African Startups Reach a Turning Point as Funding, Founders and Policy Push for Real-World Impact

Across busy markets in Lagos, Nairobi and Accra, something interesting is happening. After years of chasing headlines with sky-high valuations and rapid user growth, Africa’s tech scene is settling into a more disciplined phase. Investors aren’t writing blank checks anymore. They’re rewarding ventures with clear revenue models, actual customer traction, and unit economics that actually make sense. The numbers tell part of the story: African startups pulled in about $4.1 billion in funding last year, creating roughly 1.2 million jobs for people under 35, according to recent industry analysis. That’s a more than 45 percent jump from the previous year, signaling a real recovery from the global capital drought. But it’s not just about the money coming back, it’s about where it’s going and who’s providing it. Local venture capitalists are stepping up, covering an estimated 40 percent of the funding gap left when global investors pulled back. Take Delta40, a Kenya-based venture firm that just raised $20 million to back early-stage companies with checks from $100,000 to $500,000. Their round included development finance institutions, foundations, and family offices, pointing to a growing preference for models that pair capital with hands-on operational support. You can see this shift playing out across the continent’s tech renaissance, where the focus has moved from hype to substance.

Sector Shifts and Practical Solutions

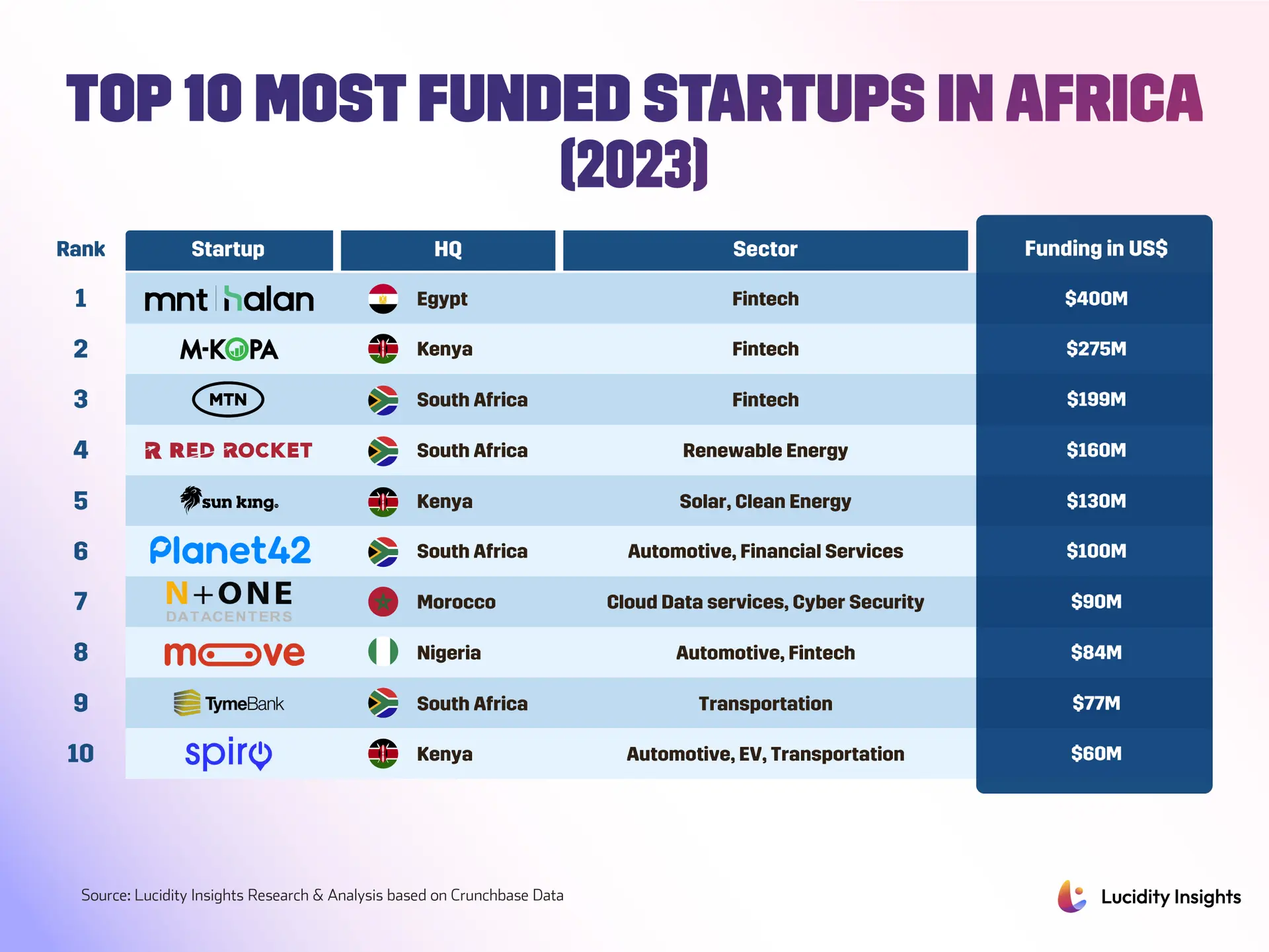

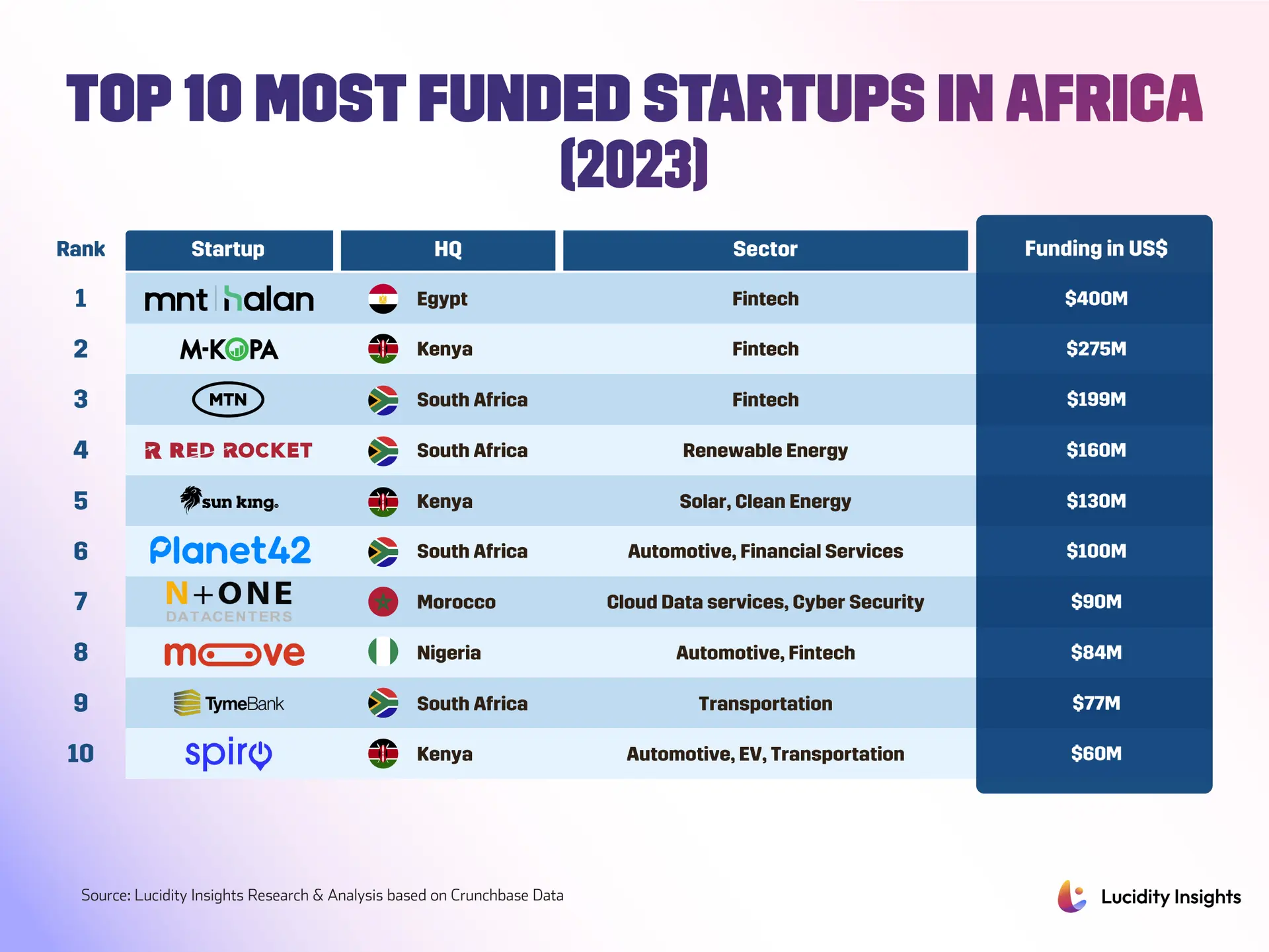

Fintech still leads the pack, but it’s growing up. Mobile money and better internet access have pushed digital payments into everyday commerce, and pan-African payments infrastructure is beginning to take shape under the African Continental Free Trade Area. New players are solving persistent friction in cross-border transactions. One startup using stablecoins, which are cryptocurrencies tied to a stable fiat value, processes about $150 million a month and serves hundreds of thousands of people and small businesses, offering a faster, cheaper way to move money across borders. Meanwhile, agritech is moving from pilot projects to measurable gains on actual farms. Startups applying internet-connected sensors and simple automation, often called the Internet of Things or IoT, are reducing post-harvest losses by roughly 20 to 25 percent in regions where they’re deployed. In places like Kano, Nigeria, digital marketplaces now let farmers sell directly to buyers in Nairobi and beyond, cutting out middlemen and improving prices for producers. Energy and climate tech are also attracting serious attention because they solve daily problems. Frequent blackouts give solar and battery-backed solutions immediate value, and a new wave of green tech mixes hardware, finance, and artificial intelligence to make distributed energy more predictable and affordable. That combination helps factories, retail networks, and even market traders stay open and connected. This practical approach is producing businesses that create jobs, stabilize supply chains, and bring financial tools to small and medium enterprises that previously relied on cash, as detailed in recent startup coverage from regional analysts.

Challenges and What Comes Next

Don’t get me wrong, challenges remain. Power supply issues, regulatory uncertainty, and a shortage of late-stage capital continue to slow scaling. Many markets still score poorly on energy reliability, and early-stage founders often face a difficult road from prototype to profitable product. Investors are pressing startups to reach product-market fit quickly, test with initial users, and scale city by city rather than betting on continent-wide rollouts from day one. Geography still matters too. Nigeria, Kenya, and South Africa account for the majority of deal volume, but countries like Senegal and Ghana are drawing more attention from overseas investors. Improved regional connectivity, underpinned by better fiber and mobile networks, is making it easier for startups to serve cross-border customers and for investors to deploy capital across multiple markets. What’s striking isn’t just the numbers, it’s the mindset shift. Founders are pricing products from day one, testing with small cohorts, and iterating rapidly. They’re building solutions that solve logistics bottlenecks, make agriculture less wasteful, and connect informal traders to digital payments. Looking ahead, Africa’s tech ecosystem seems poised for steady, sustained growth rather than sudden, speculative surges. If local capital continues to complement international funding, if policies under AfCFTA reduce cross-border frictions, and if startups keep focusing on unit economics and operational resilience, the continent may be on track toward a substantially larger digital economy in the coming years. The startup ecosystem’s boom in recent years shows this isn’t just a passing trend, but a fundamental shift in how African entrepreneurs build businesses that last. As TechCrunch’s Africa coverage has documented, the question now is which founders and funds will turn disciplined strategy into market-shaping businesses that endure, building on the continent’s ongoing digital renaissance and the insights from comprehensive tech startup reports that track these developments.