Africa’s Mining Sector: Navigating Sovereignty, Environment, and Economic Crossroads

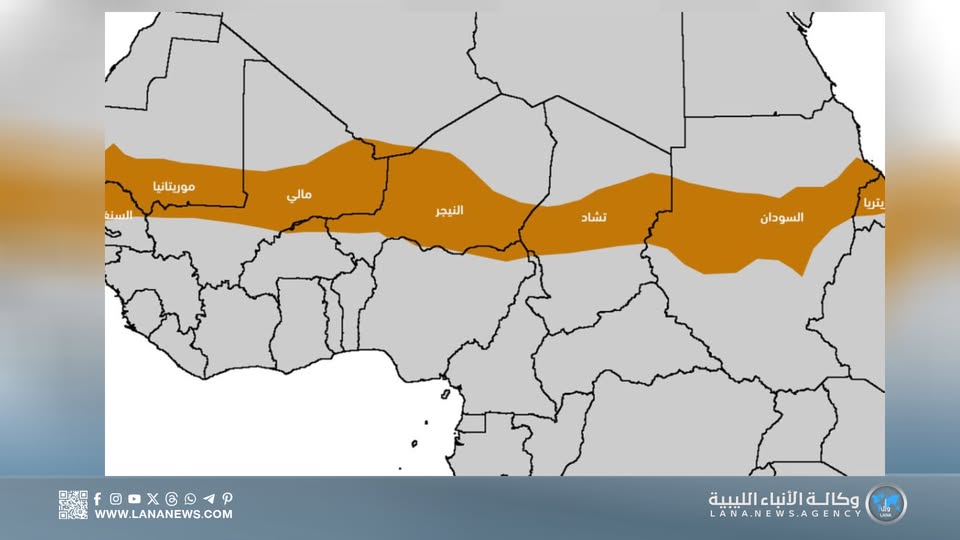

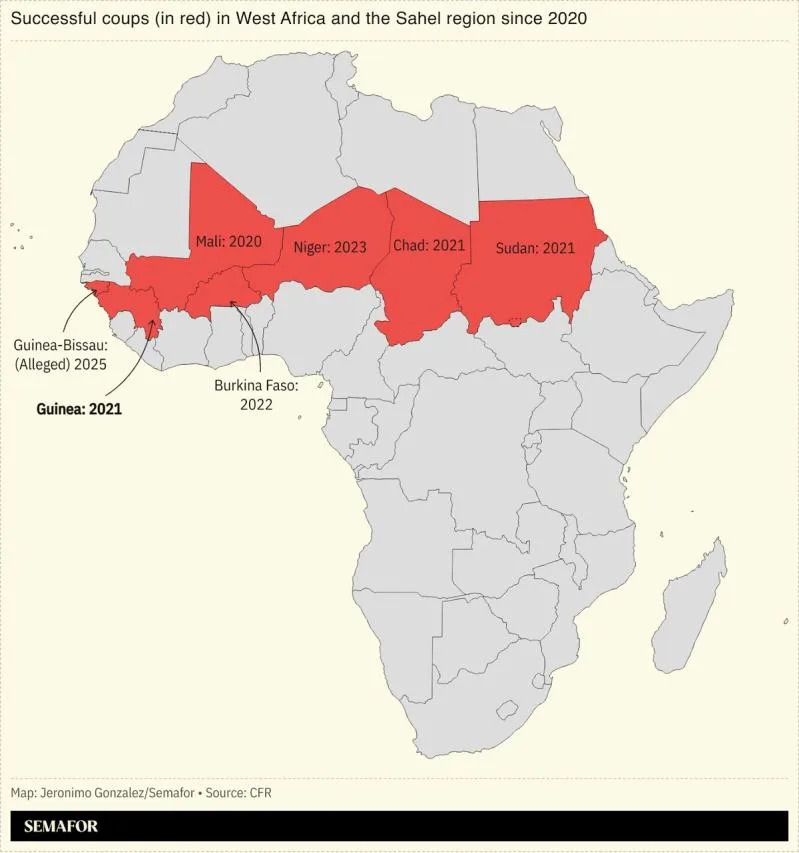

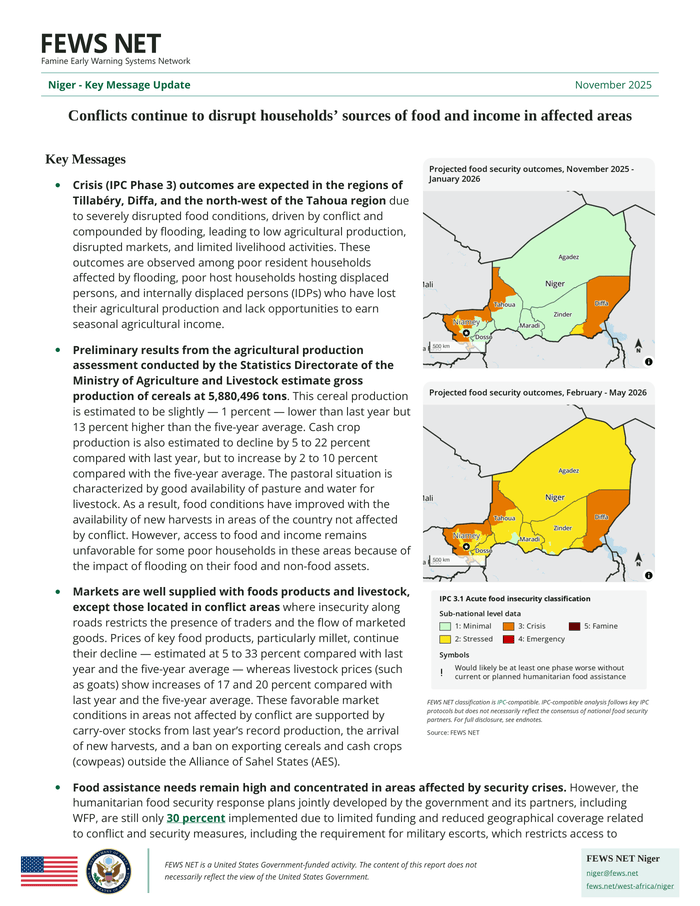

Africa’s mining sector finds itself at a critical juncture, facing turbulent waters as nations and corporations grapple with multifaceted challenges spanning sovereignty, environmental safety, and crucial economic policy decisions. Recent events in Niger and Zimbabwe aren’t just isolated incidents, they’re loud signals reverberating far beyond their borders, underscoring the urgent need for a more nuanced approach to resource management across the continent’s vital extractive industries. In Niger, for instance, we’re witnessing an escalating standoff between the government and French mining giant Orano. This isn’t a new quarrel, it’s a deepening dispute rooted in accusations of radioactive pollution directly linked to uranium mining activities. The friction really kicked off last June when Niger took a decisive step, nationalizing its Somaïr uranium mine and seizing Orano’s significant 63.4% stake. Orano quickly pushed back, labeling the move illegal and raising serious, legitimate concerns about the environmental and safety standards surrounding uranium shipments. Do these shipments truly meet international benchmarks? That’s the core question, suggesting potential risks not only for Niger’s own populace but for global markets, particularly France, which relies on Niger for roughly 15% of its uranium imports to power nearly 70% of its electricity grid. This rift, therefore, goes beyond a simple business disagreement, it powerfully highlights the broader, intricate tensions around resource sovereignty, critical environmental stewardship, and complex geopolitical dependencies that often define much of Africa’s mining industry. What does this mean for the future of international resource partnerships?

Beyond these immediate disputes, there’s a compelling narrative of innovation and strategic development emerging across Africa’s industrial and environmental landscapes. One inspiring example is the Gas to Industrial Sustainable Process, or GISP, initiative. For a decade, GISP has championed the transformative idea of turning waste materials into productive resources, making impressive progress in closing industrial loops. Such forward-thinking projects clearly demonstrate Africa’s immense potential to significantly enhance efficiency and sustainability in vital sectors, including mining, energy, and manufacturing. Imagine the impact of transforming waste streams into economic drivers, boosting growth and environmental protection simultaneously. On the financial services front, changes in leadership, such as Samy Touhouche’s appointment as CEO of Algerian Gulf Life Insurance Company, AGLIC, signal a strong commitment to modernizing and strengthening crucial risk management frameworks. Touhouche isn’t just taking the reins, he’s emphasizing digital transformation and robust corporate governance, positioning AGLIC to become a key player in personal insurance across the region. This kind of modernized financial infrastructure is absolutely vital, it underpins the economic fabric that supports ambitious industrial sustainable process and mining ventures, providing the stability needed for growth. These developments highlight a broader effort to build more resilient and diversified economies, lessening reliance on raw material extraction alone and fostering an environment where strategic minerals are managed for long-term benefit.

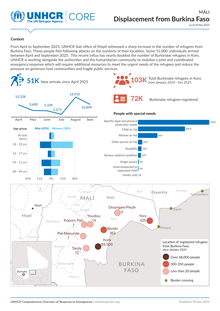

So, how do we make sense of this intricate mosaic of Africa’s resource economies? We’re witnessing a strong assertion of national control over strategic minerals like uranium and gold, often driven by a powerful blend of economic nationalism and growing environmental consciousness. It’s a clear message: African nations want more say in their own destinies and resources. But governments also face the intricate challenge of crafting policies that don’t inadvertently create problems like increased gold smuggling operations or devastating environmental degradation. The goal, always, is to foster investor confidence and ensure genuinely sustainable development. Looking ahead, the way African nations adeptly manage these intertwined challenges will undoubtedly be critical. Establishing transparent regulatory environments that strictly uphold international safety and environmental standards, coupled with genuine, collaborative engagement with multinational corporations and local stakeholders, could truly pave the way for more equitable and effective resource governance. Similarly, embracing innovative industrial projects and consistently modernizing financial services can collectively create a robust foundation for resilient and inclusive growth, helping to finally reduce the historical reliance on extractive cycles that have too often led to painful boom-and-bust dynamics. As Africa’s dynamic mining landscape continues to evolve, the global community, investors, and local populations alike will be watching incredibly closely. The continent’s ability to truly harness its vast mineral wealth, steadfastly safeguard its environment, and significantly improve economic outcomes for its people will hinge heavily on forward-looking policies and partnerships that clearly recognize the profound complexity of these interdependent factors. This vision aligns perfectly with Africa’s tech renaissance, where innovation and strategic investments are propelling the continent forward.