From Payment Rails to Farm Gates: African Startups Reshape the Continent’s Economy in 2026

The Financial Foundation

Remember those conversations at Davos about rethinking global finance on Africa’s terms? Well, they’re not just talk anymore. African entrepreneurs are actually building the future they envisioned, and 2026 is shaping up to be a pivotal year. At the heart of this transformation sits finance, but it’s not your grandfather’s banking system. Digital platforms are expanding consumer access while doubling as infrastructure for wider commerce. Take Affinity Africa’s recent $8 million funding round, which shows how digital banking can reach previously underserved customers. Then there’s Honeycoin, a newcomer using stablecoins, those cryptocurrencies pegged to traditional currencies to reduce wild price swings, to smooth cross-border transfers. Honeycoin claims hundreds of thousands of users and moves hundreds of millions monthly, proving that alternative rails are filling gaps where old systems remain slow and expensive.

The startup scene isn’t just growing, it’s maturing. Tracxn’s 2026 data reveals a steady stream of IPOs and acquisitions across fintech, telecoms, and energy. These exits matter because they signal to investors that there are real pathways to returns, which should attract larger pools of capital. But with maturity comes scrutiny. Reports from African Business and others note that venture capitalists are applying tougher filters, demanding clearer paths to profitability as competition for later-stage capital heats up.

This pressure is pushing founders toward sectors with deep, structural demand. Agriculture, often discussed in abstract terms, is emerging as a headline opportunity. Analysts see a trillion-dollar potential in digitizing, financing, and integrating agricultural value chains into export markets. Startups like Woliz are already proving the model. After a modest pre-seed round, it onboarded tens of thousands of stores, processed substantial gross merchandise value, and partnered with Morocco’s ministry to digitize hundreds of thousands of retailers. These platforms turn informal retail networks into measurable, lendable assets, unlocking working capital and formal credit that can strengthen the crucial farm-to-market connection. This shift is part of a broader tech renaissance that’s redefining what’s possible across the continent.

Beyond Finance: Logistics, Skills, and Creative Economies

The innovation wave isn’t stopping at finance and farms. Logistics and last-mile delivery present another practical frontier where African ingenuity shines. Nigerian and Kenyan startups, from ride-based advertising networks to delivery platforms that blend local knowledge with artificial intelligence, are tackling road-level complexity head-on. These operationally heavy models show that technology in Africa often succeeds by complementing human know-how rather than replacing it.

A more strategic shift is brewing in skills and hardware. Companies like ChipMango are training African engineers in semiconductor design, aiming to plug the continent into the global supply chain for the chips that power everything from AI to mobile devices. It’s a long-term play, but it reflects a growing ambition to capture higher-value segments of the tech stack, not just consume finished products.

Even creative industries are getting a digital and financial upgrade. Platforms such as SongDis help musicians manage releases, royalties, and advances tied to streaming income, effectively turning creative content into a monetizable, exportable asset. These businesses demonstrate how new financial instruments and digital distribution can formalize sectors long relegated to the informal economy.

Of course, founders aren’t operating in a vacuum. Policy and geopolitics create both tailwinds and headwinds. Major infrastructure moves, like the United States backing a multibillion-dollar airport project in Ethiopia, change the calculus for regional trade and mobility. Simultaneously, regulatory shifts are tightening. Nigeria has faced allegations of tampering in new tax laws, and the European Union’s carbon border tax is forcing exporters to prepare for a world where carbon intensity influences market access. For businesses in oil-producing nations, debates about channeling fossil fuel profits into renewable investment, as seen in Uganda, highlight both the fragility and the potential of energy transitions. This complex environment requires the kind of resilient growth seen in the continent’s booming startup ecosystem.

Selective Capital and the Road Ahead

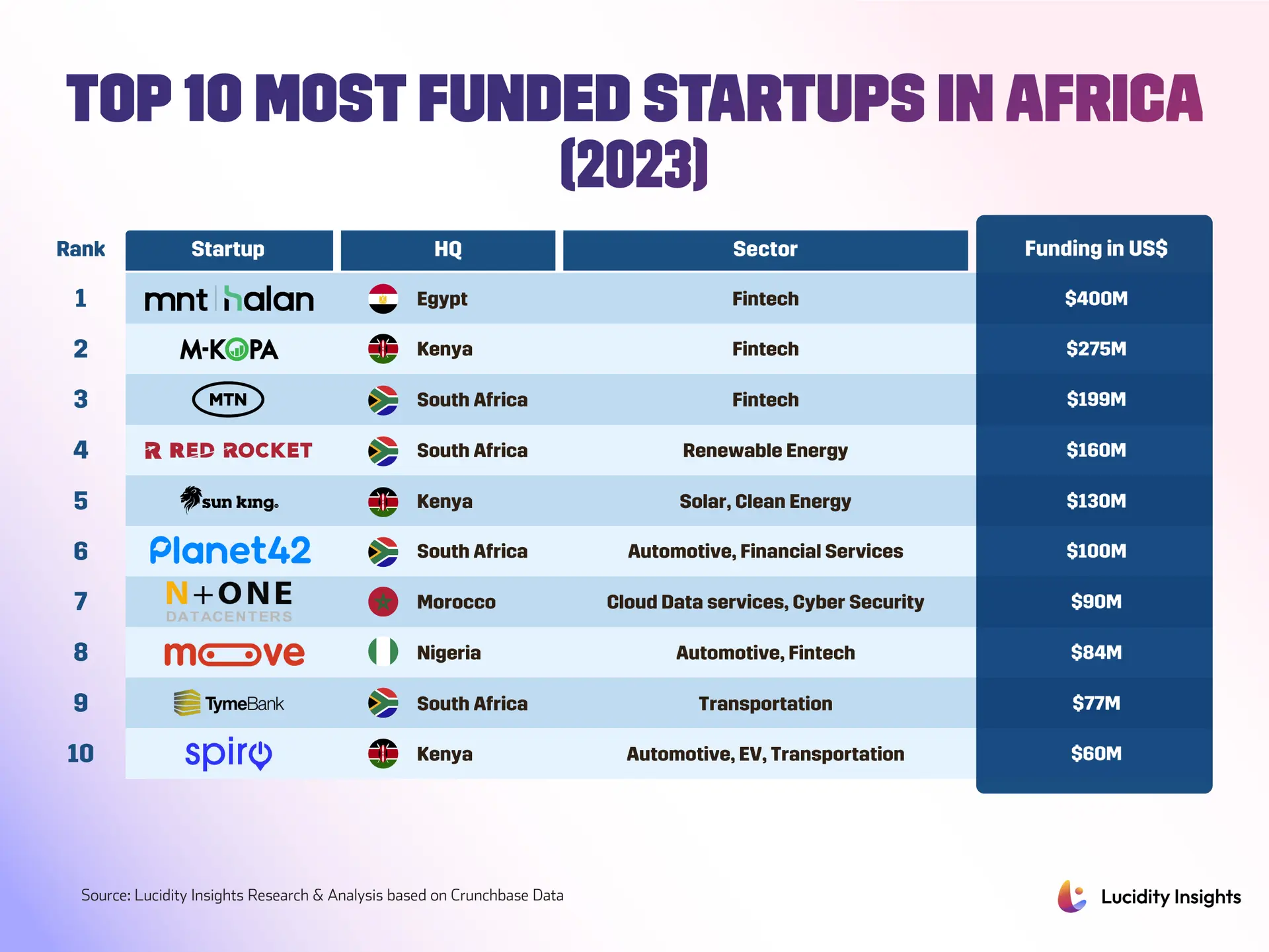

So, is the money there to fund all this ambition? The answer is yes, but it’s becoming more selective. Large development and corporate-backed events like IATF2025, which announced over $48 billion in deals, demonstrate a clear appetite for African opportunity. Yet investors are increasingly demanding clearer governance, scalable unit economics, and compliance with evolving regulations. This newfound realism could help weed out speculative plays while accelerating the most durable business models. The funding landscape reflects this maturation, as detailed in analyses of the record investment flowing into African startups.

The near-term picture is one of pragmatic optimism. Founders are building companies that tackle immediate friction points, from payments and credit to logistics and media monetization. Investors are recalibrating expectations, bringing disciplined capital that prefers proof of growth and defined exit routes. Governments and international actors are reshaping the operating environment with major infrastructure, trade rules, and climate-related policies.

Looking ahead, the next chapter will likely hinge on a few critical questions. Can financial innovations like stablecoins and digital banks be integrated into regulated systems that enable scale without introducing systemic risk? Will policymakers harmonize rules across borders to support tradeable digital businesses? And perhaps most importantly, can the continent translate export earnings from legacy sectors into long-term investment in energy, skills, and manufacturing? The journey of companies like Affinity Africa, covered by outlets like Tech in Africa, offers a glimpse into this evolving narrative.

If these elements align, Africa’s startups won’t just attract capital and headlines. They’ll anchor transformative change in agriculture, mobility, hardware, and creative economies, turning local solutions into global offerings. The ingredients for that shift are already here, simmering. 2026 may well be remembered as the year the continent’s entrepreneurs moved decisively from proving concepts to building the platforms that could underpin a new economic order.