Africa’s Startup Surge in 2026: What It Means for Growth, Policy and Investment

The New Pragmatism

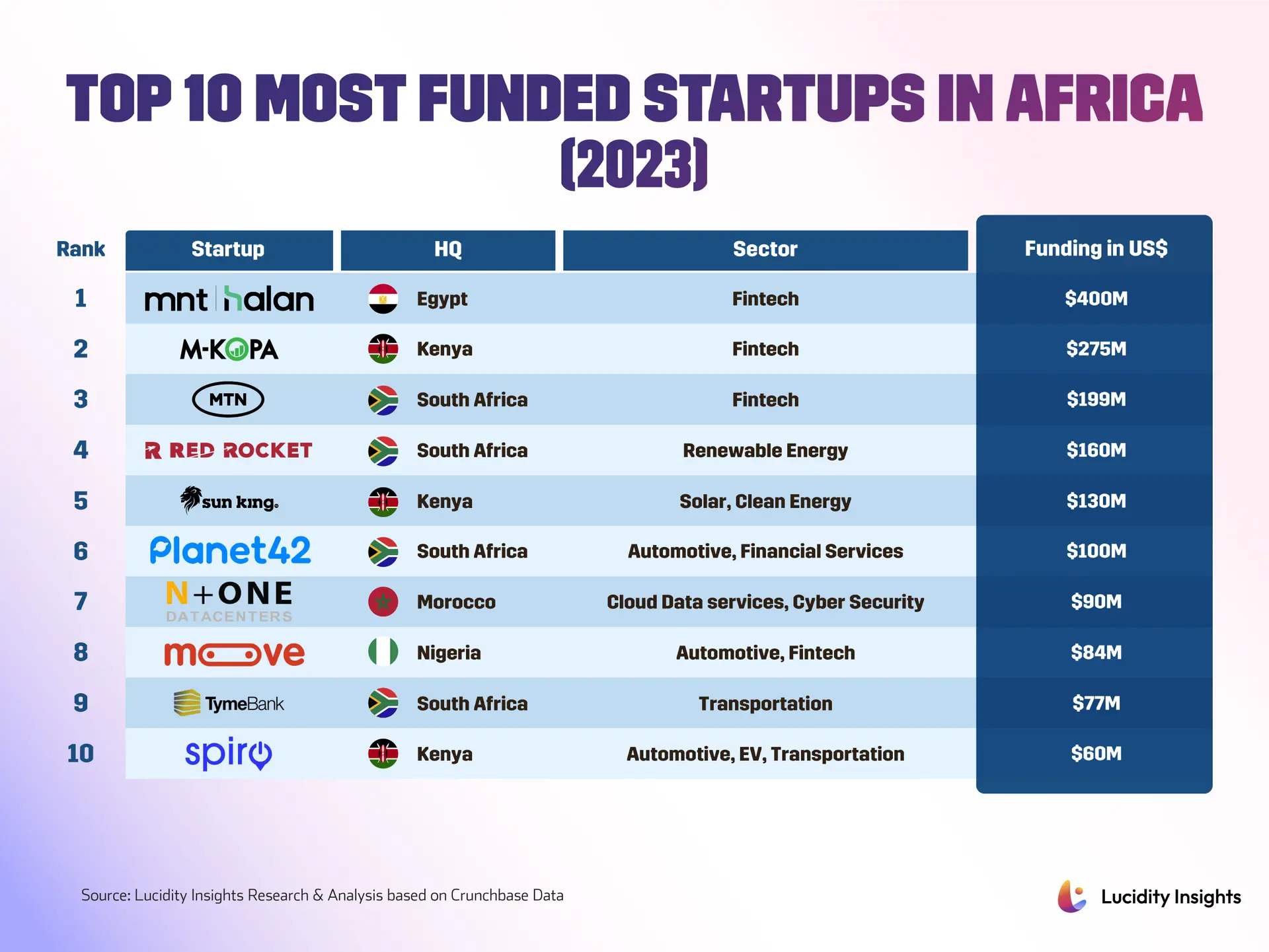

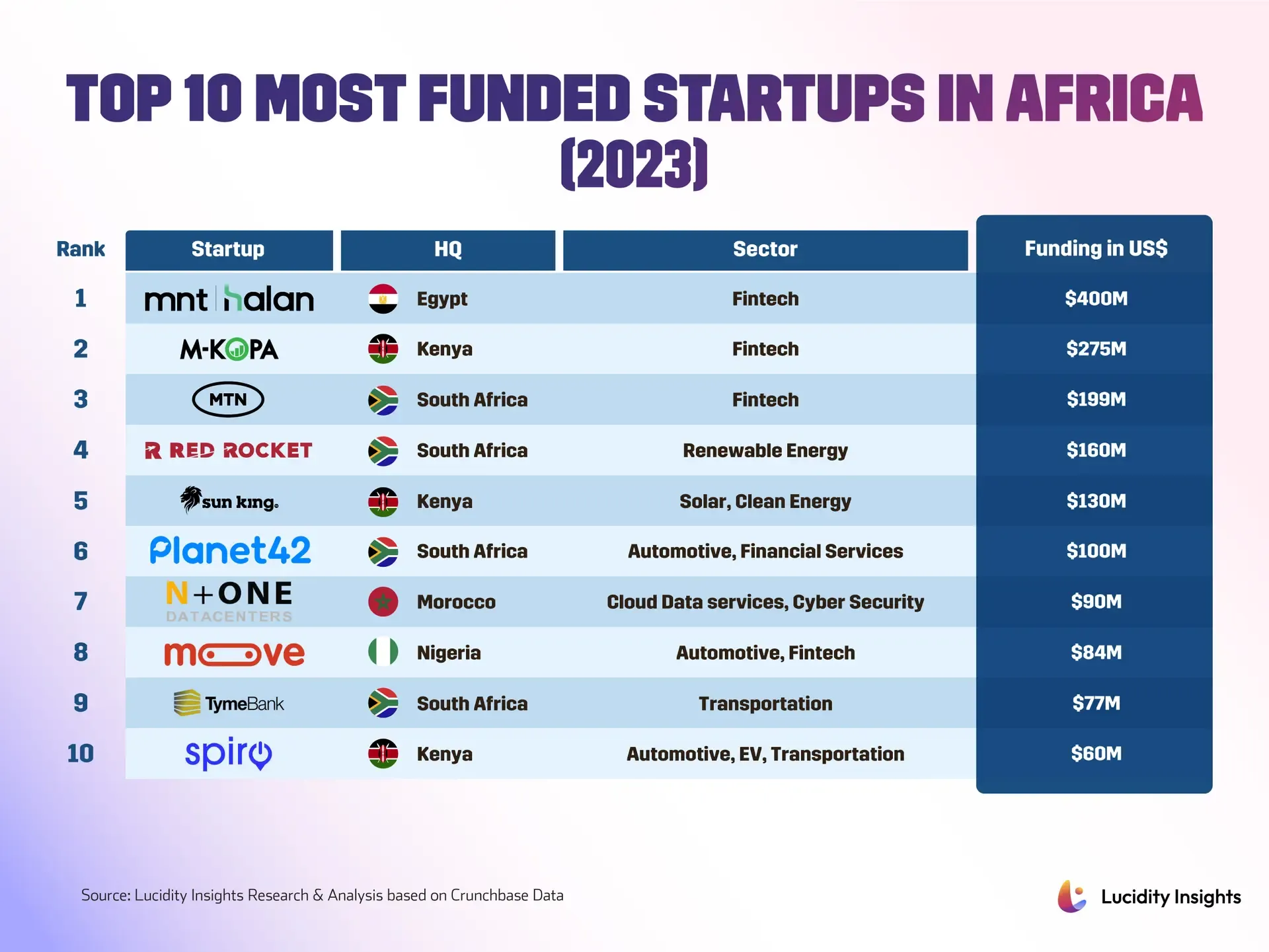

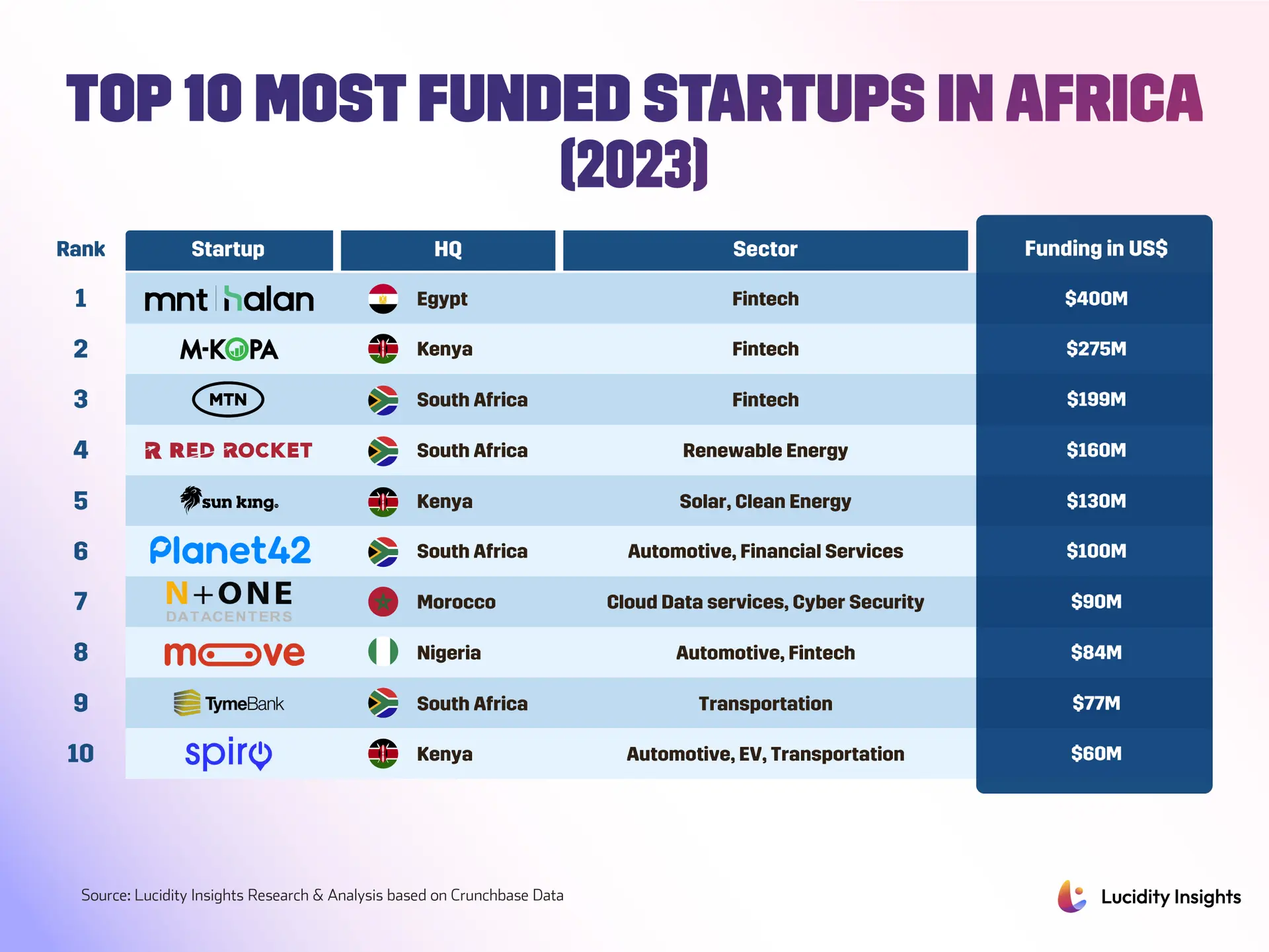

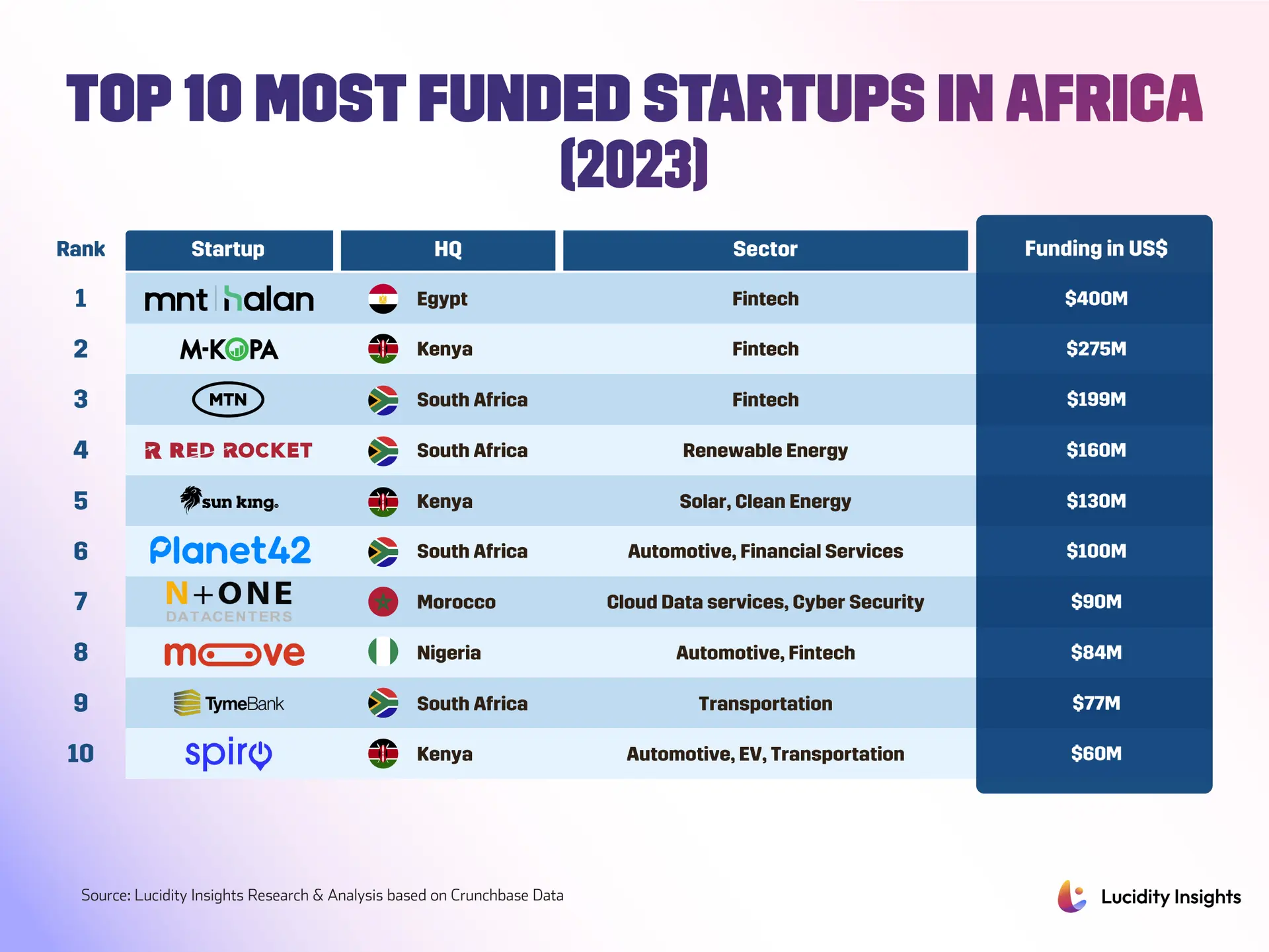

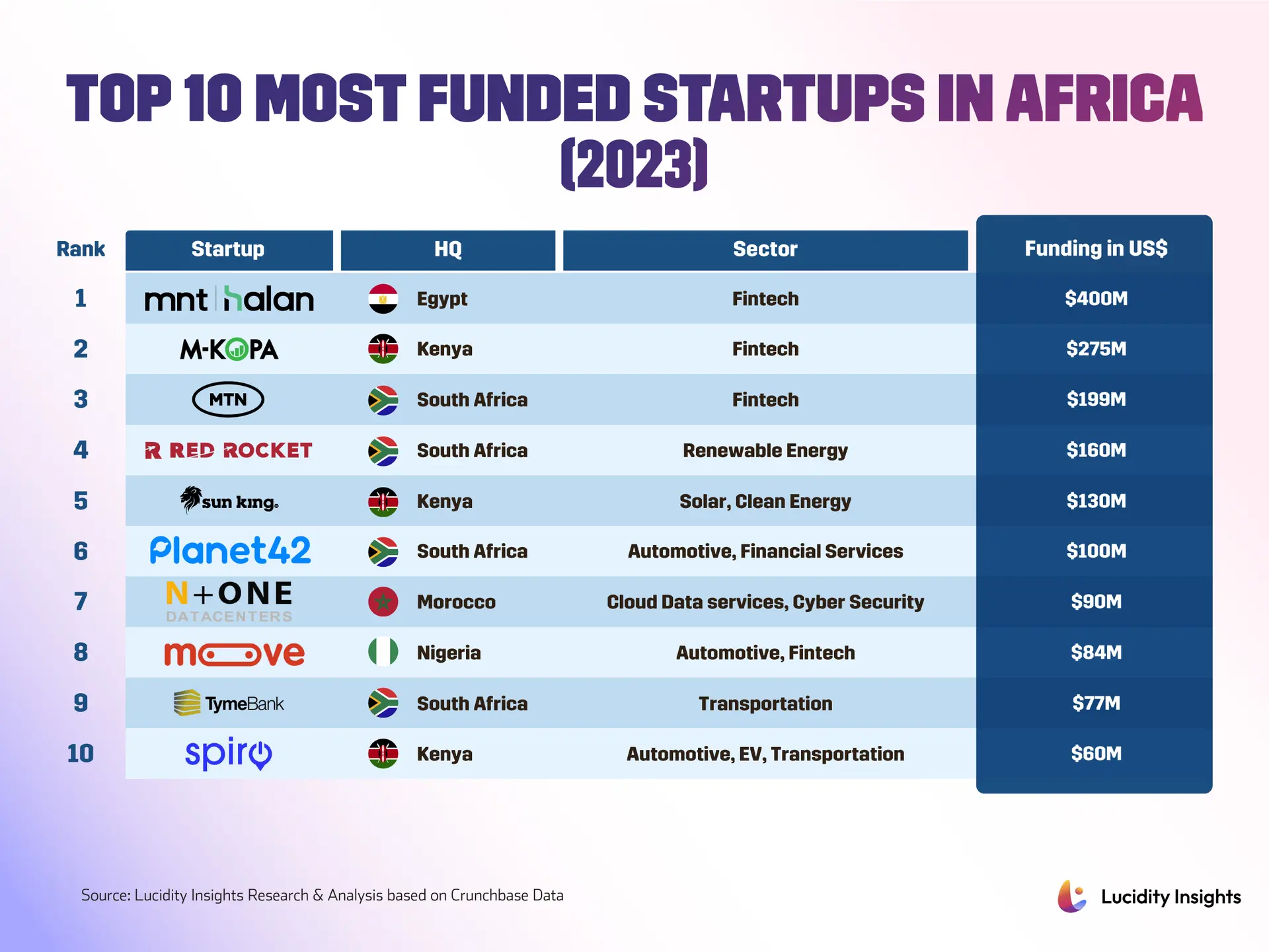

Something quiet but powerful is reshaping Africa’s startup landscape as we move into 2026. After that global venture capital slowdown everyone felt, disclosed investments across the continent actually climbed back, hitting more than three billion dollars in 2025. That recovery hasn’t just returned things to business as usual, though. Instead, founders, funders and policymakers are all recalibrating around a new kind of pragmatism. They’re chasing regional scale and sectors with clearer paths to actual cash generation. Investors aren’t chasing growth at any cost anymore. Venture capital and later stage backers are favoring companies that serve essential needs, scale across borders and show early profitability. Clean energy, fintech, electric mobility and digital health stood out as the biggest recipients of capital in the last cycle, which tells you something about the structural demand across these markets. At the same time, new financing structures like debt and structured finance are filling gaps where straight equity rounds have gotten harder to secure. But what does this shift really mean for the continent’s economic future? It signals a maturation that could rewrite Africa’s entire economic playbook, moving beyond neat prototypes to durable operations with verifiable impact and scalable revenues. You can see how this startup ecosystem growth is creating new opportunities across sectors.

From Farm Gates to Payment Rails

The practical implications of this new focus are visible in the startups themselves. In Morocco, Woliz has emerged as a striking example of how focused product-market fit can translate rapidly into traction. The retail technology company digitizes nanostores and connects them with brands and financial services. After a $2.2 million pre-seed round, they reported onboarding 55,000 outlets and processing over fifty million dollars in gross merchandise value. Their partnership with Morocco’s ministry to digitize tens of thousands of shops shows how private innovation and public policy can multiply impact when incentives align. In Kenya, Flux is taking a different tack, marrying agricultural experimentation with environmental goals. The startup has been running mineral rock trials with smallholder farmers, collaborating with the United Nations Convention to Combat Desertification. By GPS-mapping fields and preparing basalt rock applications ahead of planting cycles, Flux is building data-driven evidence for practices that could boost soil health and yield. Those steps make Flux a good illustration of how startups are combining field-level science, partnerships and patient capital. Logistics and last-mile deliveries remain fertile ground too. Senga, a Kenyan firm promising deliveries in under 48 hours across difficult corridors, has completed tens of thousands of deliveries since launching. VDL Fulfilment, which now spans eight countries, demonstrates the rising demand for end-to-end logistics services that support cross-border commerce. Even cultural and creative industries are being professionalized. SongDis, a Nigerian music distribution platform, helps artists manage releases, royalties and advance funding tied to streaming income. This reflects a broader trend where digital platforms are formalizing informal income streams and linking creators with monetization tools. According to recent African Business reports, this practical focus is exactly what investors want now. The continent’s tech renaissance isn’t just about flashy apps anymore, it’s about solving real problems with sustainable business models.

Policy, Carbon and What Comes Next

Not every high-profile model is holding up, of course. The recent failure of a cookstove carbon credit enterprise raised serious questions about some carbon finance mechanisms. Carbon credits are certificates intended to represent a tonne of avoided or removed carbon dioxide, and they’ve been used to funnel global climate finance into projects from clean cookstoves to reforestation. Where project delivery is weak, or where monitoring and verification fall short, markets punish credibility and investors pull back. That caution has real implications for start-ups relying on carbon revenue, and it underscores the need for robust measurement and diversified revenue models. Policy and geopolitics are shaping the backdrop in ways founders must factor into strategy. The European Union’s carbon border adjustment mechanism, a tariff based on the carbon intensity of imported goods, is already prompting African exporters and industrial planners to rethink competitiveness. Large infrastructure moves matter too. The United States backing a multibillion dollar airport project in Ethiopia signals how geopolitical competition can translate into major construction and connectivity investments that affect trade and supply chains across the region. Meanwhile, multilateral and continental conversations are heating up. South Africa’s role as a convenor for global economic discussions has put a spotlight on what Africa wants from the G20 table. Initiatives like Mission 300, which pushes for industrialization, underline the continent’s renewed focus on manufacturing and value addition, not just raw exports. These interlocking forces have produced a market where startup founders must be fluent in product, policy and capital structure. The winners will likely be those who can stitch together credible unit economics, regional distribution, and regulatory compliance while remaining nimble in financing choices. Exit pathways are diversifying too. Recent IPOs and acquisitions across the continent show that public markets and strategic buyers are active again, offering routes to scale for companies that can show sustained growth. There’s also a clear practical lesson for international investors. Africa’s ecosystems are heterogenous, each with its own regulatory quirks and consumer behaviours. Funders who couple local teams and long-term capital with technical assistance where needed are better placed to help startups translate pilot results into nation-wide and regional rollouts. Looking ahead, the most exciting chapters will likely come where private ingenuity and public policy converge. Digitisation programs that bring small merchants into formal payment rails will support fintech adoption and tax bases. Agricultural pilots that generate reproducible yields will attract follow-on capital for climate-smart farming. Logistics and distribution platforms that knit together fragmented markets will enable exporters to meet standards demanded by new carbon-aware buyers. As ArabFounders analysis shows, the startups to watch are those building infrastructure for the next phase of growth. At the same time, founders must build resilience into business models to withstand regulatory shifts, geopolitical realignments and the inevitable market corrections. Africa’s startup story in 2026 isn’t just about capital returning, it’s about maturation. For investors and policymakers, the challenge is to create the patient, disciplined ecosystem that makes that transition possible. You can track more of these emerging companies through resources like Techpoint Africa’s watchlist, and see how this funding surge is transforming the continent’s economic landscape.