Africa’s Startup Reset, From Stablecoins to Semiconductor Training, Signals a More Mature Era for Investment

The Quiet Shift in African Tech

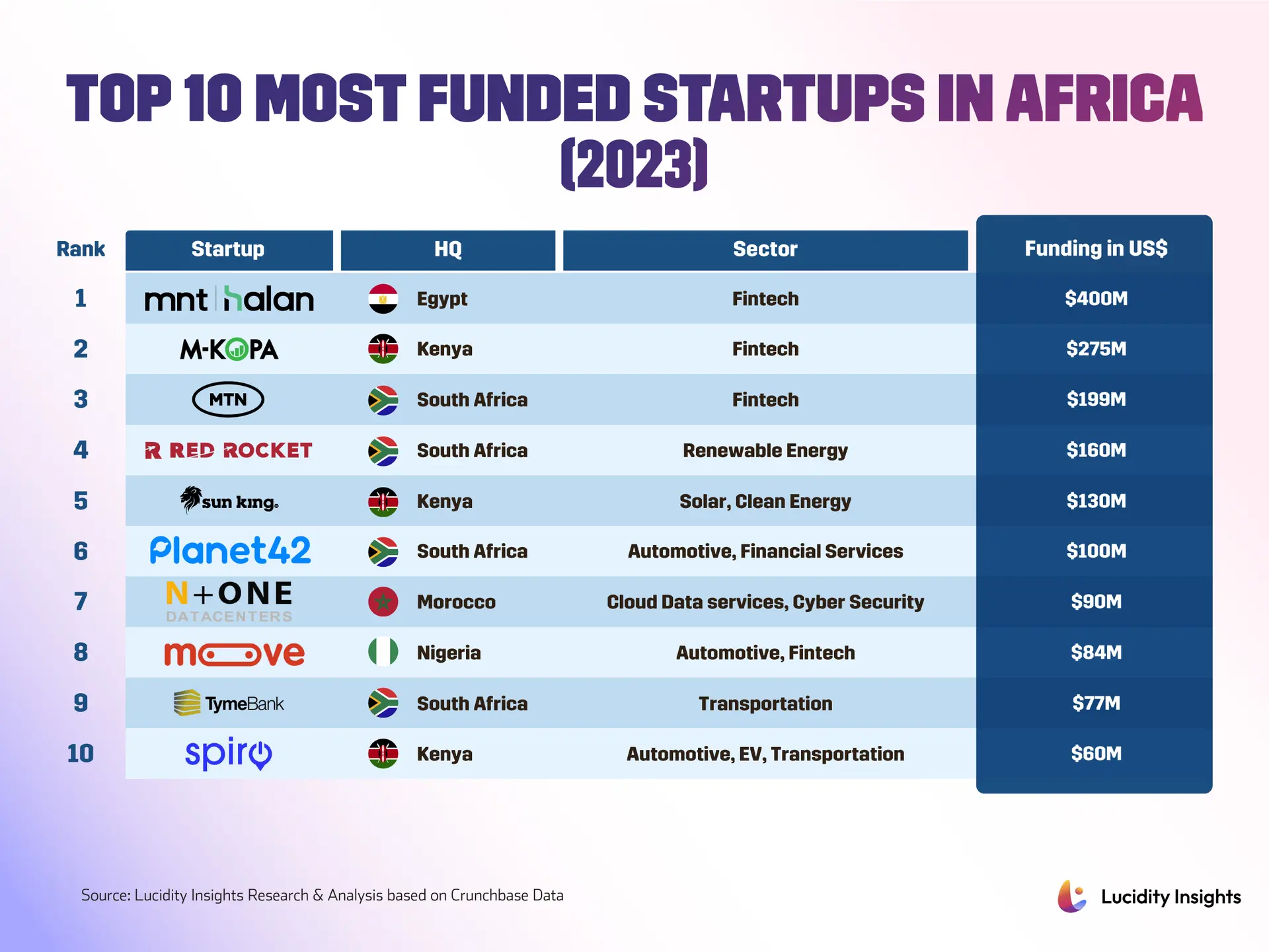

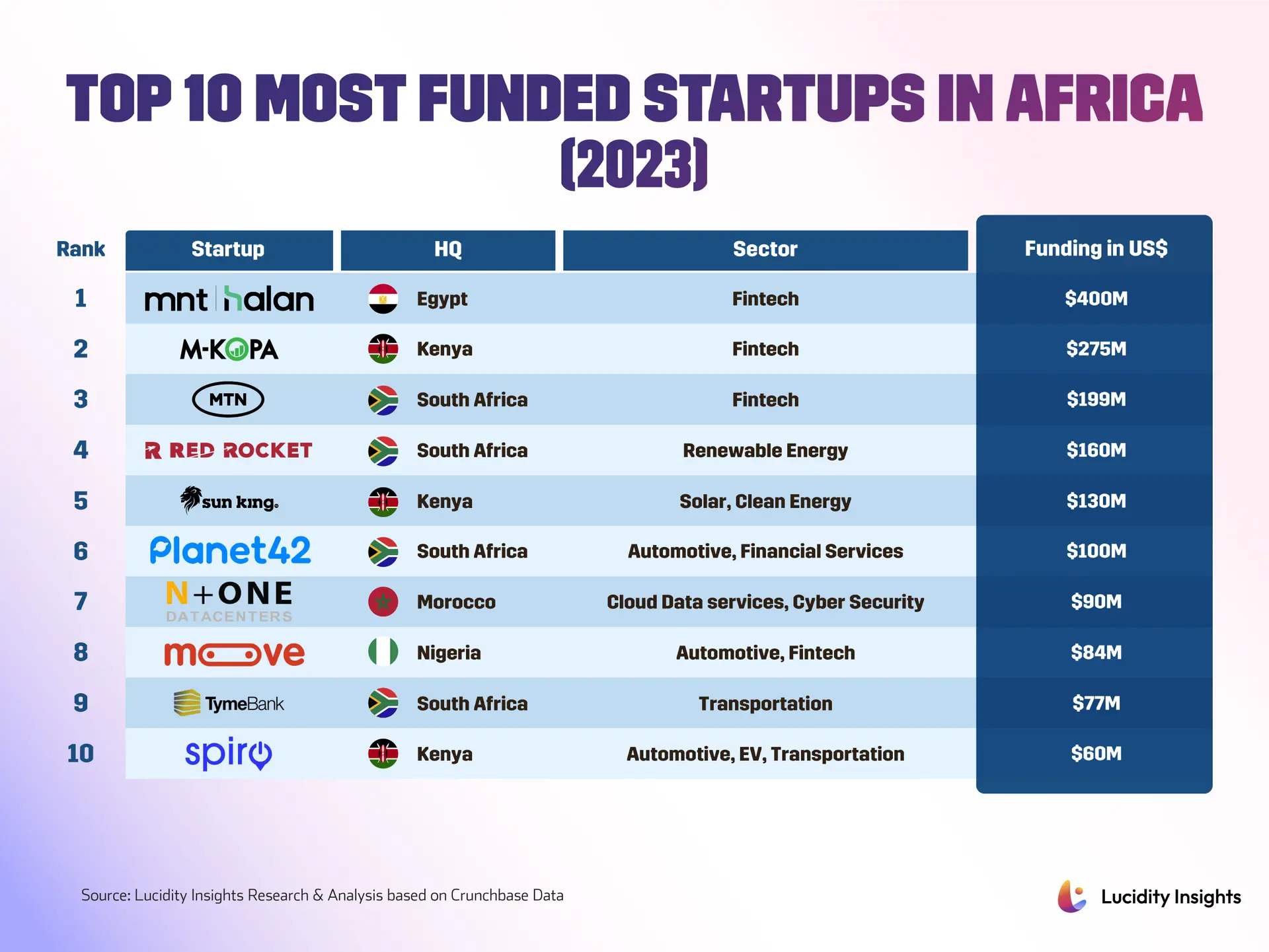

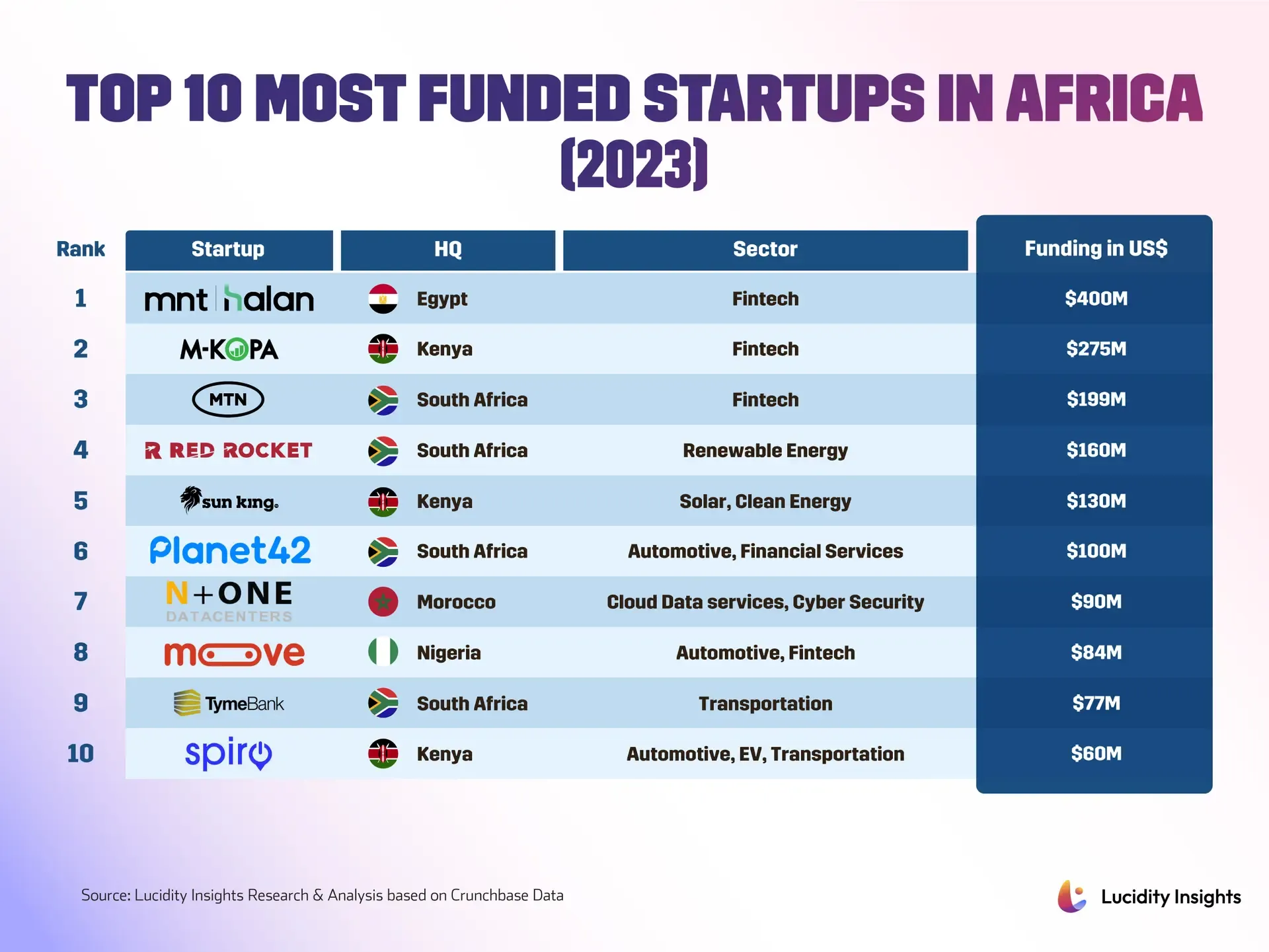

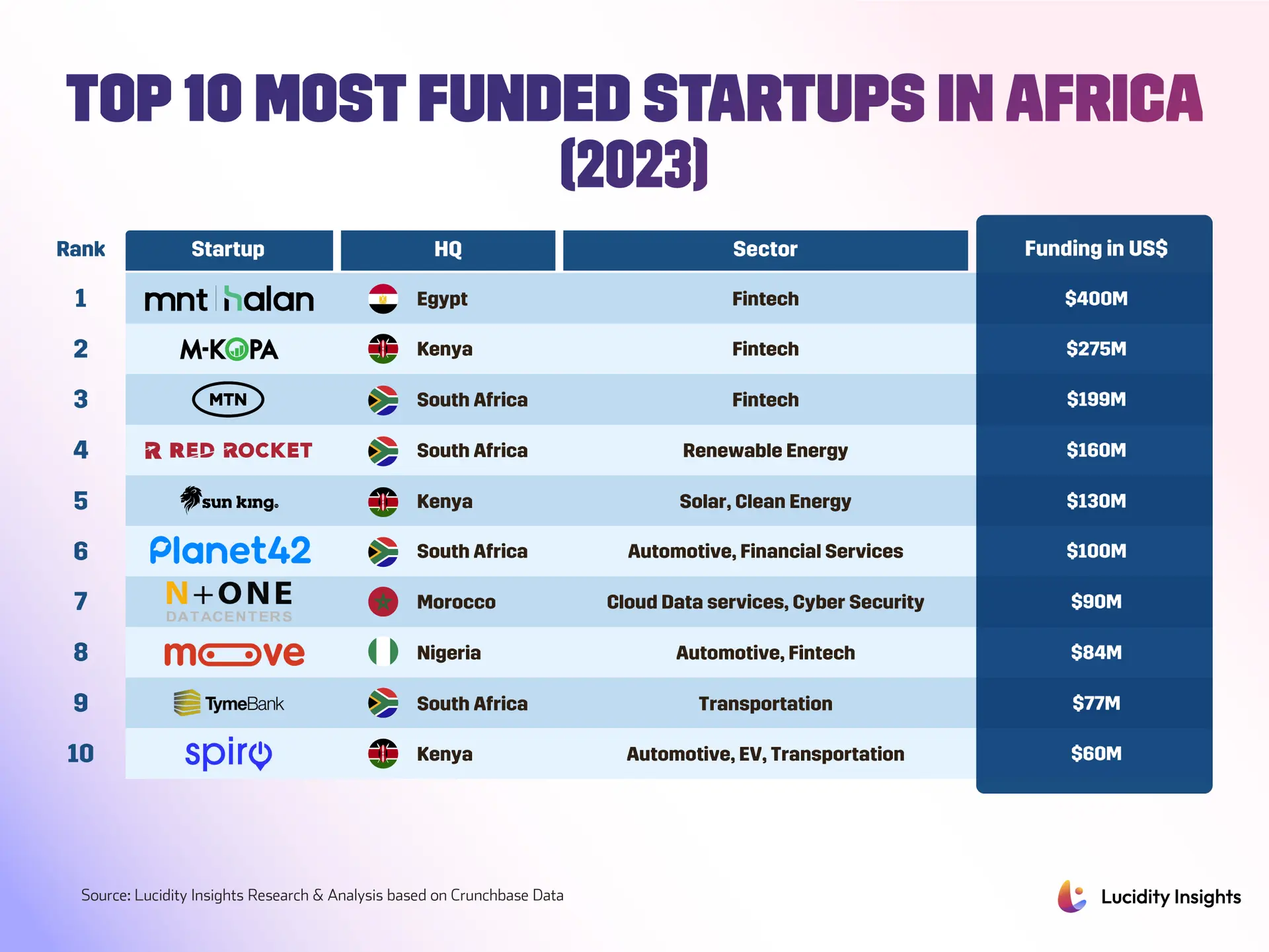

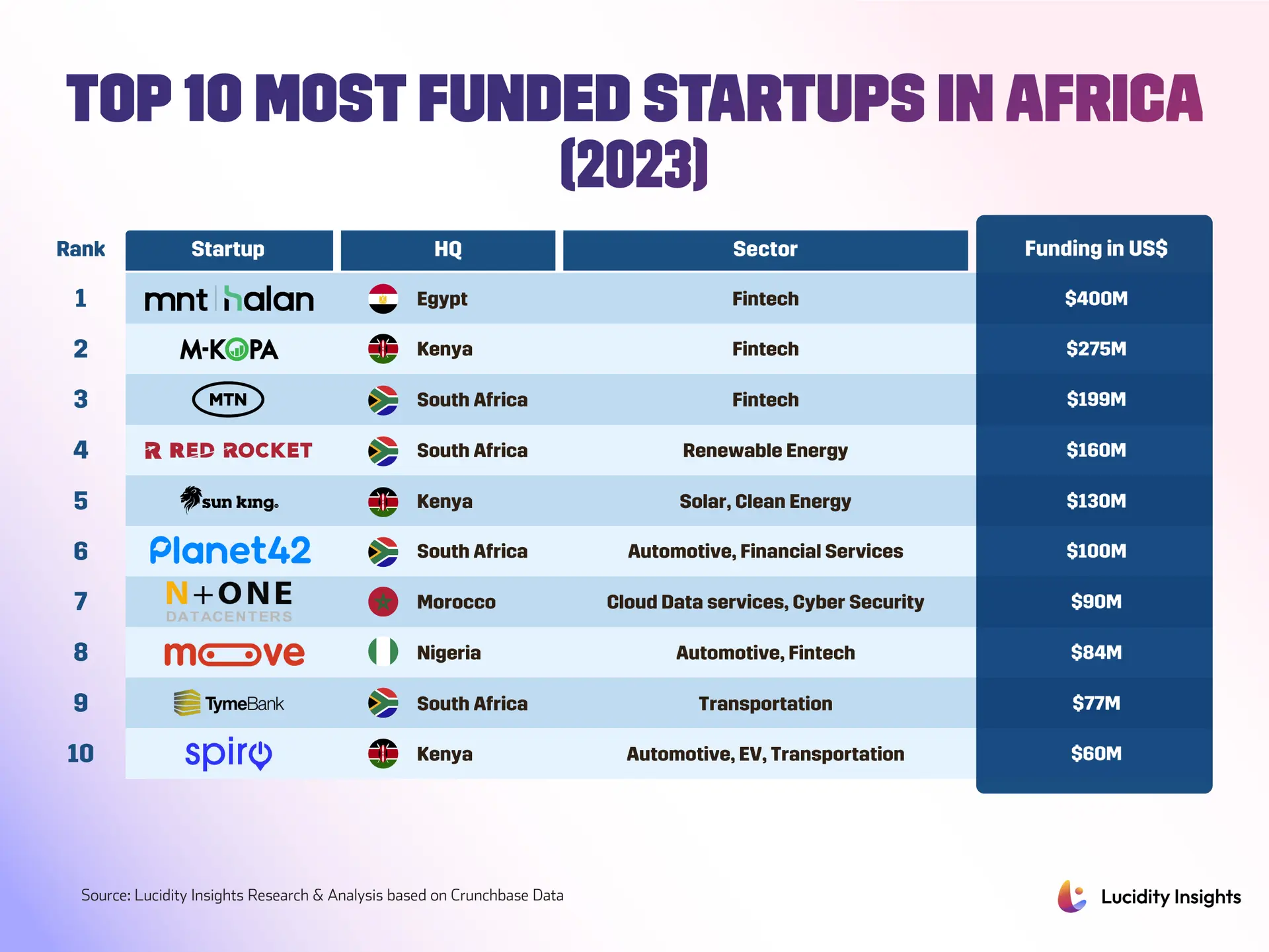

Something’s changing across Africa’s tech hubs, and it’s not just the headline numbers. After a period where global venture capital cooled its heels, 2025 and early 2026 brought a noticeable rebound, with disclosed investments topping roughly three billion dollars. But here’s what really matters: the composition of that capital is shifting in ways that signal a more mature, pragmatic era for the continent’s startup ecosystem. Investors aren’t just throwing money at ideas anymore, they’re being choosier, and founders are responding by sharpening their revenue models. The days of speculative consumer plays are giving way to businesses that address essential infrastructure and services, with clearer paths to cash and the ability to scale across borders. You can see this tech renaissance playing out in real time, as reported by outlets like African Business, which tracks these evolving investment patterns. Clean energy, financial technology, electric mobility, and digital health have become favored destinations for smart money. Even the deal structures are changing, with an increase in non-traditional financing like debt and structured instruments as founders and backers look for durability alongside growth.

From Defense Tech to Digital Rails

The new maturity shows up in vivid examples. Take Terra Industries, a Nigerian defence-tech firm that secured a $22 million round to build manufacturing capacity for security systems and expand deployments across Africa. That deal size marks one of the largest to date in the continent’s defence tech space, highlighting how mission-critical hardware and systems are attracting serious capital. On the payments front, startups like Honeycoin are carving distinctive roles. This stablecoin-based payments rail serves hundreds of thousands of users, processing large monthly volumes as a faster, cheaper alternative for cross-border transfers. In markets where traditional bank transfers remain slow and expensive, these crypto-native rails are proving their product-market fit, and investors are taking note. Yet the technology stack beneath software startups is evolving too. ChipMango, a Nigerian initiative that trains chip designers and offers design services, speaks to a much longer horizon. Semiconductors are foundational to AI, telecoms, and mobility, and by investing in local talent and design capabilities, Africa can move from device consumption to capturing parts of the value chain that earn higher margins and offer more strategic autonomy. This aligns with the broader startup ecosystem growth detailed by analysts at TechCrunch, who’ve documented the sector’s expansion beyond traditional software.

Scrutiny, Policy, and the Path Forward

This comeback isn’t without its strains, though. Some high-profile e-commerce names that raised big rounds have restructured, cutting staff and pivoting toward export markets with a traceability and B2B focus. That combination of layoffs and strategy shifts is symptomatic of an investor base that now insists on tighter unit economics. Venture capitalists are pushing for clearer paths to profitability, and founders are responding by prioritizing revenue, operational efficiency, and disciplined capital use. Public policy and geopolitics are reshaping the backdrop too. The United States is deepening ties with countries like Ethiopia through large infrastructure commitments, and Europe’s impending carbon border adjustment mechanisms are prompting African exporters to consider decarbonisation investments. Such developments change the calculus for industrial projects and for startups whose customers are export-oriented corporates. For entrepreneurs, the practical lesson is clear: focus on markets where structural demand is high, build solutions that can be monetised across regions, and be ready to use blended financing, from equity to debt and revenue-based instruments. Looking ahead, the next phase of Africa’s tech story will be less about headline valuations and more about durable enterprises. Expect more capital directed at hardware and infrastructure-adjacent plays, more use of alternative financing, and a premium on teams that can scale operations across diverse regulatory and market environments. The continent’s digital renaissance is entering a more professional era, one where pragmatic engineering, policy alignment, and strategic finance will determine who grows and who survives, as the latest data from Tracxn continues to show.