Africa’s Startup Ecosystem at a Crossroads: Capital Returns but Investors Demand Clear Paths to Profit

A New Investment Reality Takes Shape

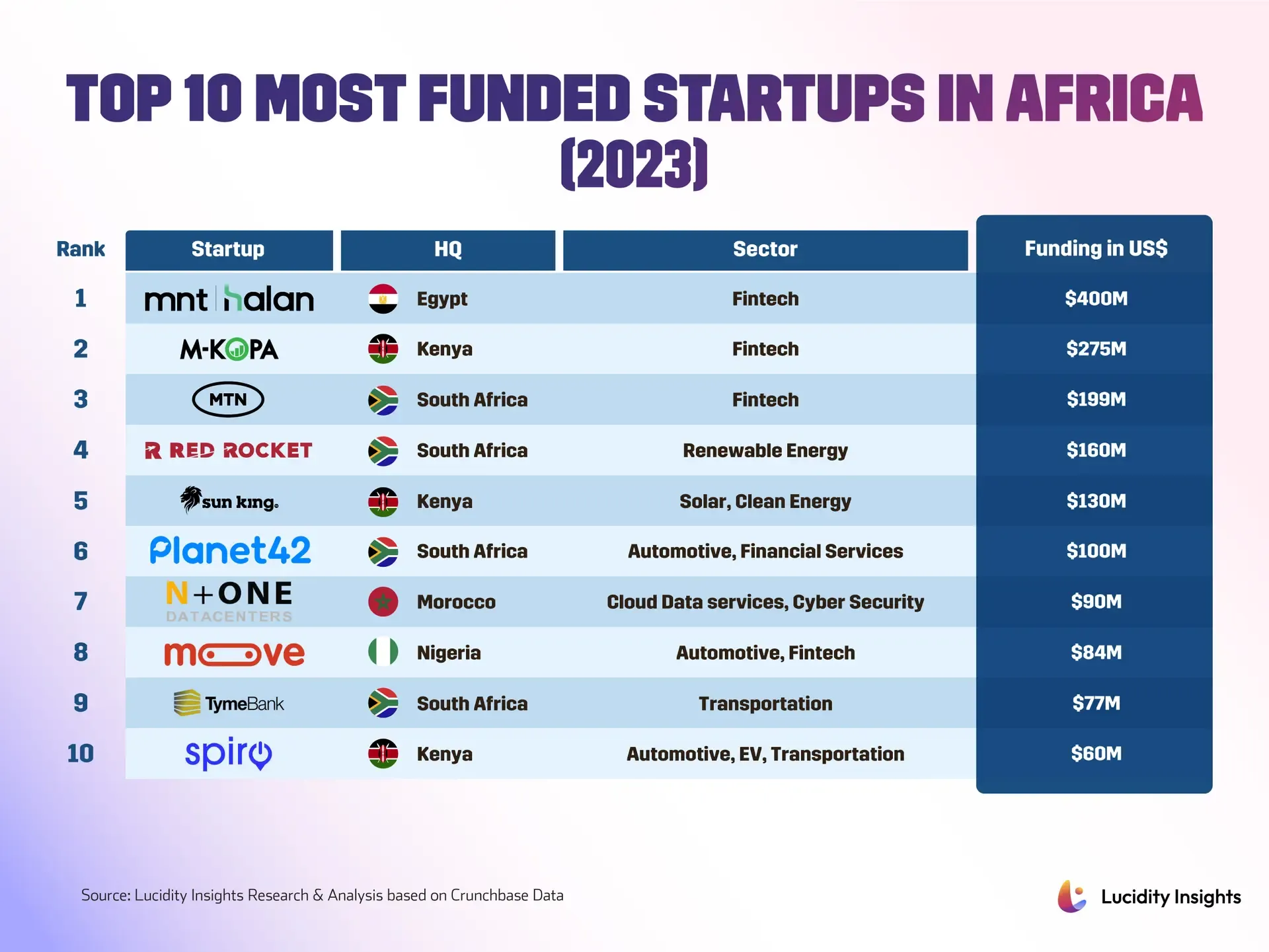

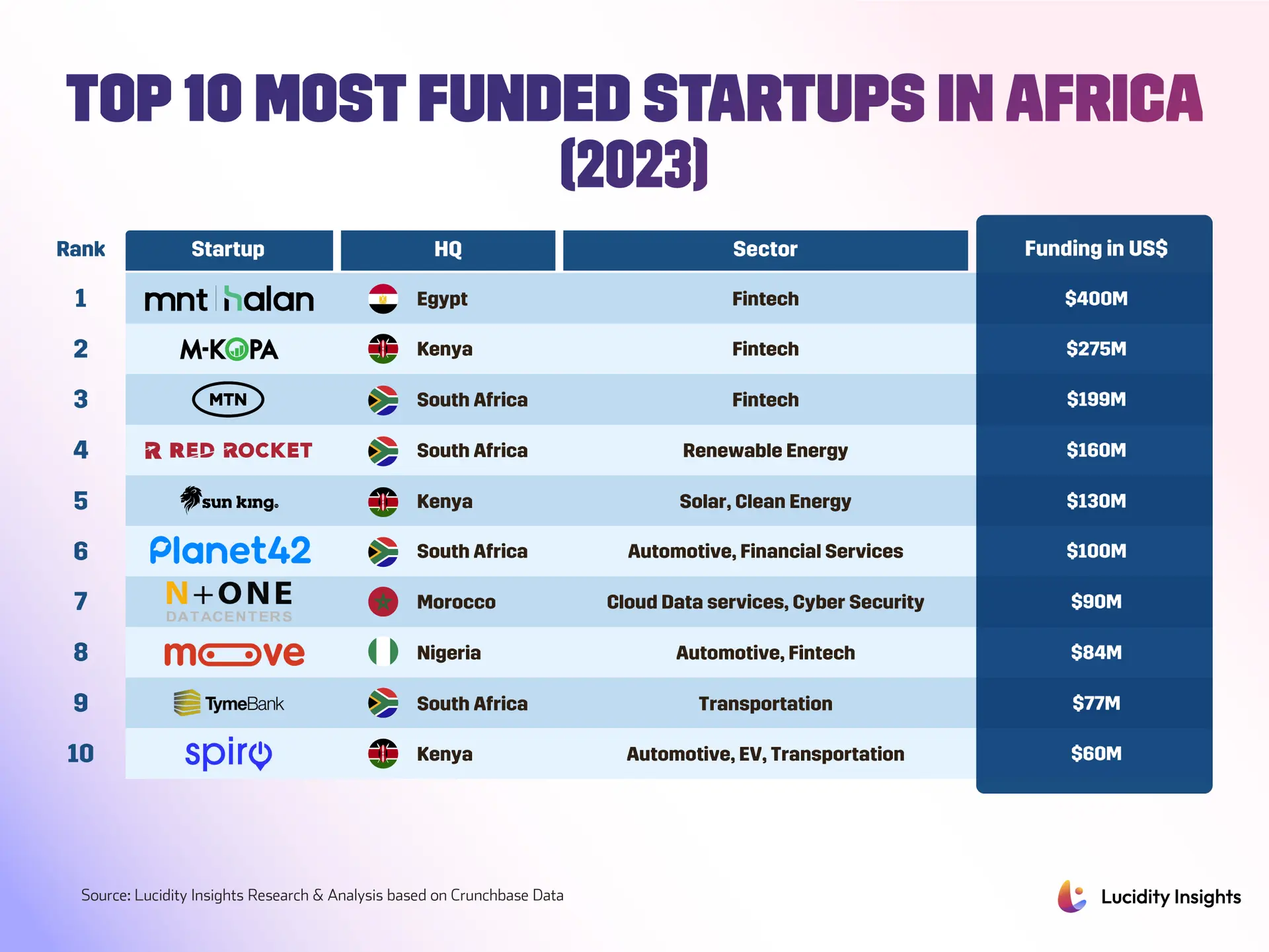

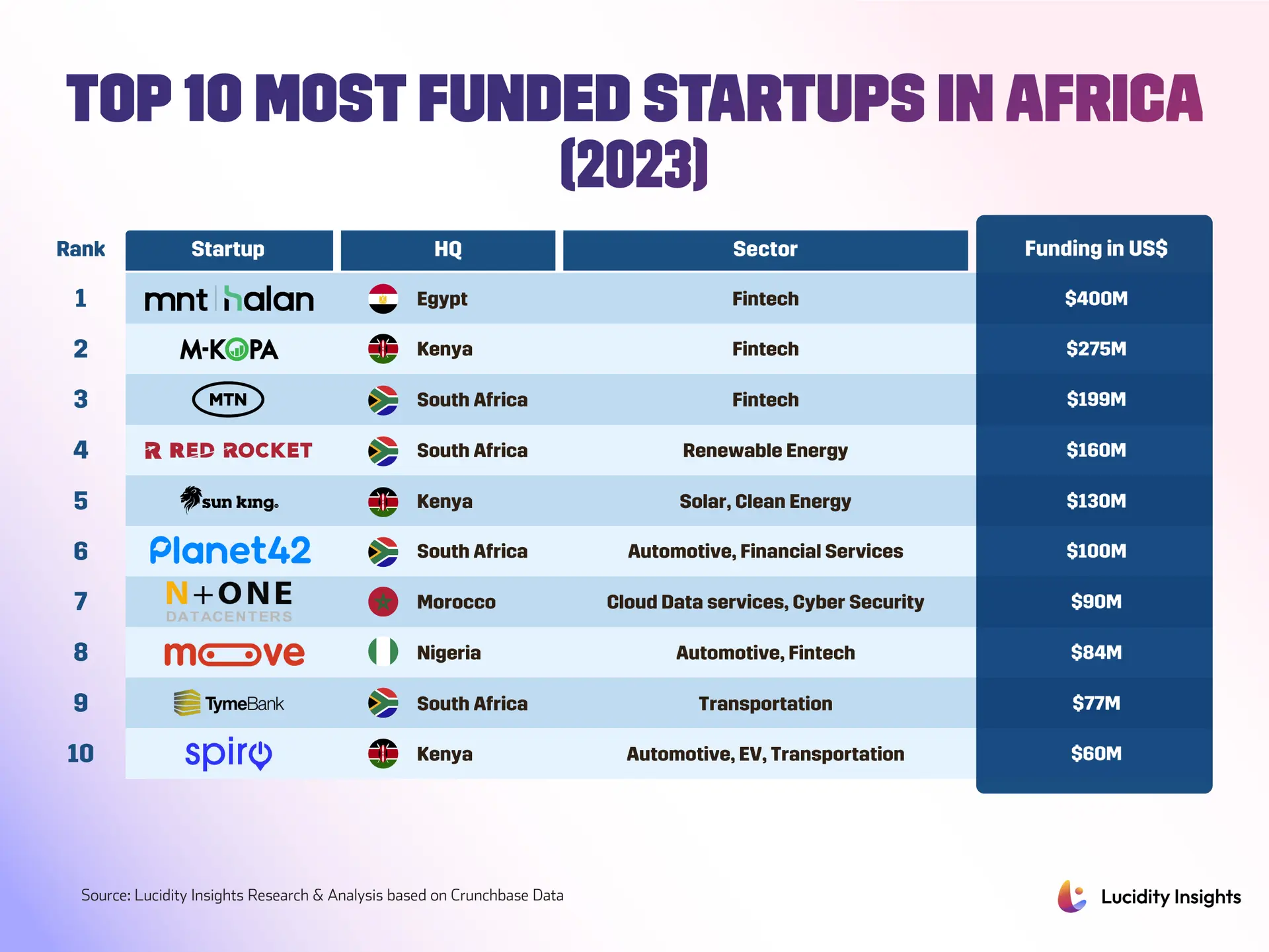

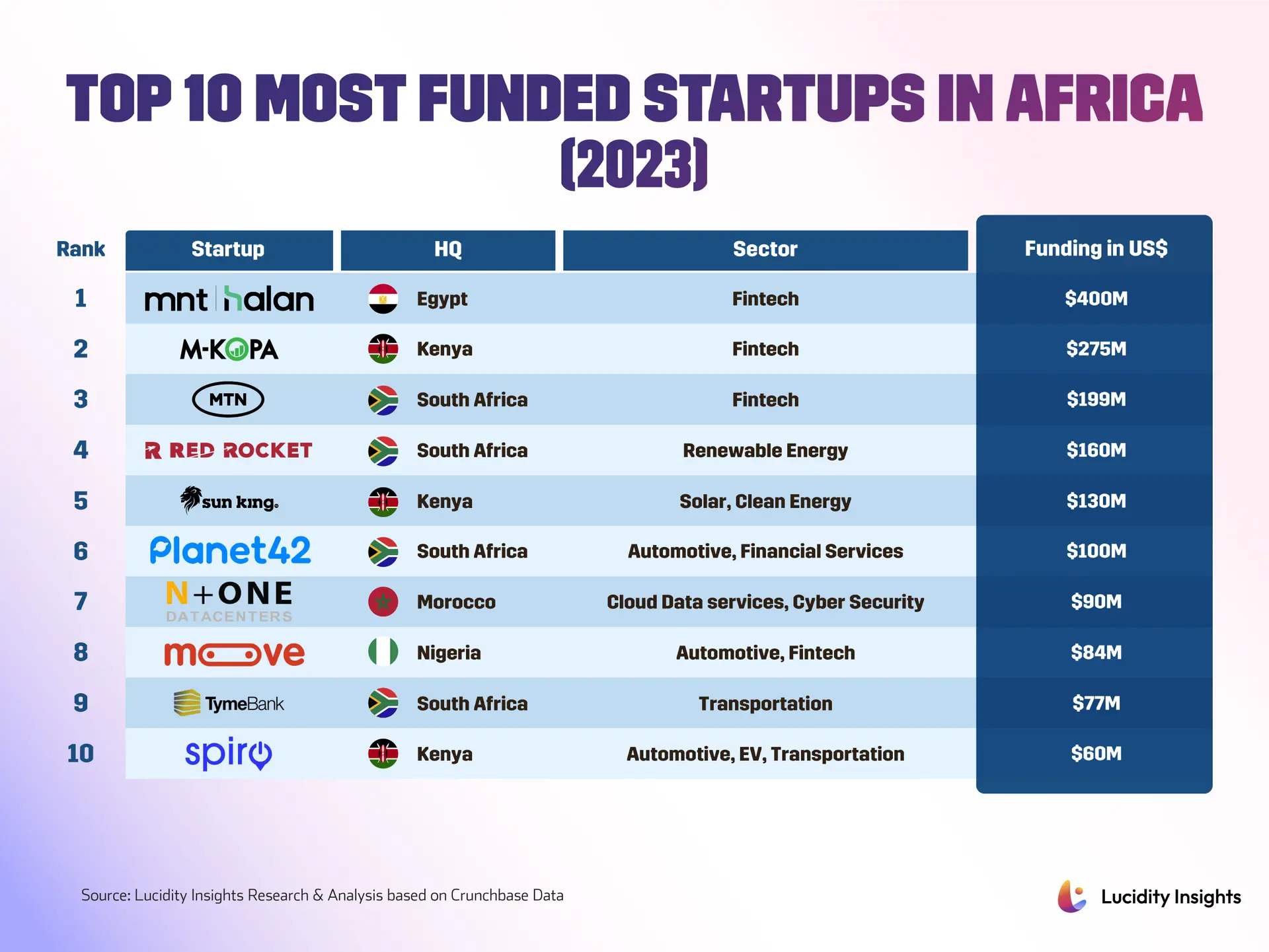

Africa’s startup scene isn’t just bouncing back, it’s growing up. After a period of exuberant growth chasing, investors have sobered up and now want to see real returns. The money’s definitely flowing again, with disclosed investment across the continent hitting roughly $3 billion in 2025. That rebound gathered real pace last year, bringing fresh pools of capital and new deal activity. But founders looking to convert that interest into sustainable businesses face a tougher playbook. Just look at January 2026, when startups raised about $174 million, with fintech alone accounting for nearly 60 percent of that monthly total, according to CNBC Africa’s reporting. Egypt led the fundraising tally that month, capturing roughly half the capital, while long-standing hubs like South Africa and Kenya were comparatively quieter. It’s a clear signal that geography matters differently now, with capital concentrating where regulatory stability, large markets, and strong local investor networks align.

The Rules of the Game Are Changing

Investors aren’t just writing checks anymore, they’re demanding clearer routes to getting their money back. Mergers and acquisitions have taken center stage as realistic exit strategies, allowing investors to sell stakes to larger or strategic buyers. Recent acquisitions by names like Flutterwave, Ezii, and Savannah show how M&A can deliver liquidity. Initial public offerings are also beginning to surface more often, though IPOs remain less common than exits by sale. What’s really interesting is where the money’s coming from. Local capital is becoming material to the ecosystem, providing not just money but market knowledge and connections that foreign capital sometimes lacks. A report showed local investors now supply about 40 percent of startup funding, up from 25 percent just two years earlier. That shift gives founders access to strategic support that can make all the difference. The sector mix is widening too. While fintech continues to dominate investor attention, clean energy, electric mobility, digital health, proptech, and even defence tech have attracted meaningful cheques. Notable deals from the past 18 months include consumer finance and payments platforms, a proptech giant in Egypt raising more than $50 million, and climate and mobility plays securing nine and ten figure investments, as detailed in ArabFunders’ analysis of top African startups. You can see this startup ecosystem boom transforming the continent’s economic landscape.

Building for the Long Haul

This new environment is producing a different kind of fundraising story. Big, late-stage rounds have returned, but so have more conservative instruments like structured finance and debt. These let companies grow without immediate dilution for founders, though they require sharper attention to cashflow. The discipline is extending to operations too. Several startups that had chased top-line growth are re-tooling. Some have restructured, others have trimmed staff or pivoted to clearer revenue models. That includes e-commerce and food supply startups rethinking unit economics, and players in logistics and mobility shifting toward profitable, asset-light models. These moves reflect investor insistence on measurable unit economics, the per-customer or per-transaction math that shows a business can grow profitably. There are risks, of course. Some high-profile startups have laid off staff or pivoted after large raises, signaling that growth without profitability can be unsustainable when investor patience wanes. For founders and policymakers, the message is clear. Unit economics matter more than ever, and investors will fund businesses that demonstrate scalable revenues and viable margins. Startups should plan for realistic exit routes, whether through regional consolidation, strategic sales to larger corporates, or eventually IPOs. Founders must also be fluent in a broader array of financing options, from venture equity to debt and structured instruments, and be ready to explain how each affects control and cashflow. As Africa’s tech renaissance continues, the momentum now looks less like a sprint and more like a series of measured legs. Winners will be those that balance ambition with discipline. Expect to see more selective large rounds, a rising number of exits by sale, and a gradual increase in IPOs as 2026 advances, trends that TechCrunch’s ongoing Africa coverage consistently tracks. The ecosystem is maturing, and the question for founders is no longer only how fast to grow, but how sustainably that growth can be monetised and multiplied across African markets. For more insights into the continent’s evolving funding landscape, check our previous coverage.