African Startups Shift from Hype to Hard Work as Investment Patterns Evolve

The Quiet Revolution in African Tech

Remember when African tech was all about flashy launches and billion dollar valuations? Those days are fading fast. What we’re seeing now is something quieter but far more consequential. Africa’s startup ecosystem is growing up, trading headline grabbing hype for the hard work of building real infrastructure and solving industry specific problems. Investors haven’t disappeared, but they’ve gotten choosier. The money’s still flowing, but it’s following a more nuanced pattern that reflects a maturing market. This shift isn’t about decline, it’s about depth. Startups that once chased viral consumer apps are now rolling up their sleeves to fix broken systems that have held back African industries for decades. Think less about social media buzz and more about creating the digital rails that make everything else possible. It’s a transition from seeking attention to building something that actually lasts, and it’s reshaping what success looks like across the continent. You can see this maturation in the broader investment trends, where record growth in 2025 set the stage for this more disciplined era. The ecosystem isn’t shrinking, it’s sharpening its focus, and that’s ultimately a sign of health for any market that wants to move beyond initial excitement to sustainable impact.

Where the Money’s Going and Who’s Getting It

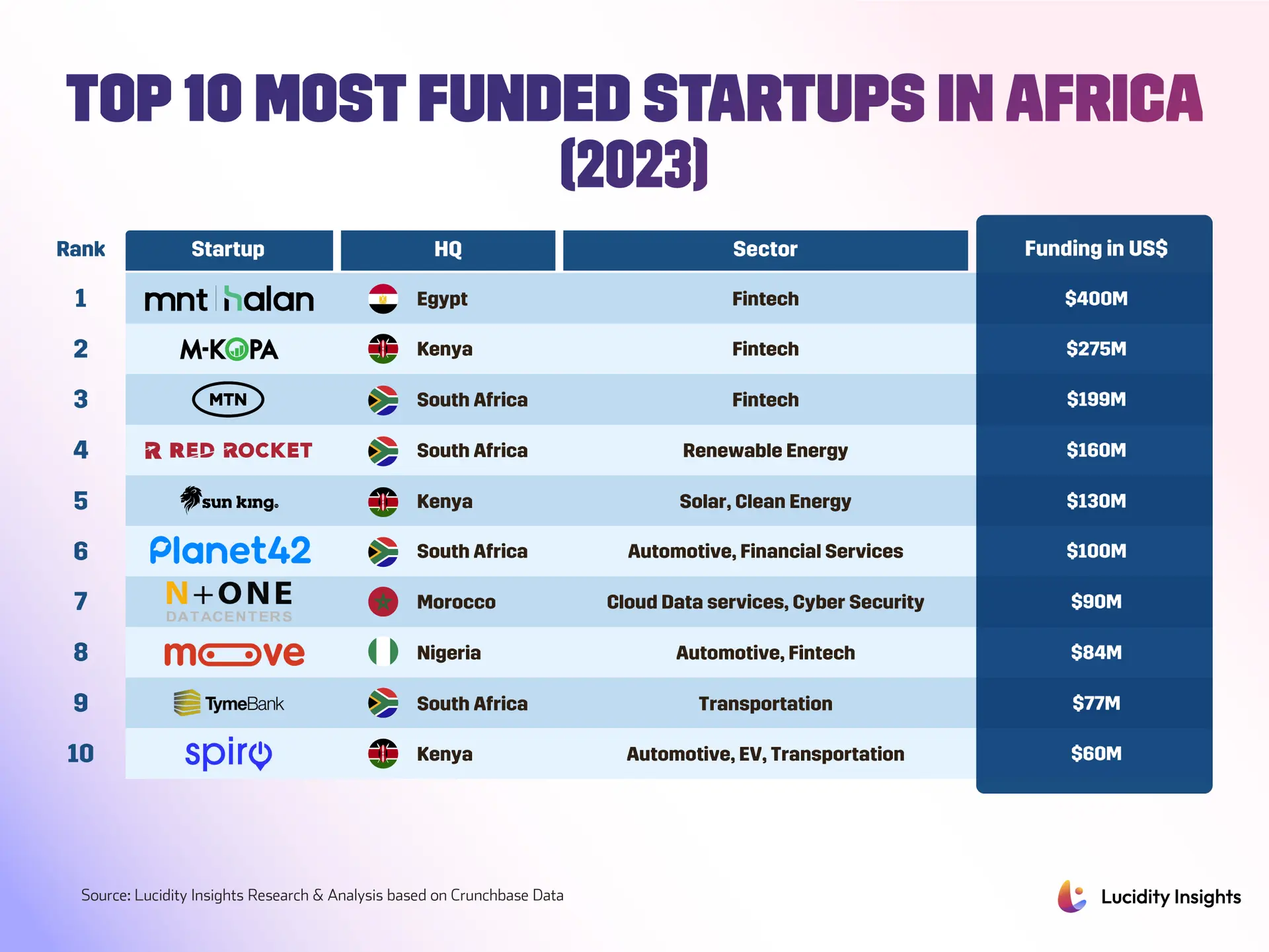

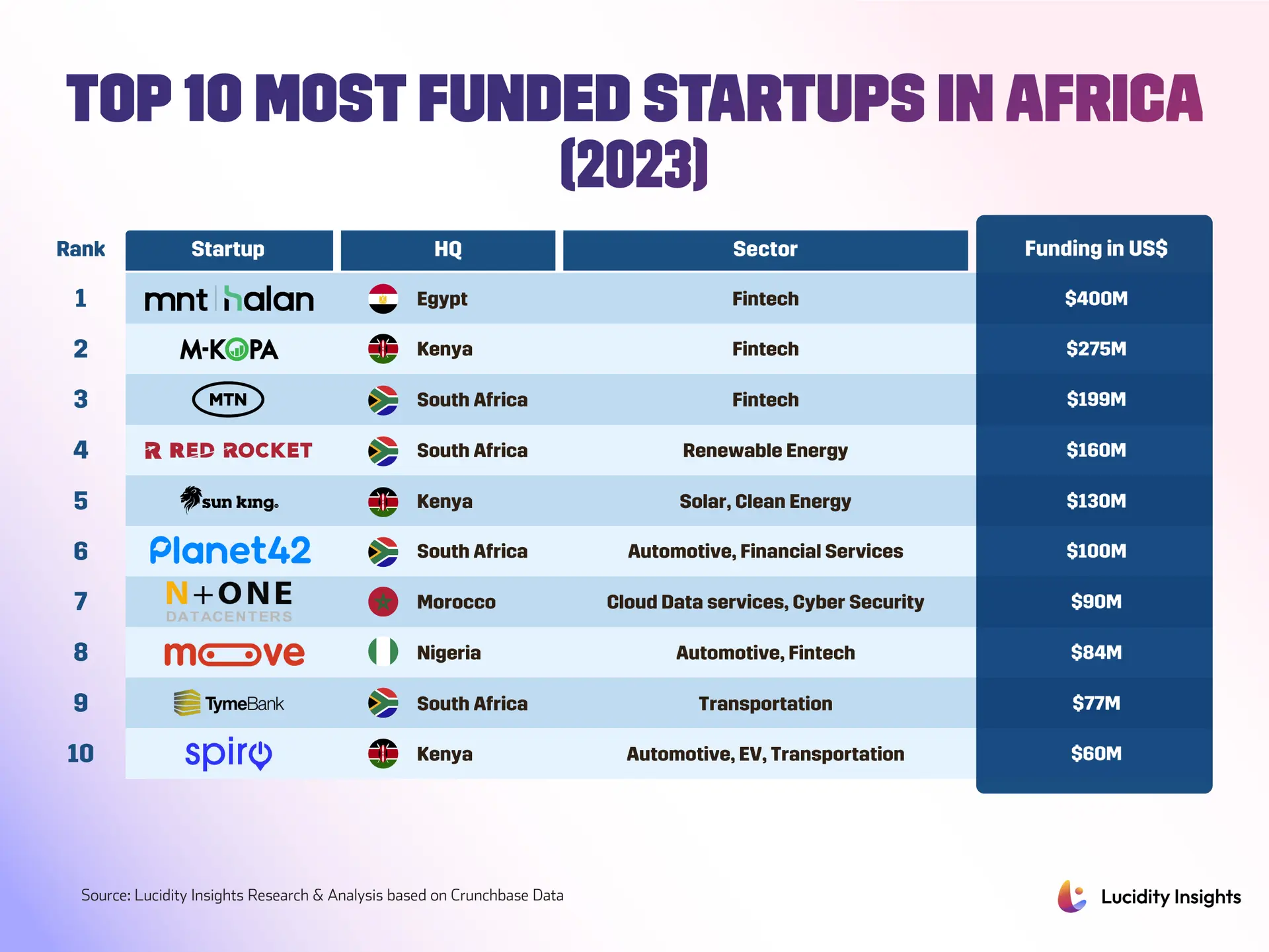

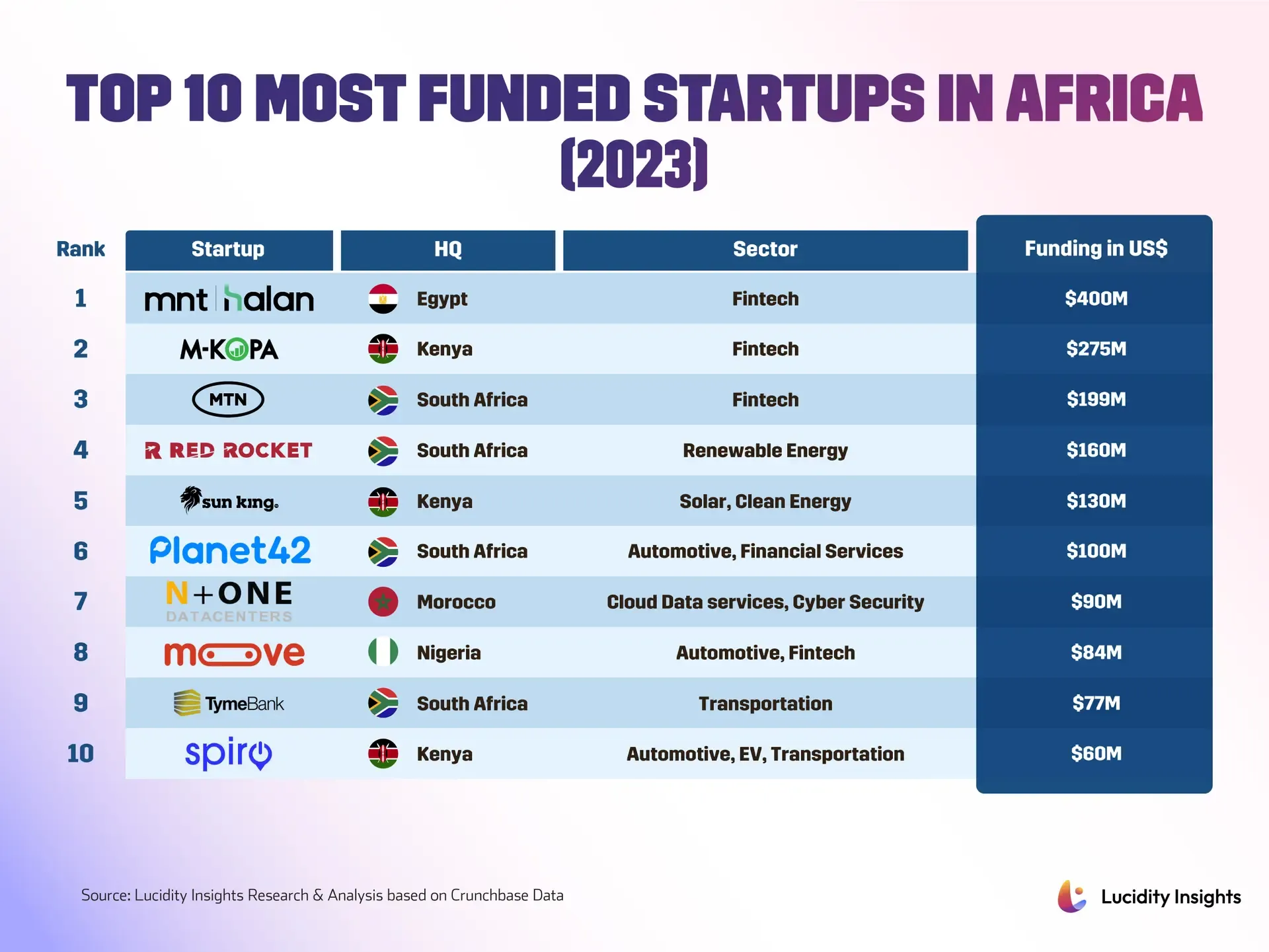

So what do the numbers tell us? According to data from Africa: The Big Deal, startups raised about $174 million in January 2026. That figure raised some eyebrows because it came in lower than many monthly averages from 2025, when total investment jumped by more than 45 percent. But analysts caution against reading too much into a single month. Fundraising naturally slows after December’s rush, and monthly fluctuations don’t define a market’s trajectory. What’s more revealing is where that January money went. Fintech dominated, claiming almost 60 percent of the funds, and Egypt unexpectedly captured about half of the total capital. The month’s biggest deals included Egypt’s The Value raising over $60 million and Nigeria’s Max securing roughly $25 million. But beneath these headline numbers, you’ll find startups tackling very specific, unsexy problems. Take BAC Intelligence, which is bringing transparency to Africa’s opaque aviation sector by aggregating and standardizing data for airlines, lessors, and regulators. Or consider Honeycoin, a fintech using stablecoins to speed up cross border payments while cutting costs. They already serve 300,000 individuals and 300 businesses, processing around $150 million monthly. Then there’s Nigeria’s Carschek, building trust in the used car market through verification and inspection data. These companies aren’t chasing viral moments, they’re fixing market frictions that have existed for years. As highlighted in recent analysis of startups to watch, the most promising ventures in 2026 are those addressing infrastructure gaps and information asymmetry rather than consumer virality. The geography of investment is shifting too. While Kenya and South Africa remain important hubs, capital is flowing in new directions. Egypt’s January surge shows how concentrated rounds can sway national tallies, and investors are widening their gaze to include sectors like proptech and even defense tech, signaling a maturing appetite for diversification beyond fintech’s dominance.

Investor Scrutiny and the Road Ahead

What’s driving this more selective investment environment? Several dynamics are at play. Limited partners are demanding clearer returns and operational discipline, which means startups face increased scrutiny on unit economics and runway management. Regulatory uncertainty, especially in payments and crypto, continues to be a headwind, forcing companies to pair innovation with robust compliance strategies. Infrastructure challenges, from undersea cables to energy systems, remain both a constraint and an opportunity, particularly as African economies navigate the transition to renewables while managing gas development. For founders navigating this landscape, the recipe for success has two key ingredients. First, build products that solve measurable, industry level problems with tangible impact. Second, communicate realistic metrics and regulatory readiness to increasingly skeptical investors. The startups that combine deep domain expertise with financial discipline stand the best chance of converting interest into sustainable growth. Looking ahead, 2026 could be the year Africa’s tech ecosystem consolidates the lessons from its rapid expansion phase. Fundraising will still have its ups and downs, but both investors and founders are adapting to a world where foundational infrastructure, reliable data, and pragmatic scaling approaches matter more than social media buzz. If this shift holds, Africa’s tech story will be less about chasing scale at any cost and more about creating the durable systems that enable broader digital transformation. As Africa’s tech renaissance continues, the focus is shifting from mere innovation to implementation that delivers real value. This evolution reflects a broader trend captured in ongoing coverage of the region’s emerging technology landscape, where sustainable growth is becoming the priority over explosive but fleeting success. The continent’s record funding achievements in 2025 provided the capital foundation, but now comes the harder work of turning that investment into lasting infrastructure and impact. It’s a challenging transition, but also a necessary one for any ecosystem that wants to move beyond potential to proven results.