Africa’s Startup Moment, Revisited: From Big Bets to Built-to-Last Businesses

Remember when African tech felt like a gold rush? Those days are fading fast. In 2026, the continent’s startup scene isn’t chasing quick wins anymore, it’s building something that lasts. After a record-breaking 2025 that poured billions into African innovation, including over $1.4 billion in startup funding, this year feels different, more mature. The numbers tell the story: January saw just $174 million raised across the continent, the lowest monthly tally in years according to Nairametrics data. But don’t mistake that dip for disaster. Money’s still flowing, it’s just getting smarter, more selective. Investors aren’t betting on promises anymore, they’re backing proof. They’re clustering around later-stage startups with real revenue, particularly in fintech, infrastructure, and defense-adjacent sectors. The result? Fewer checks for early-stage teams, more capital for companies that already show traction. When funding concentrates like this, you get fewer deals overall, even when the monthly totals get lifted by a handful of big transactions. This climate is forcing consolidation, with stronger companies acquiring assets and talent to position themselves for scale in a market where every dollar counts.

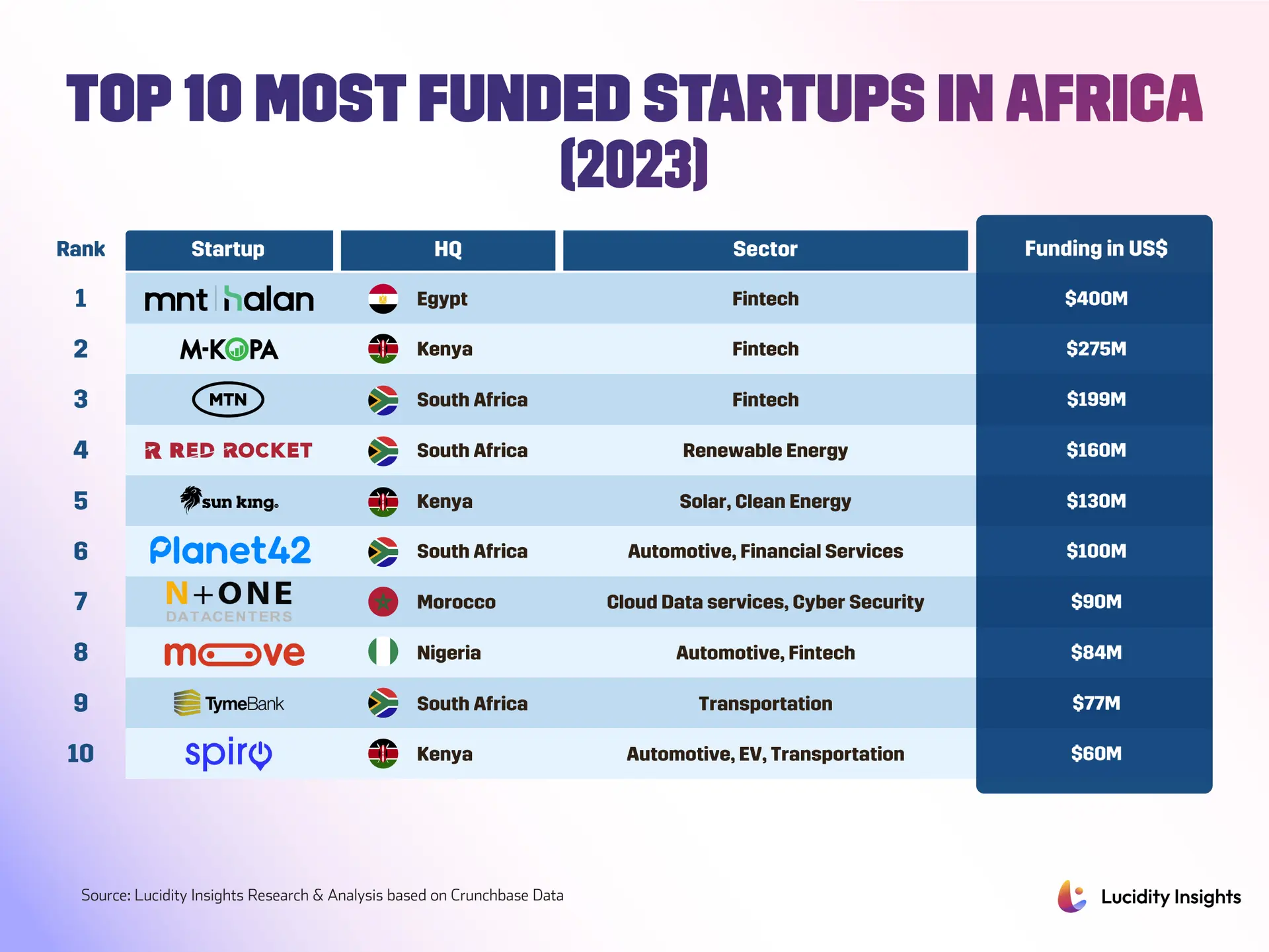

So where’s the money actually going? Fintech still leads the pack, processing billions for small businesses that used to rely entirely on cash. Cross-border payments are booming, helped along by the African Continental Free Trade Area (AfCFTA) which is simplifying trade rules and making transfers from Lagos to Accra or Nairobi seamless. Agritech is moving from novelty to necessity, especially in Nigeria and Kenya where startups connecting farmers directly to buyers have already cut post-harvest losses by 20 percent. With broader adoption of Internet of Things sensors that monitor soil, storage, and weather, yields could jump by up to 30 percent while cutting costs by a quarter for medium and large farms by year’s end. Green tech is stepping up too, with solar combined with AI helping businesses and homes leapfrog unreliable grids. These technologies aren’t flashy, but they’re essential, and investors increasingly reward practical durability. The founder playbook is changing just as dramatically. Out of necessity, many are ditching the growth-at-all-costs mantra for leaner, evidence-driven development. Successful teams now price from day one, test with dozens rather than thousands of users, and scale city by city. That discipline reduces burn and makes businesses actually investable in a market where investors demand clear paths to profitability.

Building Beyond the Headlines

Nigeria, Kenya, and South Africa continue to dominate, accounting for roughly 72 percent of recent deals thanks to market size, local capital, and active investor networks. But cities like Dakar and Accra are gaining ground, and homegrown funds are closing about 40 percent of the gaps left by global investors. A quieter trend worth watching is the rise of deep-tech and infrastructure talent. Startups building the backbone for other industries, think aviation analytics, chip design training, and ad inventory platforms, are gaining traction, with some appearing on lists of African startups to watch in 2026. Some operate from university partnerships and small labs, but they’re building what could become regionally strategic capabilities. The challenges haven’t disappeared though. Power reliability, regulatory uncertainty, and limited early-stage capital still slow some startups down. Talent gaps and uneven internet infrastructure mean scaling across borders remains tough, even with AfCFTA in place. But entrepreneurs are nothing if not pragmatic. Solar backups and hybrid business models are common fixes, while partnerships with universities and industrial buyers help de-risk product development. The narrative that external capital is drying up just doesn’t hold water. Analysis from MOHAC Africa’s 2026 tech report shows significant resources still flowing in from advanced economies and Gulf financiers. It hasn’t translated into broad-based early-stage financing though, instead accelerating the tilt toward larger, later-stage investments. Africa’s tech ecosystem is maturing right before our eyes. The headline numbers will keep ebbing and flowing, but the meaningful shifts are happening quietly, in boardrooms and labs across the continent. Founders learning to sell profitably, investors backing durable models, and policymakers removing cross-border friction will determine whether this era produces a few unicorns or whole durable industries. If 2025 proved capital could still be redirected to Africa, 2026 is testing whether that capital can translate into sustainable jobs, robust supply chains, and resilient infrastructure. The next chapter belongs to teams focusing on fixes, not flash, and partners willing to invest in patient scaling. For anyone tracking the continent’s progress, that’s where the real excitement lies, because this phase decides whether technology becomes a foundation for inclusive growth or just another boom that fades with the headlines.