Africa’s Evolving Investment Landscape: Homegrown Capital, Venture Studios and Policy Pressures

A New Era of African Investment

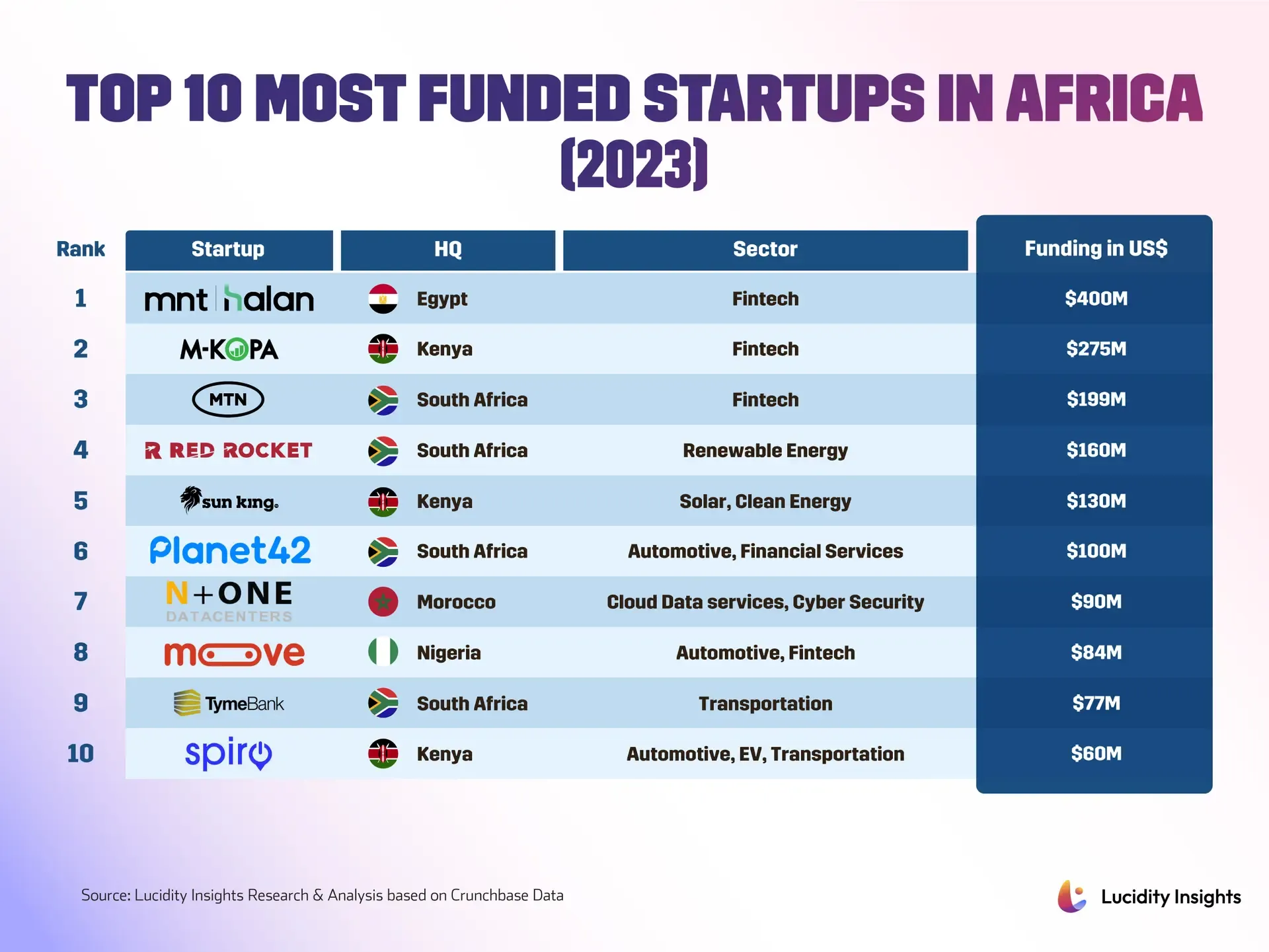

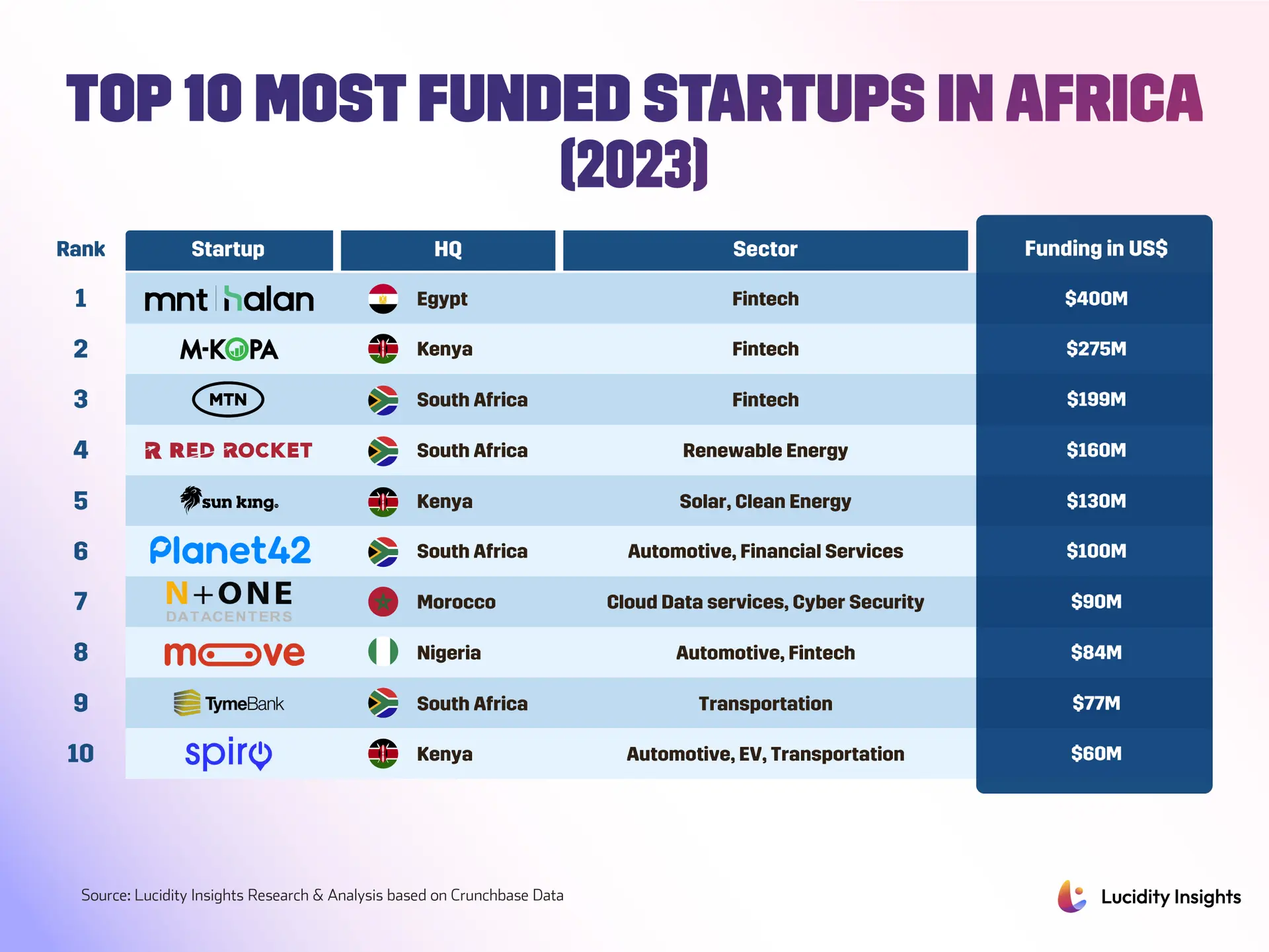

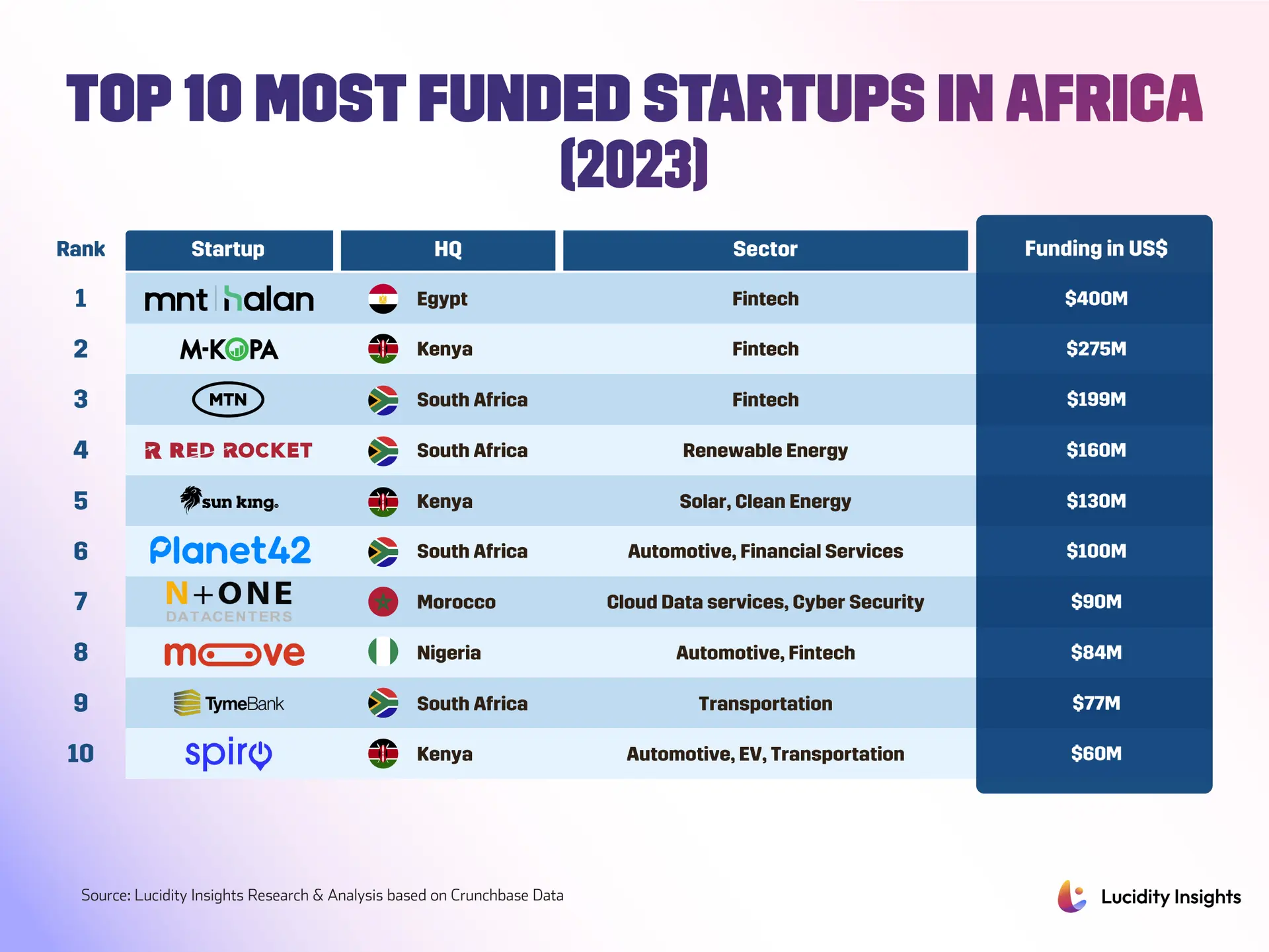

Africa’s investment scene isn’t just growing, it’s maturing fast. You can see it in the numbers: local investors now provide nearly 40 percent of startup funding, up from just 25 percent two years ago according to a recent African Business report. That’s a seismic shift. These homegrown backers bring more than cash, they bring market knowledge and networks that distant venture funds can’t match. But don’t think it’s getting easier for founders. Investors have tightened their belts, prioritizing profitability and solid execution over endless growth stories. Startups now face tougher due diligence and clearer demands for returns. Into this more disciplined environment steps a new breed of supporter: the venture studio. Take Delta40, which just raised $20 million to combine funding with hands-on operational expertise, as TechAfricaNews reported. Their model partners with founders from idea to scale across energy, mobility, agriculture, and fintech. As Delta40 founder Lyndsay Holley Handler puts it, they’re building ventures that deliver both impact and exits. For many African entrepreneurs, that kind of partner could mean the difference between a promising prototype and a pan-African company.

Policy Realities Reshape Opportunities

Capital flows aren’t happening in a vacuum. Policy and geopolitics are drawing clear lines around what gets funded and what doesn’t. The European Union’s carbon border adjustment mechanism, a tax on embedded carbon in imports that African Business analysts have warned about, will fundamentally alter export competitiveness for African goods. Governments and companies will need to invest in cleaner production and carbon accounting if they want access to key markets. At the same time, massive infrastructure moves are reshaping regional opportunities. The United States backing for a proposed $10 billion airport project in Ethiopia signals continued global interest in African connectivity. National privatization programs, like Kenya’s planned sale of the Kenya Pipeline Company, show just how much state asset reshaping is happening across the continent. These policy shifts intersect with basic needs in concrete ways. Water and power, long underappreciated constraints, are now central to competitiveness. Digital reforms can help dispel outdated images of a distressed continent by accelerating services and trade. In short, the success of startups and manufacturing alike will depend on reliable utilities and forward-looking regulation.

The New Playbook for African Builders

So what’s the takeaway for founders navigating this transformed landscape? The playbook is becoming clearer by the day. Build unit economics early, seek partners that bring operational muscle alongside money, and prepare for tougher due diligence. For policymakers and development partners, the task is to provide predictable regulation, invest in utilities and logistics, and align industrial policy with carbon constraints so African exports remain competitive globally. Events and networks are accelerating this transition. Summits like the Africa Tech Summit and competitions like the Startup World Cup provide visibility and investor contact, while gatherings like IATF2025 recently credited with over $48 billion in deals remind everyone that large-scale trade forums remain critical. Even the financial plumbing is evolving, with stablecoins and digital dollar rails gaining traction to move value across fragmented currency zones. Looking ahead, Africa’s investment ecology feels less like a frontier and more like a market in purposeful transition. Homegrown capital will likely keep rising, venture studios will proliferate, and policy pressures will accelerate green and digital upgrades. That combination could produce a new class of durable African companies, companies that scale profitably while contributing to jobs and resilience. The moment favors builders who can combine ambition with discipline, and institutions that can turn capital into reliable, inclusive growth.