Africa’s Startups Stage a Cautious Comeback as Investors Prize Scale and Unit Economics

Africa’s tech scene isn’t just bouncing back, it’s growing up. After a tough period where survival was the name of the game, the continent’s startup ecosystem is quietly shifting gears into what you might call disciplined growth mode. The numbers tell part of the story, African tech startups pulled in around $4.1 billion in 2025, a solid 25 percent jump from the year before. But here’s what’s really interesting, that headline recovery masks a fundamental change in how money’s flowing. Equity investment rose modestly to about $2.4 billion, while venture debt ballooned to a record $1.6 billion. For founders who don’t want to keep giving away chunks of their companies, that debt financing acts more like a traditional loan they repay with interest, and it’s becoming an attractive alternative. This shift in the funding mix speaks volumes about investor sentiment these days. Backers aren’t just throwing money at cool ideas anymore, they’re prioritizing ventures that serve essential needs, show clear unit economics, and can deploy capital efficiently across multiple markets. In plain English, investors want businesses that actually make money per customer, can scale regionally, and won’t need an endless stream of equity just to stay afloat.

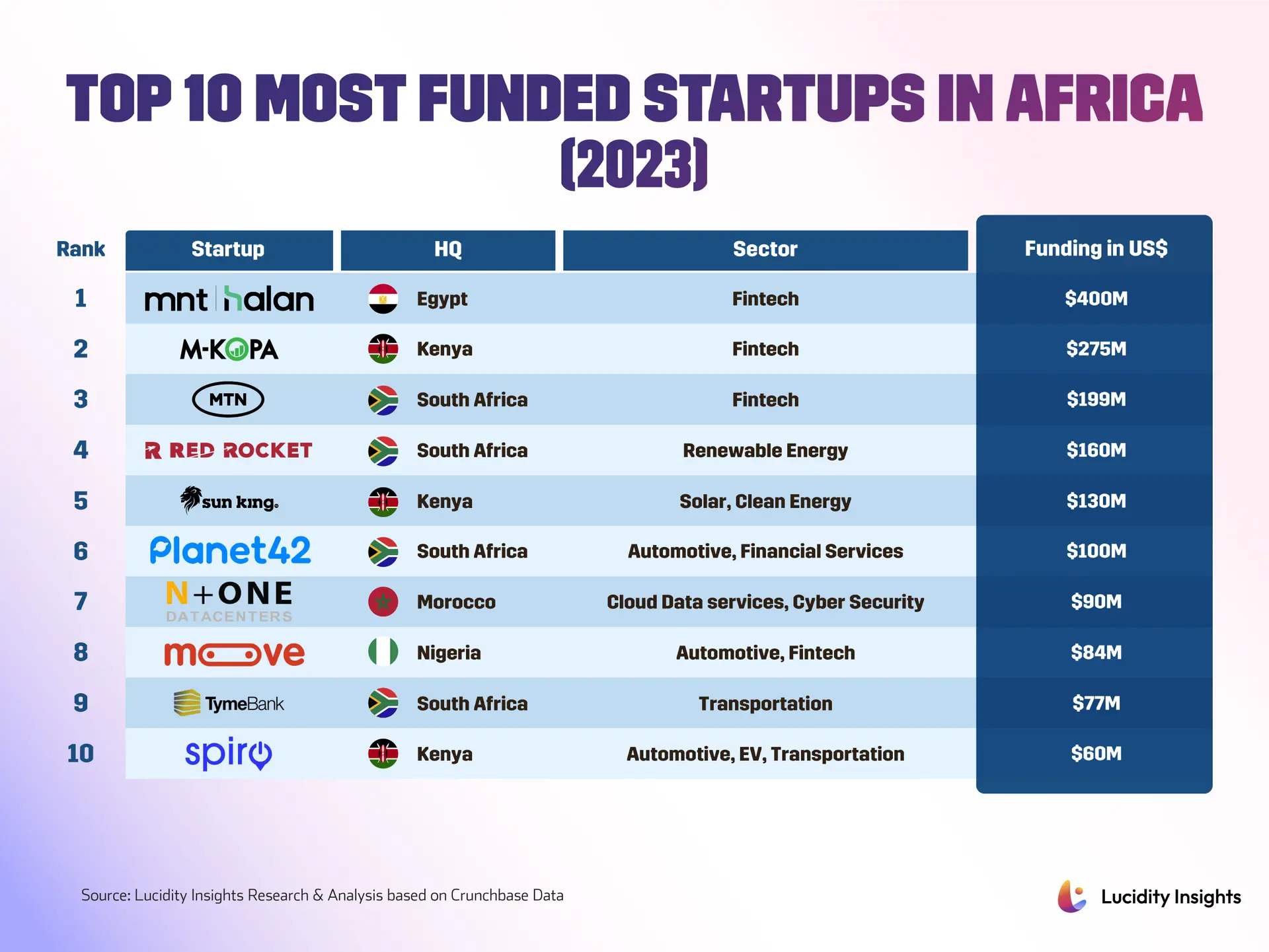

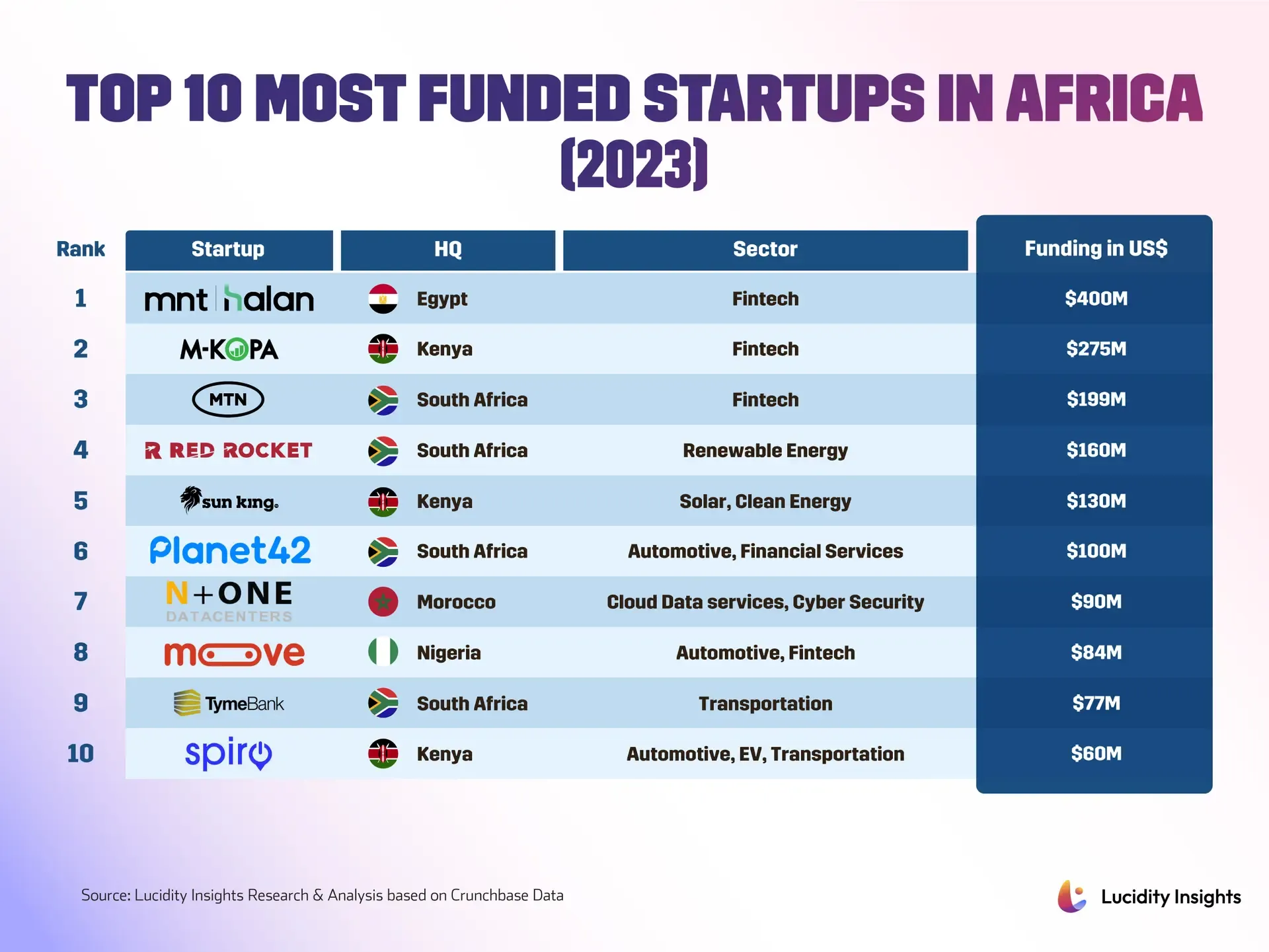

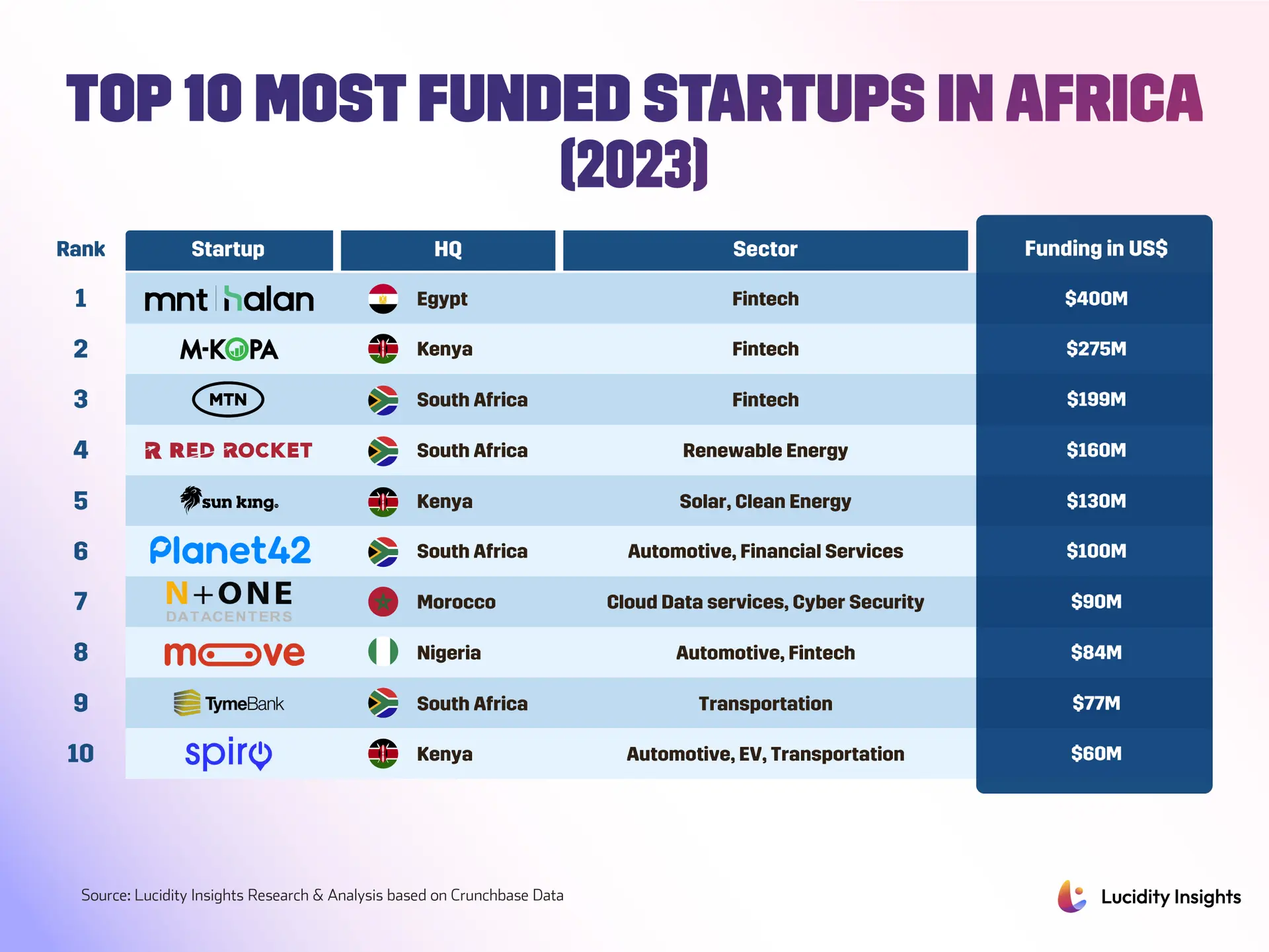

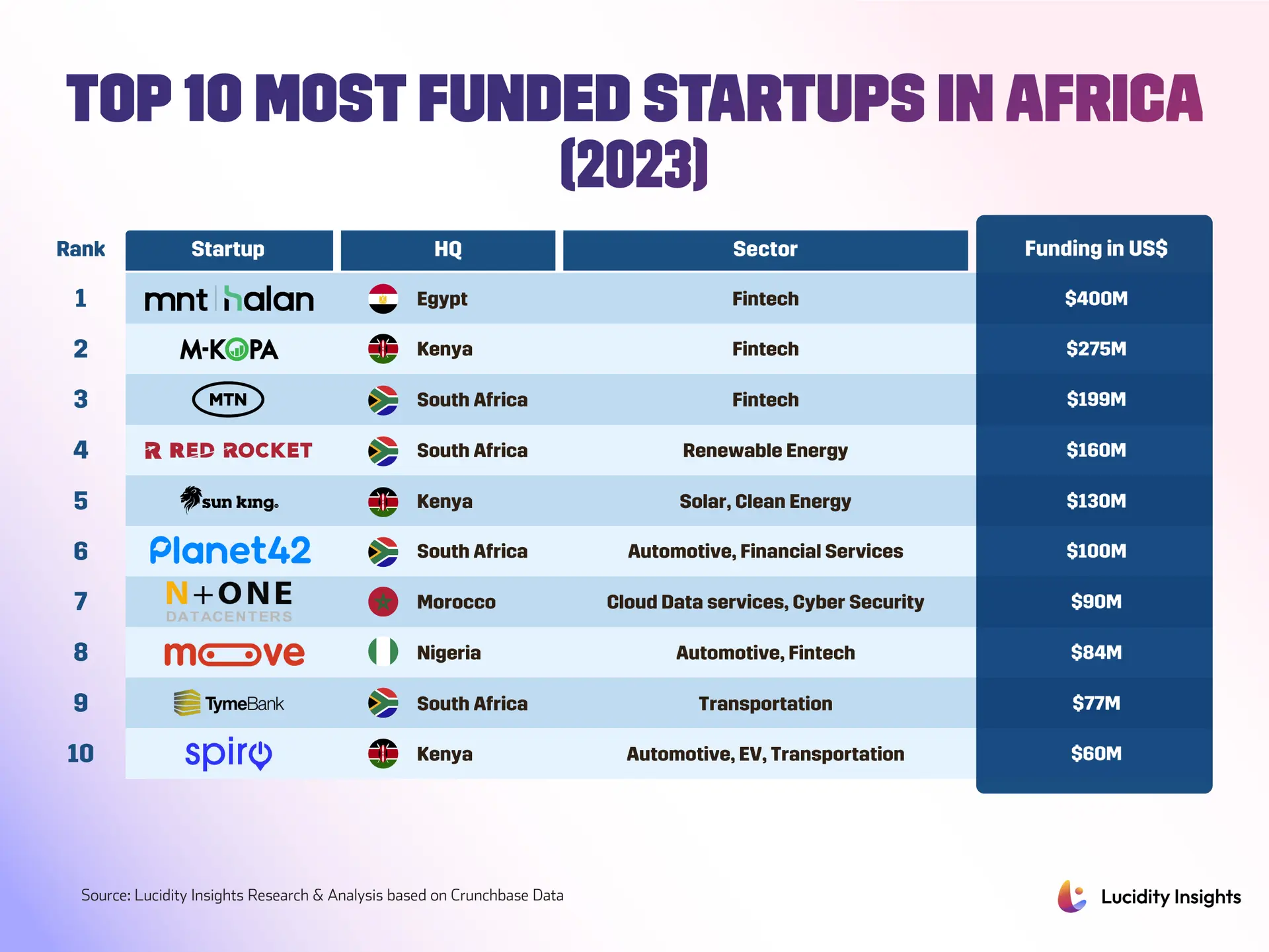

Geographically, the action remains concentrated but is spreading. Nigeria reaffirmed its heavyweight status, raising around $572 million across 102 deals last year, with Lagos maintaining its position as the continent’s frenetic early-stage hub, especially for fintech, e-commerce, and enterprise tech. South Africa and Kenya continue to host more mature fintech and mobility plays, while Morocco and Ghana showed encouraging signs of deeper ecosystem development. Morocco raised about $80 million and benefits from its proximity to Europe, while Ghana’s deal flow, though slower, still signals steady entrepreneurial activity. When you look at which sectors are heating up, fintech remains the most active area, driven by payments, SME lending, and cross-border solutions. Mobility and logistics startups continue to attract capital as Africa’s cities grow and last-mile delivery becomes more complex. Energy and climate tech have climbed the priority list too, with investors eager to back ventures that can address persistent infrastructure gaps while offering commercial returns. Digital health and proptech are emerging as serious growth-stage arenas, demonstrated by large non-fintech raises and strategic mergers. After a year without new unicorns, attention has shifted to a cohort of nearly 18 growth-stage companies that analysts say could become the continent’s next billion dollar stories or pursue IPOs in 2026. High-profile examples illustrate the trend toward capital efficiency and regional ambition. Egypt’s Nawy, a proptech platform, raised about $52 million in equity plus $23 million in debt to scale across markets. In healthtech, a merger put LXE Hearing on a strong footing with $100 million, showing that consolidation can create better-capitalized regional players outside of fintech.

The funding isn’t just coming in traditional venture rounds anymore. Venture studios and blended funds are gaining prominence as mechanisms to incubate and scale climate-oriented and infrastructure-focused startups. Kenya-based Delta40, announced this year with $20 million in funding, is an example of a venture studio aiming to seed and accelerate climate tech solutions in energy, agriculture, water and mobility across Africa. These models let investors bundle operational support with capital, reducing early-stage risk and increasing the odds of building scalable companies. On the product front, startups like Terra Industries and ChatSasa show the breadth of innovation. Terra expanded a funding round and valuation above $100 million by extending capital that supports hardware and industrial applications. ChatSasa combines human-assisted AI with omnichannel customer support, offering businesses real-time insights across WhatsApp, websites, and email. Fintechs using stablecoins for cross-border flows, like Honeycoin, are another wave to watch, processing large volumes for businesses and individuals while tackling long-standing payment frictions. This comeback is marked by selectivity. Investors are looking for repeatable business models, measurable unit economics, and the ability to scale regionally. That bias explains why essential services and climate-smart ventures attracted some of the largest rounds, while glamour sectors that previously drew large speculative piles of cash saw more muted interest. At the same time, IPO activity remained limited, with only a couple of public listings in 2025, pointing to continued caution around exits. That caution hasn’t dampened founder ambition, however. Many startups are choosing strategic mergers, debt financing, or regional expansion as pathways to growth rather than rushing toward an IPO in a still-fragile public market. As 2026 unfolds, the narrative to watch isn’t simply how much capital returns, it’s whether African startups can convert this more disciplined funding environment into durable, regionally scaled businesses. If founders keep sharpening unit economics, deploy debt strategically, and use studio and fund models to de-risk early ventures, the continent could see a steadier pipeline of growth-stage successes and eventual public exits.