Africa’s Startup Reset: Profitability, Exits and a New Playbook for Growth

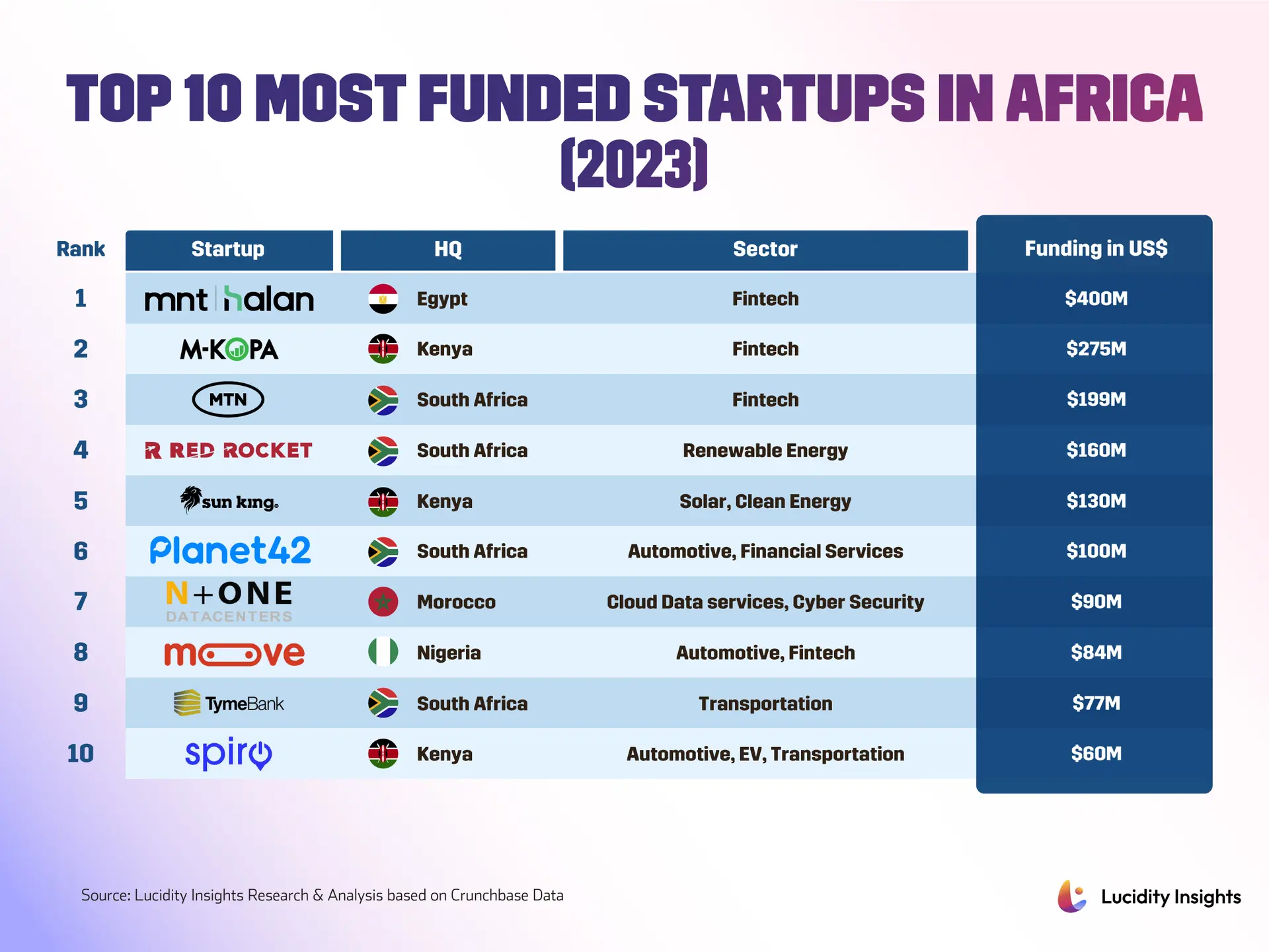

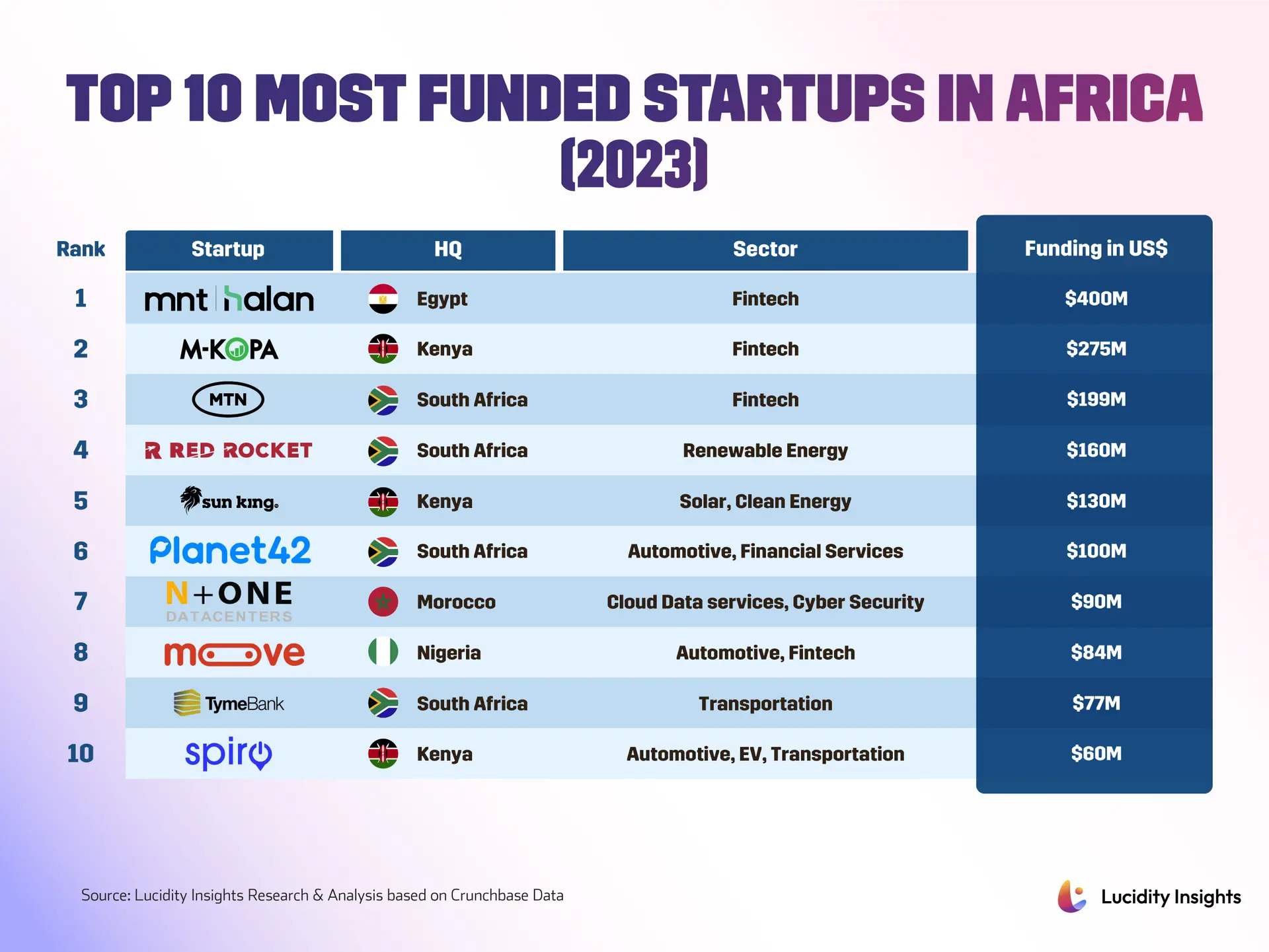

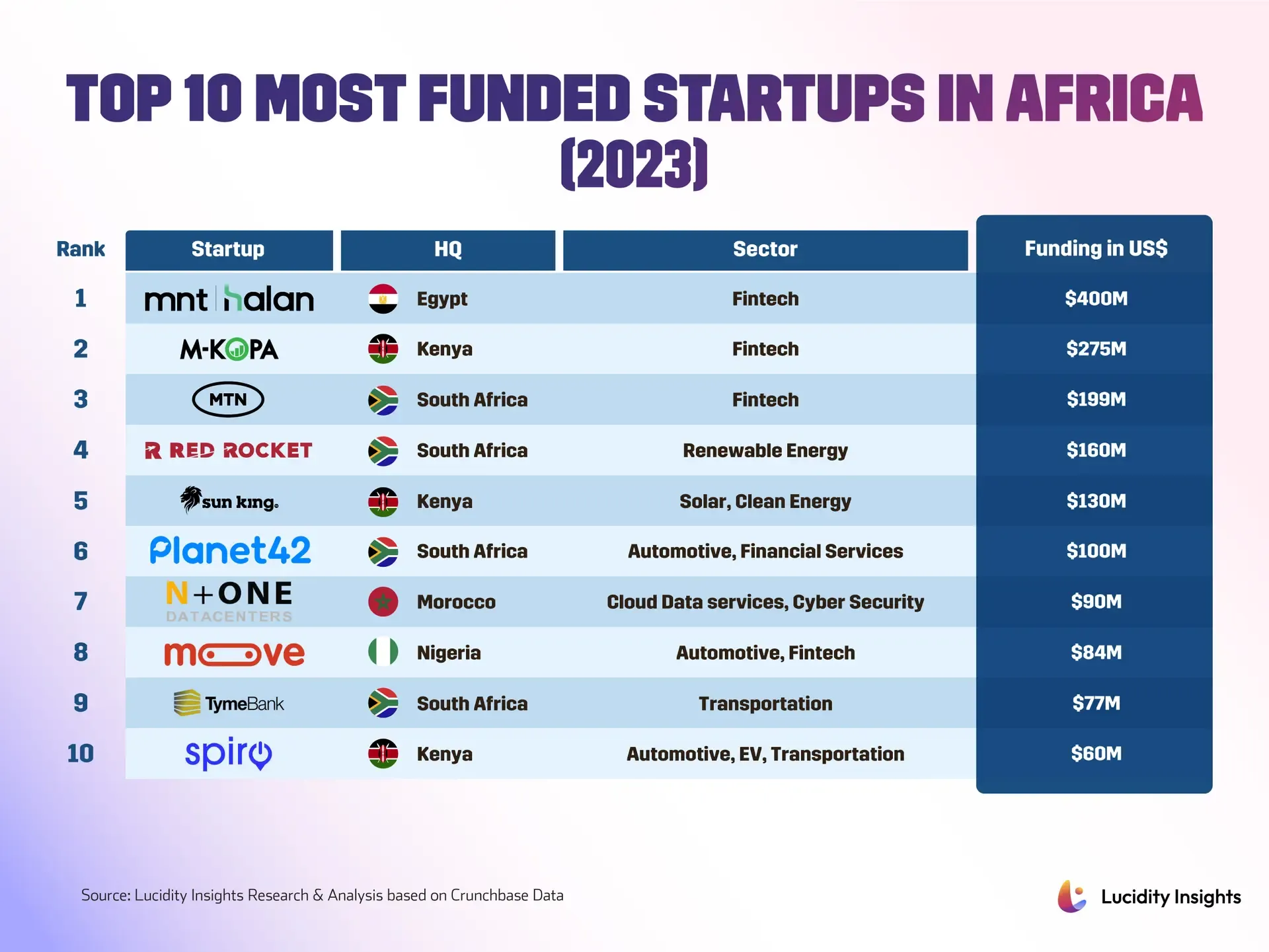

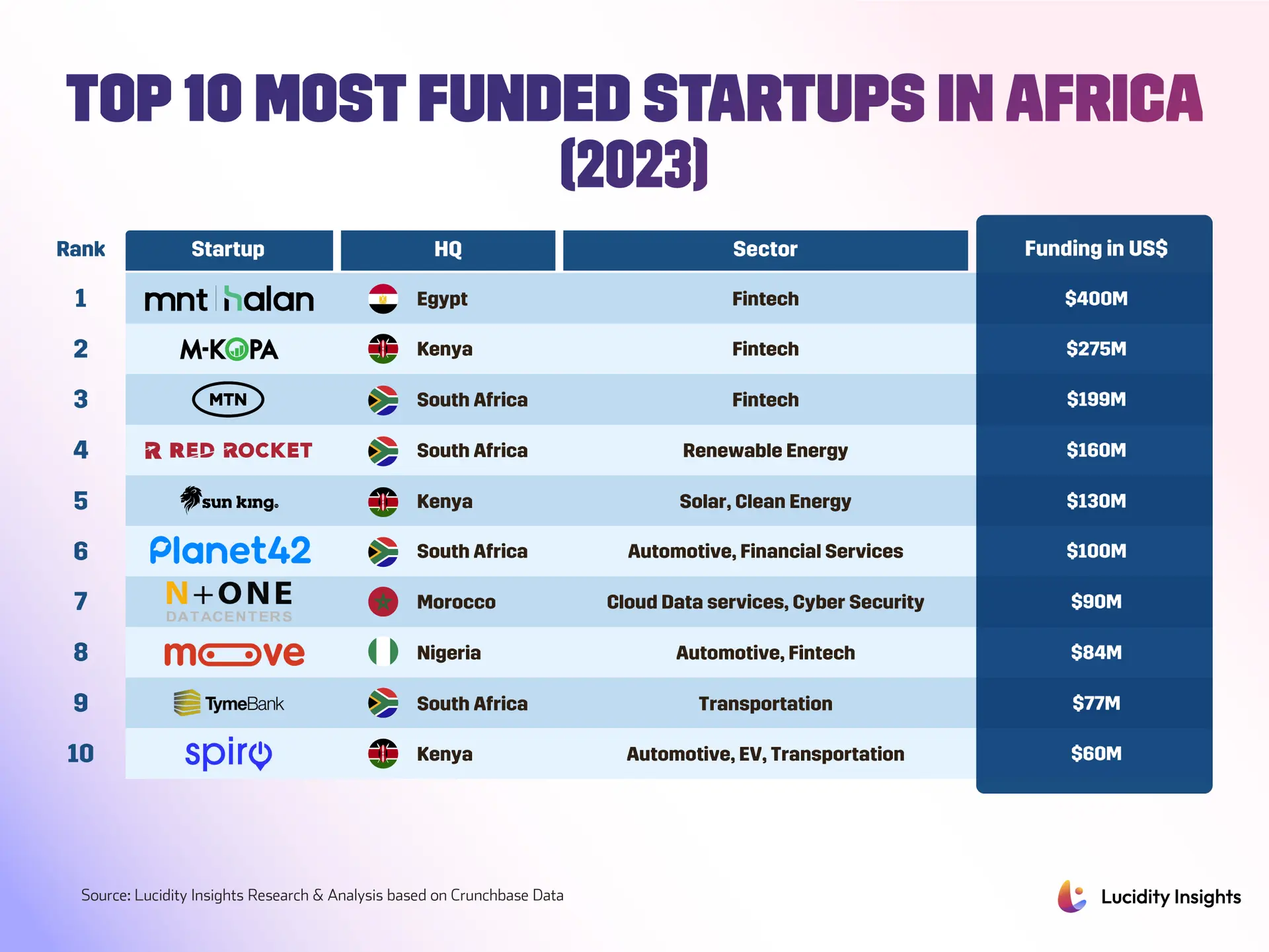

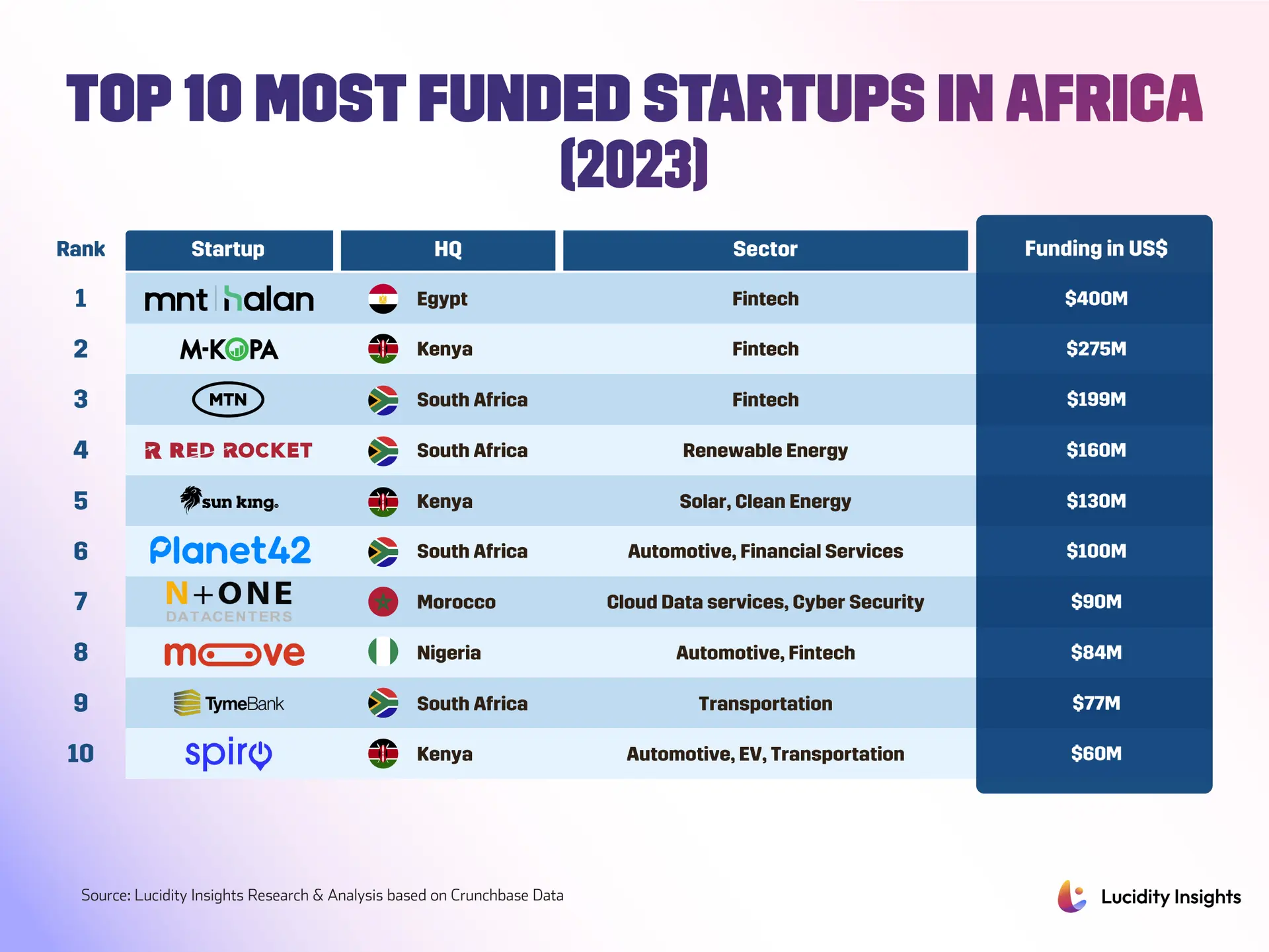

African startups aren’t playing by the old rules anymore. As we move into 2026, investors who once threw money at rapid user growth are now demanding clearer paths to returns, and founders are adapting faster than anyone expected. Take January’s fundraising snapshot, which tells a revealing story about where things stand. Startups across the continent raised about $174 million that month, a figure that might seem modest compared to past headline grabbing rounds but actually signals something more important. Fintech continued to dominate, accounting for nearly 60 percent of the funds, which makes sense when you consider payments and credit remain underdeveloped in many African markets. What’s really interesting is where the money went geographically. Egypt surprised everyone by leading the pack, taking roughly half of January’s capital, while traditional hubs like South Africa and Kenya had quieter months. This shift isn’t random, it shows investors are concentrating their bets where they see clear revenue models and large addressable markets. They’re also looking beyond the usual suspects, backing founders in less heralded markets who’ve refined propositions that appeal to both local customers and regional investors. It’s part of a broader startup ecosystem transformation that’s been building for years.

Now exits are taking center stage in a way we haven’t seen before. As the narrative moves from growth at all costs to realizable returns, traditional exit pathways are getting serious attention. Mergers and acquisitions are growing in prominence, with recent transactions showing that larger players and corporates are willing to buy scale and talent. Look at deals involving companies like Flutterwave, Ezii and Savannah, where acquirers saw immediate value in product, market share or distribution. At the same time, public listings are no longer just hypothetical. A spate of IPOs across regional exchanges in 2024 and 2025, from telecom and retail to mining and financial services, has helped normalize the idea of African companies listing locally or abroad. For many investors, a working IPO market reduces exit risk and makes earlier stage bets more attractive. But here’s the thing, investors aren’t just asking about exits anymore, they’re drilling down on unit economics, cash burn and sustainable distribution channels. Where a large user base could once paper over weak monetization, founders now must demonstrate repeatable revenue and a path to profitability. This has pushed some startups to pivot, prioritize pricing discipline, and explore alternate revenue streams like B2B services, enterprise contracts, or payments rails. The debate isn’t simply growth versus profit either. Many founders are pursuing a staged approach, chasing strategic growth milestones that justify successive funding while tightening operations to extend runway. For venture backers, the priority is clear, they’re hunting for robust, scalable business models that can deliver returns in a still uncertain macro environment. While fintech remains the most funded sector, investors are also diversifying their portfolios. Proptech, which uses technology to change how property is bought, sold and managed, drew attention after several large rounds in Egypt and the wider North Africa region. Defense tech, healthtech, AI and climate tech startups also showed promise at investor focused events. These sectors often require different capital mixes and longer timelines, which has encouraged creative funding structures and strategic partnerships with corporates and development finance institutions. This evolution reflects the continent’s broader tech renaissance that’s driving innovation across multiple fields.

Deal flow is also being stimulated by a busy calendar of summits and accelerator programs. High profile events like the Africa Tech Summit, regional Startup World Cup competitions, and international forums focused on AI and trade provide founders with visibility and access to global investors. Meanwhile, institutional programs are stepping up. Afreximbank, for example, launched an accelerator to back startups that enable intra African trade under the African Continental Free Trade Area, offering mentorship and potential equity funding that can propel companies toward regional scale. For founders, this means expecting more rigorous diligence, an emphasis on unit economics, and a wider range of exit options. Short term tactics include tightening burn rates, focusing on customer retention and pursuing strategic partnerships that can accelerate revenue. Medium term strategies involve building governance and reporting standards that make a company attractive to buyers or public markets. Looking ahead to the rest of 2026, the direction appears promising but pragmatic. Expect continued consolidation as stronger players acquire complementary services, and more companies testing public listings as viable exits. Investors will likely keep concentrating funds in proven verticals while cautiously exploring new sectors that show disciplined monetization strategies. For African founders, the playbook is evolving, rewarding those who can marry growth ambition with financial rigor and regional scale. If the continent’s startup scene is entering a phase of maturation, it’s doing so with energy and creativity. Events, cross border programs and smarter capital are creating a market that supports both innovation and sustainable returns. The next wave of African success stories will probably be less about headline valuations and more about durable businesses that generate profit, employ talent, and integrate into the wider economy. As recent data shows, this shift toward disciplined growth is already underway, with platforms like TechCrunch Africa tracking these developments closely and resources like Tracxn’s Africa funding database providing detailed insights into investment patterns. The momentum is building, and events like the Africa Tech Festival continue to showcase how the ecosystem is maturing toward sustainable, profitable growth.