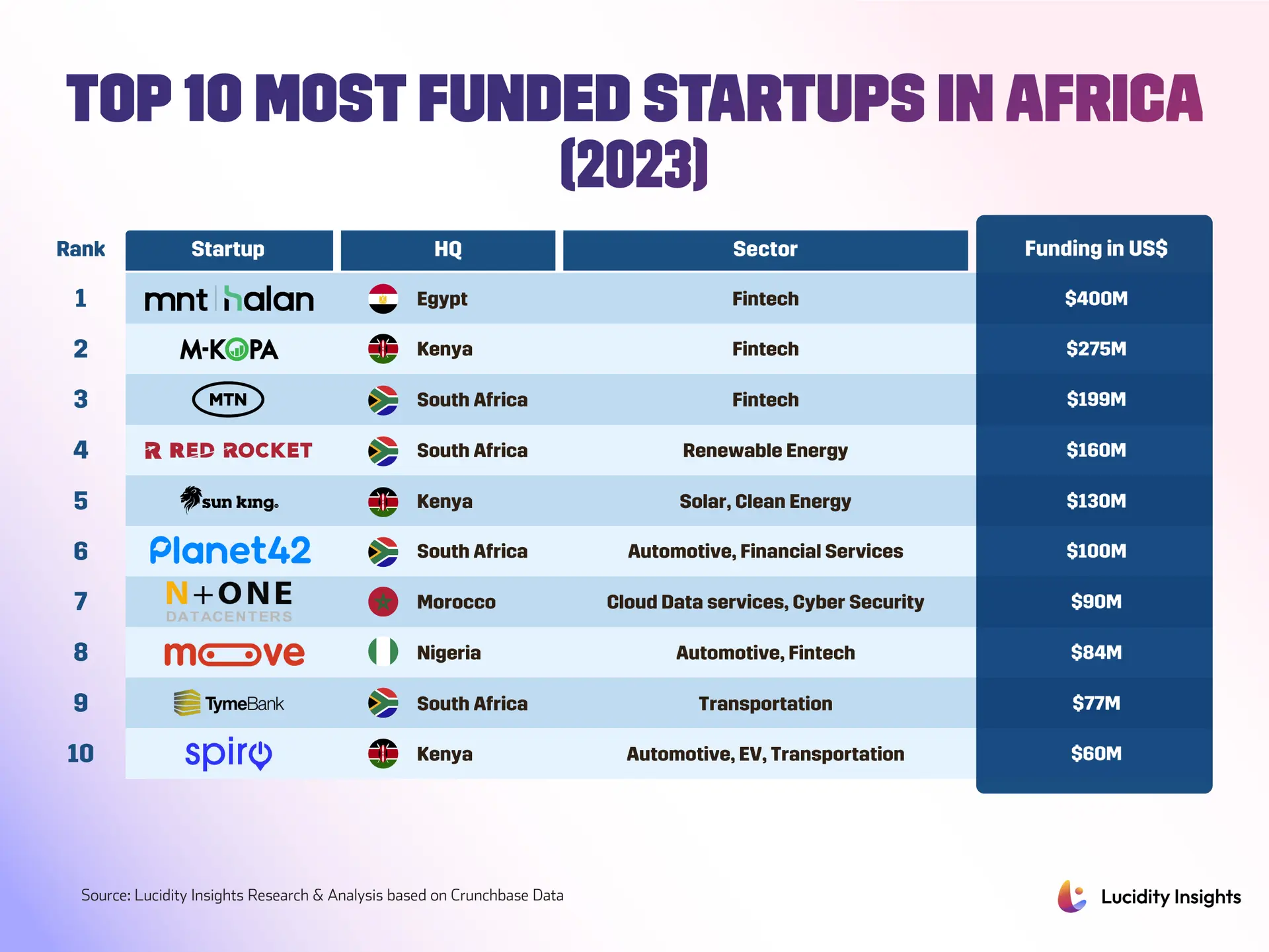

Geography continues to shape outcomes in Africa’s startup revival. Nigeria remained a dominant market in 2025, raising roughly $572 million and recording the highest number of deals at 102. Lagos still produces a heavy volume of fintech, e-commerce and enterprise startups, supported by a large consumer base and an increasingly seasoned founder community. Kenya retains strength as an East African hub, not only for fintech but also for climate and logistics plays. Morocco is climbing steadily, with roughly $80 million raised and growing deal activity driven by fintech, logistics and software, helped by proximity to European markets and evolving regulatory frameworks. Ghana, while experiencing a modest slowdown in total funding, remained active with a steady trickle of early-stage deals that continue to attract regional and diaspora investors. Fintech remains one of the most consistently funded sectors. Payments, cross-border transfers and SME financing are still investor favorites, and North Africa in particular is seeing a fresh wave of companies to watch. Egyptian payments provider Paymob, with point of sale and soft POS solutions, has built a presence across several markets and counts major regional and global investors among its backers. In Morocco, Chari is digitizing FMCG distribution and recently secured a payment institution license from the central bank, a milestone that signals growing regulatory maturity and opens the door for wider expansion. Policymakers are playing a role. Regulatory sandboxes, interoperability frameworks and national digital strategies are lowering barriers to experimentation, but they also raise expectations for compliance and scalability. Investors are rewarding startups that can navigate regulation efficiently and demonstrate unit-level profitability. This geographic and sectoral concentration is evident in the latest funding rounds and trends tracked across the continent.

A Broader Palette of Investors and the Road Ahead

The comeback has drawn a wider set of investors, from global funds to specialist debt providers. Traditional VC firms remain active, but there’s growing involvement from impact investors, development finance institutions and strategic corporate players. That diversification matters because it supports a broader set of business models, from high-growth marketplaces to asset-heavy energy providers. Venture debt, explained simply, is a loan structured for startups that typically expects repayment from future cashflows instead of equity dilution. Securitization and hybrid instruments blend debt and equity features to give lenders protection while letting founders retain upside. These structures are attractive when investors want returns without assuming the level of execution risk that earlier-stage equity demands. The story of 2025 wasn’t only about funding. Talent, product-market fit and operational discipline became deciding factors for success. TechCrunch and other outlets highlighted companies ranging from profitable food delivery startups to AI tooling, vehicle financing platforms and neobanks reaching millions of users. Those companies illustrate that African founders are building resilient, revenue-generating businesses across sectors. Looking ahead, Africa’s startup landscape is moving into a more sophisticated phase, where capital is available but conditional. Founders who can demonstrate repeatable unit economics, regulatory readiness and regional expansion plans will command the most favorable deals. Climate tech and fintech look set to remain focus areas, but the growing use of venture debt and hybrid financing means that traditional equity alone will no longer be the default route to scale. For investors, the message is that patience and structuring matter. For founders, the imperative is execution, clear financial metrics and the ability to translate local wins into multi-market expansion. In practical terms, the next chapters will be written by ventures that can bridge ambition with revenue, and by investors willing to craft instruments that share both risk and reward. This evolution is captured in comprehensive reports like the Top Startups in Africa 2026 analysis and discussions of the continent’s tech venture capital comeback. The funding surge past $1.4 billion in 2025 signals that Africa’s startup moment is here, but it’s arriving with new rules and higher expectations for sustainable, profitable growth.