Sahel States Forge Economic Independence with Ambitious Regional Investment Bank Amidst Tumultuous Times

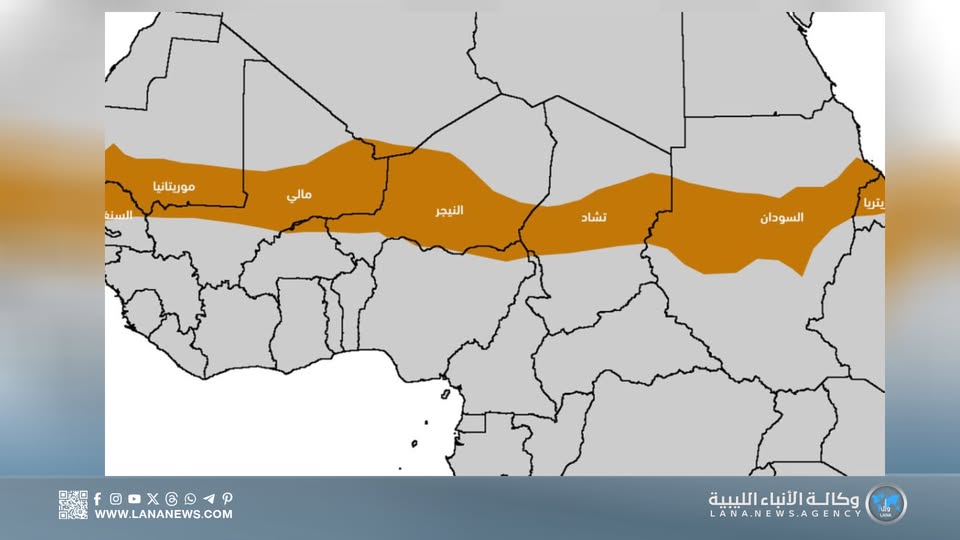

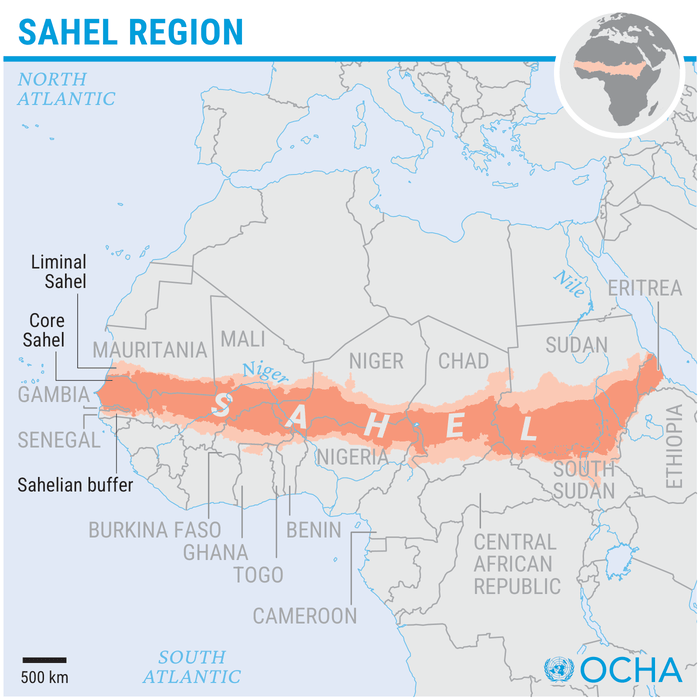

The Sahel region, often a headline for its political volatility, is now making a bold move for economic independence. Mali, Burkina Faso, and Niger, currently under military leadership, have officially launched an ambitious regional investment bank, pooling resources to the tune of nearly $895 million. This significant financial endeavor, kicking off with an initial capital injection of 500 billion CFA francs, isn’t just a numerical milestone, it’s a powerful declaration. It represents these nations’ strategic intent to bolster their economic sovereignty, especially as they navigate internal political shifts and persistent regional security threats. The timing isn’t accidental, earlier this year, these three nations made the dramatic decision to withdraw from the Economic Community of West African States (ECOWAS), a key regional economic bloc. They cited deep-seated political and security disagreements for their departure. This move clearly signals their desire to pursue economic policies independent of ECOWAS influence, actively seeking new mechanisms to finance growth and development that align more closely with their national priorities. So, what could this groundbreaking institution mean for the future of the Sahel, and for the millions who call it home?

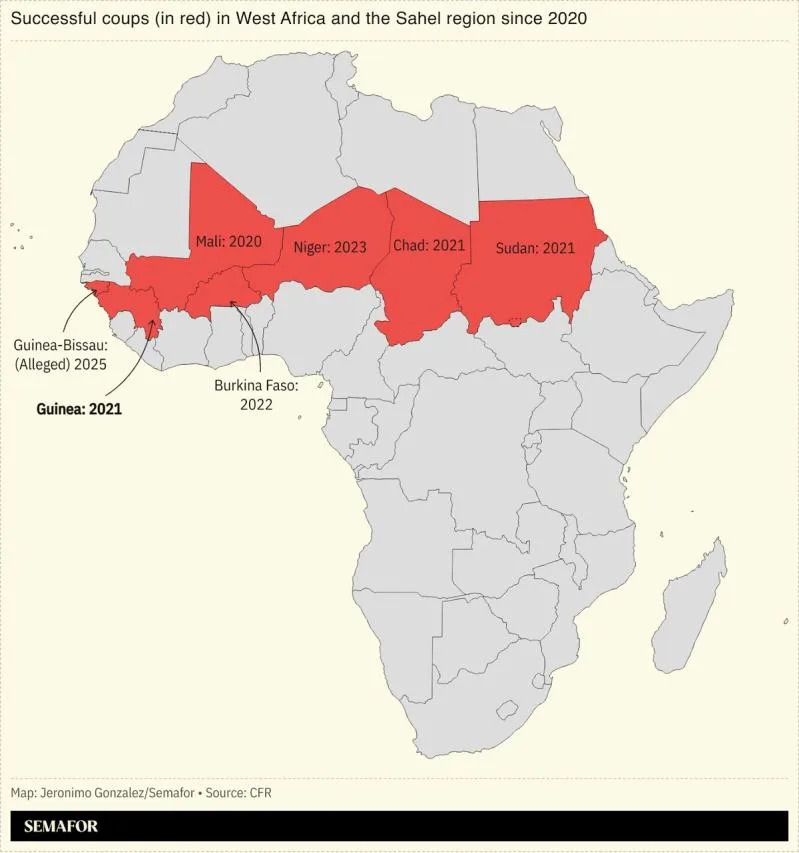

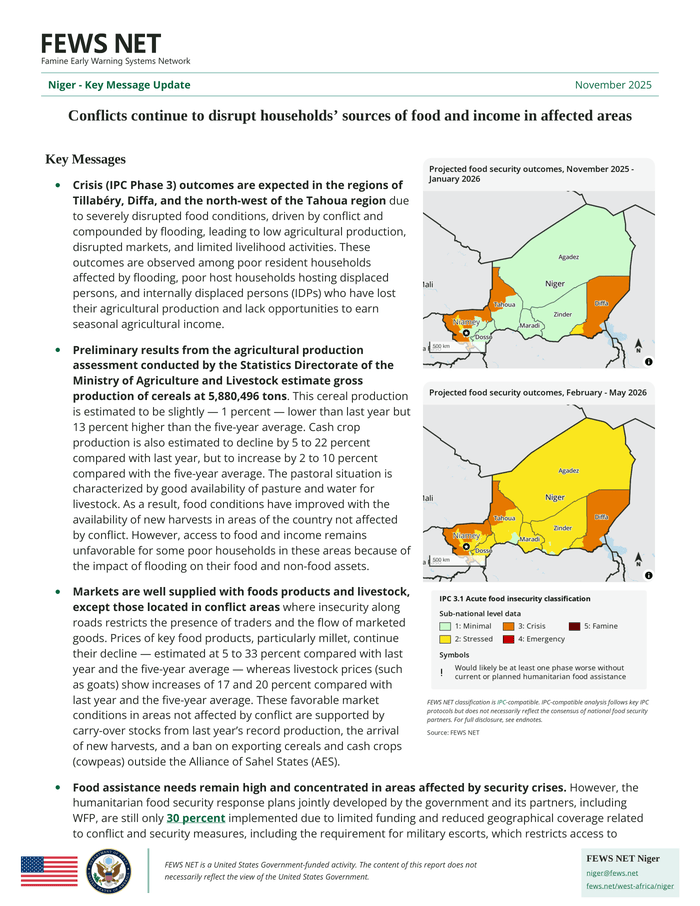

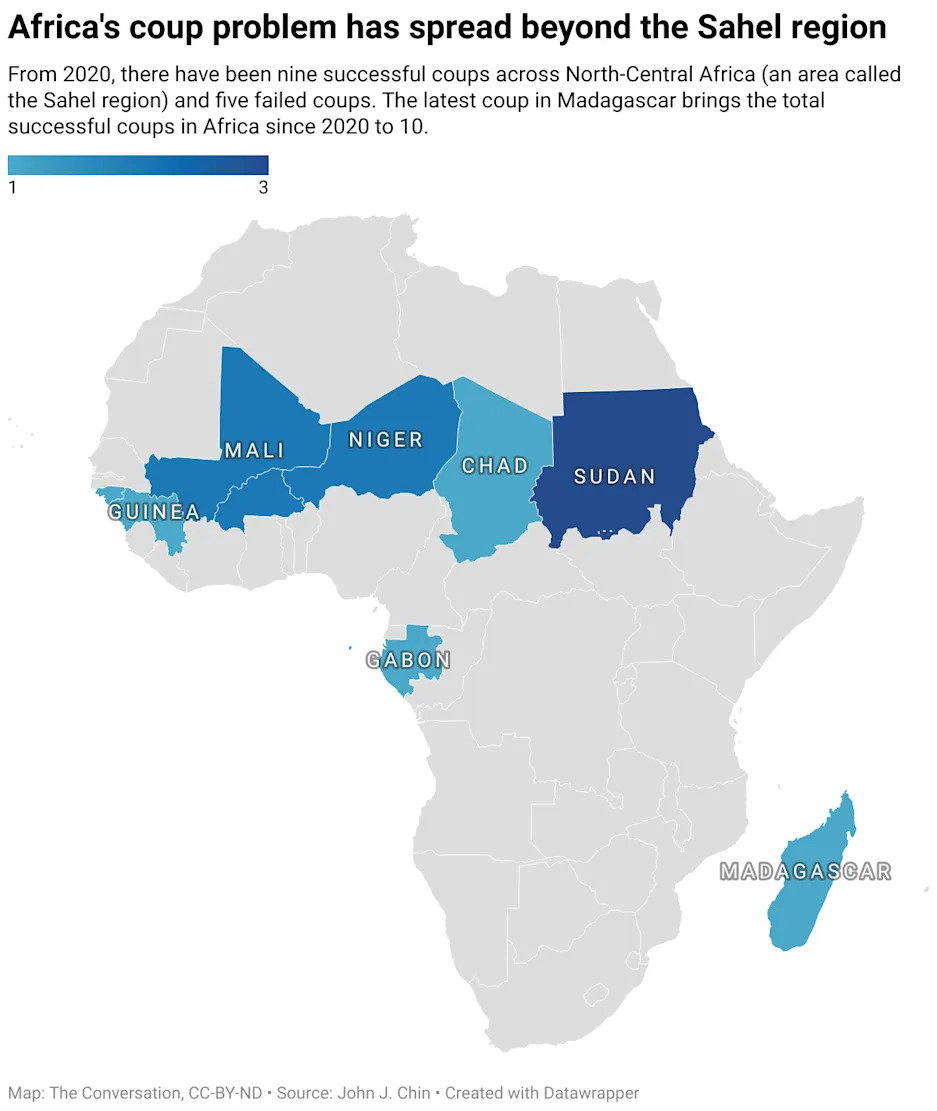

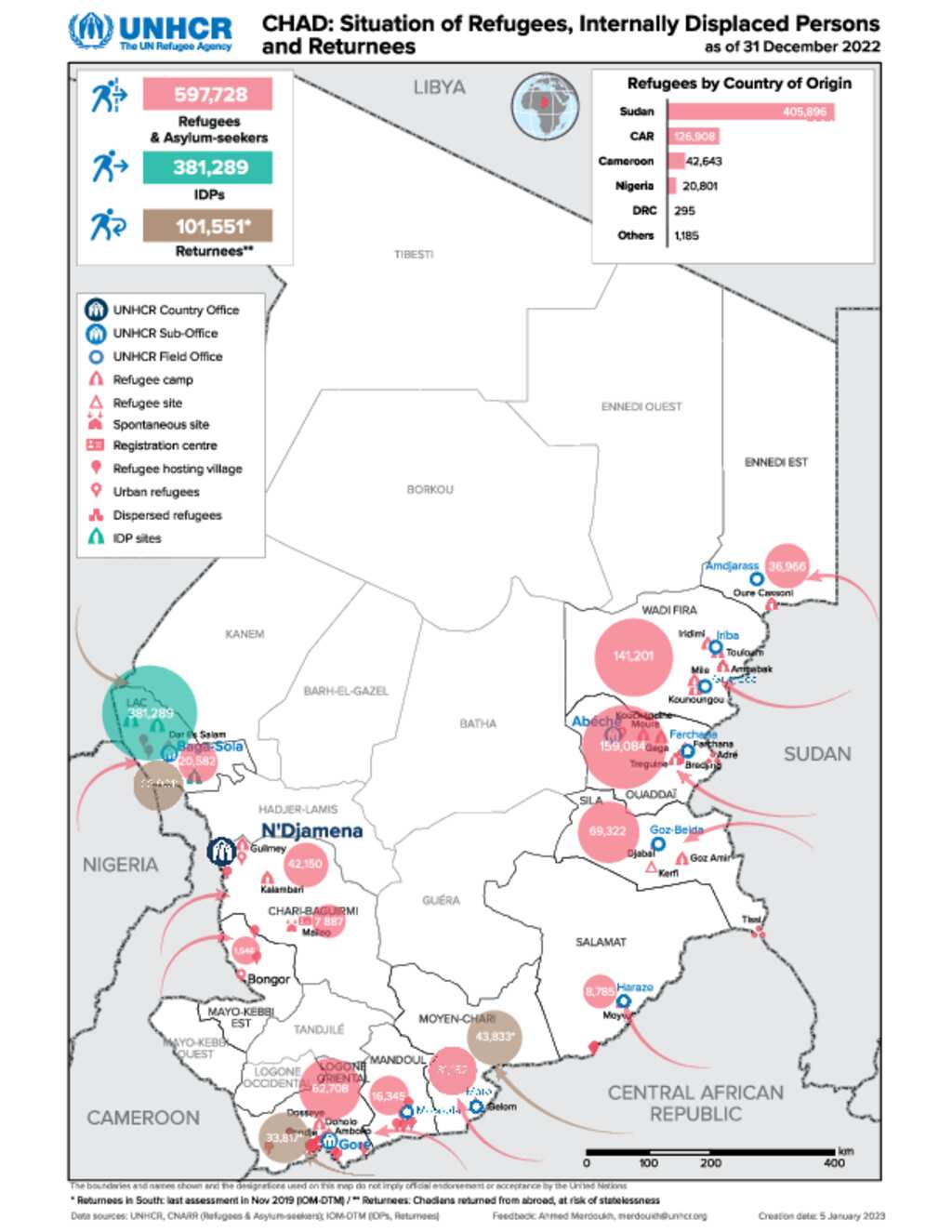

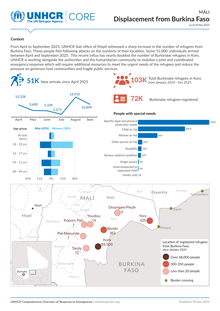

Ultimately, this new investment bank aims to be a potent financial catalyst, designed to support crucial infrastructure projects, invigorate agricultural development, and drive other key economic initiatives essential for genuinely improving living standards across the Sahel. By consolidating their financial muscle into a single, unified institution, Mali, Burkina Faso, and Niger aren’t just making a statement. They’re hoping to unlock investment opportunities that have historically been constrained by political instability and limited access to international capital markets. This bank’s launch symbolizes far more than just financial acumen, it marks a collective stride toward economic resilience, even amidst profound uncertainty. However, we’d be remiss not to consider this development within the broader context of the ongoing security and governance challenges gripping these Sahel countries. Each nation has faced tumultuous political landscapes, with military governments currently holding power, which understandably raises significant concerns about democratic governance and overall regional stability. Analysts have consistently warned that the Sahel remains vulnerable to further coups and unrest, issues tragically compounded by escalating jihadist insurgencies and humanitarian crises that continue to impact millions. Indeed, the military takeovers in Mali, Burkina Faso, and Niger reflect a worrying pattern seen across several African countries experiencing a ‘new wave’ of coups, with experts highlighting the Sahel states’ particular risk due to their fragile institutions and ongoing conflicts. This political upheaval hasn’t gone unnoticed internationally, complicating diplomatic relations, especially with ECOWAS, which has consistently advocated for a return to civilian rule.

Some regional voices, such as former Ghanaian President John Mahama, have urged ECOWAS to adopt a more diplomatic approach toward the Sahel governments. He’s called for dialogue and engagement, not isolation, arguing that such interaction is vital to ensure sanctions or political pressures don’t further destabilize these countries or undermine their progress toward peace and economic recovery. Couldn’t this regional investment bank actually serve as a vital tool in reshaping the narrative from instability to genuine opportunity? By enabling targeted, strategic investments in economic infrastructure and social development, the bank certainly has the potential to underpin governance improvements and foster conditions that could eventually support crucial political stabilization. Looking ahead, the ultimate success of this ambitious financial project won’t just materialize, it will profoundly depend on several interconnected factors. Those persistent security challenges in the Sahel demand concerted regional and international cooperation. Moreover, the military-led governments simply must demonstrate a clear commitment to gradual political reforms, crucially including restoring civilian governance, a strong demand from both African and global partners. Beyond that, the bank’s true effectiveness will hinge on transparent management, inclusive governance, and its capacity to attract private and public sector capital well beyond the initial funding. If these elements truly align, this initiative might just inspire similar economic collaborations in other parts of Africa confronting comparable difficulties. Ultimately, the launch of this regional investment bank is a hopeful signal, demonstrating that even amidst political transitions and security adversity, the Sahel states are indeed striving to carve out greater control over their economic destinies. This unfolding story will undoubtedly be watched closely by investors, policymakers, and ordinary citizens, all eager to see whether this cooperative endeavor can deliver lasting stability and growth to a region too often defined by its turmoil.